More people than ever are choosing to trade and invest in assets from the comforts of home. One of the fastest and most convenient ways to do this is to buy and sell from your mobile phone.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

To save you some online leg work – in this guide, we review the best investment apps for beginners in 2023!

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

We also discuss what to look for in an investment app when conducting your own research, as well as information surrounding the most popular features for beginners. This guide ends with a walkthrough of how you can sign up today – in a few simple steps!

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Best Investment Apps for Beginners 2023: Quick Summary

If you are too busy to read our best investment app reviews in full, you will see a quick summary of our findings below:

- No 1: AvaTrade – Best overall investment app for beginners – with multiple platform compatibility

- No 2: EightCap: – Best investment app for MT4

- No 3: Capital.com – Best investment app for user experience

- No 4: LonghornFX – Best investment app for high leverage and 24hr support.

- No 5: Currency.com – Best investment app for tokenized assets

If, on the other hand, you have got time – you will find five comprehensive reviews of the best investment apps next.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

What is an Investment App?

For those unaware of what an investment app is – it’s a type of mobile phone application that can be downloaded and used as a trading platform. This means you will be able to buy and sell instruments such as currencies, commodities, stocks, and crypto-assets – from the palm of your hand.

Notably, the team behind the investment app will almost always be an online brokerage firm – usually offering CFDs. With your sign-in details, you will also have access to the provider’s full trading suite, via your desktop platform.

The things that separate the wheat from the chaff when it comes to investment apps are things like – how many assets are available, how easy it is to use – and of course – how expensive it is. With this in mind – next up, we’ve reviewed the best investing apps for beginners in 2023.

Best Investment Apps for Beginners 2023: Full Breakdown

When looking for the best investment app for beginners we leave no stone unturned.

To get the ball rolling, we have reviewed a selection of the most well-respected brokers behind the best investing apps. After that, we divulge what you need to look out for when choosing an investment app yourself.

1. AvaTrade – Overall Best Investment App With Multiple Platform Compatibility

The first thing to state about this particular best investment app for beginners - is that the broker behind it has been providing a service to traders for over a decade. In fact, the company also operates within the rules and regulatory stipulations of 6 jurisdictions - in different corners of the globe. As such, AvaTrade takes trader fund segregation, AML, security, and client privacy very seriously.

Furthermore, there are hundreds of different financial instruments to trade as CFDs on your mobile here. We found this to include 60+ different forex markets, 90+ shares, and dozens of ETFs. You can also access 20+ major stock indices and a good choice of cryptocurrencies on this investment app. We also discovered a variety of commodities such as oil, gas, coffee, cotton, gold, silver, copper, and heaps more. Currency markets at AvaTrade cover majors, minors, and even emerging economies.

The latter covers the Mexican Peso, Russian ruble, Turkish lira, Chilean peso, and more. Indices include the FTSE 100, CAC 40, S&P 500, Dow Jones, and other well-known markets. Stocks include Apple, Intel, Twitter, Snapchat, Cisco, Walmart, and others. If you hook your investment app account up to third-party platform MT5 - you can access even more assets. The AvaTrade investment app is commission-free - so you can trade on the go and only need to factor in the spread.

We found the spread to be very competitive. To give you an idea, major FX pairs like EUR/USD average a spread of less than 1 pip. The difference between the buy and sell price of Apple stock is more like 0.1%. The maximum leverage is 1:400 - depending on your circumstances - such as country of residence. The official app offering of this broker is called AvaTradeGO, which is free of charge to download to your device and offers multilingual support. This guide found the interface super easy to use and place orders on.

The application also comes with built-in trading tools such as intuitive management features. The investment app also includes customizable watchlists, live price charts, guides, and financial data needed to predict the markets. You can start with a free demo account if you wish. Alternatively, you can add some funds to your account by using a credit or debit card, bank transfer, or e-wallets such as Neteller, Skrill, WebMoney, and more.

- Minumum deposit to trade via investment app is just $100

- Licensed in 6 jurisdictions which includes Australia, the EU, Japan, and South Africa

- Trade CFDs with 0% commission on any market

- Admin and inactivity fee after 12 months

2. Capital.com – Best Investment App for User Experience

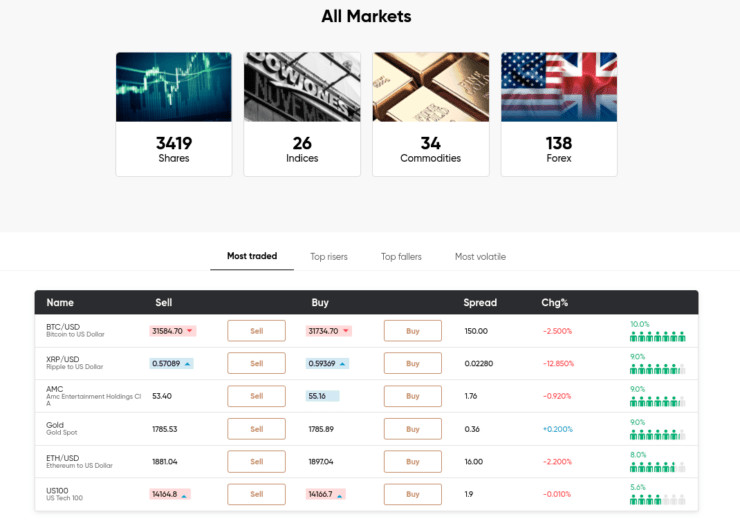

Capital.com is well-known for being a newbie-friendly trading platform. Licensing comes from the respected regulatory bodies the FCA, CySEC, ASIC, and NBRB. This means you can use this investment app for beginners, without fear of a shady broker operating it behind the scenes. You can trade over 3,000 CFD markets from the palm of your hand. As we said, this means you can make gains in either direction.

There is no shortage of options on this investment app. We found shares, indices, forex, commodities, and cryptocurrencies. All are commission-free to trade and come with competitive spreads and fast order execution. There are over 2,400 share CFDs alone on this mobile application. We found this to include Rolls Royce, Apple, NVIDIA, Twitter, Coca-Cola, Alibaba, Netflix, and more. Currencies include all the popular minor and major assets, besides emerging economies like the South African rand, Hungarian forint, Israeli new shekel, and others.

CFD commodities include oils, copper, gold, silver, natural gas, cotton, sugar, and more. You can also trade the rise or fall in the value of indices via the Capital.com investment app. We found this to be inclusive of the STOXX Europe 50, the FTSE 100, S&P 500, China A50, Russel 3000, and many more. We had a look at the spread and found this to be tight across most markets, with EUR/USD offering less than a pip. The investment app is great for beginners and is available for free download on Android and iPhone. We found the Capital.com application easy to navigate.

It's packed with technical analysis features with regular updates, heaps of drawing tools, indicators, and price alerts. Furthermore, you can create multiple demo trading accounts on this platform - to practice for free. The maximum leverage at the Capital.com investment app stands at up to 1:500. Although newbies might be better sticking to smaller amounts - such as setting yourself a limit of no more than 1:10 or 1:20. The minimum deposit to get started here is a very reasonable $20. Furthermore, you can use credit and debit cards, bank wire transfers, and e-wallets like Trustly or Apple Pay.

- Connect your investment app account to MT4 for technical analysis

- App with heaps of CFD markets and a minimum deposit of $20

- Regulated by CySEC, FCA, ASIC, and NBRB

- Light on fundamental analysis

3. LonghornFX – Best Investment App for High Leverage

LonghornFX offers a beginner-friendly investment app that requires a minimum deposit of just $10! The brokerage behind the application follows AML and CTF procedures and complies with all laws rescissory to provide a true and legitimate service to traders. Furthermore, you can trade over a hundred instruments. We had a look around and found CFDs to include indices like the FTSE 100, Dow Jones, ESP 35, NASDAQ 100, NIKKEI 225, and more.

If you fancy yourself as a currency trader you will find over 55 to choose from - covering the three aforementioned categories. The investment app also offers its fair share of cryptocurrencies - featuring IOTA, Dash, and EOS to name a few. You can also buy and sell over 60 stock CFDs. The latter covers companies like Twitter, Volkswagen, eBay, Apple, Coca-Cola, Google, and many more. You also have the option of trading metals like gold against the US dollar.

In terms of the spread, we found this to be very tight over most of the aforementioned assets, with EUR/USD averaging less than a pip. Furthermore, we must mention that although this investment app for beginners does charge commission - it works out at just $7 for every $100,000 traded. When you connect your account to the MT4 app, you can perform technical analysis free of charge, as there are a plethora of charts and a free demo platform.

There are also educational trading guides available and this platform promises 24-hour customer support. You might even look to trade passively via an EA. We touch on this later for anyone unfamiliar. This investment app is easy to use for traders of all experience and accepted deposit methods include Bitcoin, credit and debit cards, and bank transfers. It usually takes a matter of minutes to connect your LonghornFX and MT4 accounts and get started.

- CFD investment app for beginners with tight spreads

- Low commission and high leverage up to1:500

- Same-day withdrawals and wide range of CFD assets

- Platform prefers Bitcoin deposits

4. Currency.com – Best Investment App for Tokenized Assets

Currency.com is a superb investment app for beginners - and for those who want to intertwine the world of digital currencies with fiat money. In terms of safety, an authority that specializes in blockchain technology-based companies regulates this platform. This provider also adheres to rigorous AML rules and strict industry standards.

This investment app focuses on tokenized markets - comparable to CFDs. This means that you are speculating on the rising or falling value of the financial instrument. You do not own the 'product' you are trading - instead; you are merely buying and selling tokens that represent the underlying asset - such as GBP/USD, Apple shares, or the FTSE 100 for instance. Commission fees are low and spreads are tight - starting from less than a pip.

Digitalized instruments also include commodities such as cotton, palladium, silver, and gold. You can also trade tokens that mimic indices such as the GER 30, FTSE 100, S&P 500, China A50, FRA 40, IT 40, and many more. Another option via this investment app for beginners is currencies. You will find all three pair categories and most of the previously mentioned emerging markets.

The Currency.com investment app for beginners also enables you to buy and sell tokenized bonds, a wide range of crypto-assets, and shares such as Amazon, Apple, Gamestop, Coinbase, Virgin, Blackberry, Abercrombie and Fitch, Adobe, and many more. This should give you a clearer idea of what will be available to trade. Upon downloading the investment application, beginners will find it super user-friendly.

All in all, Currency.com provides access to over 2,000 tokenized assets, plus you can enjoy the advantages of short selling - such as leverage and flexibility. You can also access trading analysis tools and take the investment app for a test drive using a free demo account. Accepted deposit methods include Bitcoin, Ethereum, credit and debit cards, and bank transfers.

- Tokenized investment app with competitive spreads

- Low commission and high leverage up to1:500

- Same-day withdrawals and plenty of CFD markets

- You can not purchase traditional assets

5. EightCap – Trade Over 500+ Assets Commission-Free

Eightcap is a popular MT4 and MT5 broker that is authorized and regulated by ASIC and the SCB. You will find over 500+ highly liquid markets on this platform - all of which are offered via CFDs. This means that you will have access to leverage alongside short-selling capabilities.

Supported markets include forex, commodities, indices, shares, and cryptocurrencies. Not only does Eightcap offer low spreads, but 0% commissions on standard accounts. If you open a raw account, then you can trade from 0.0 pips. The minimum deposit here is just $100 and you can choose to fund your account with a debit or credit card, e-wallet, or bank wire.

- ASIC regulated broker

- Trade over 500+ assets commission-free

- Very tight spreads

- Leverage limits depend on your location

What to Look for in the Best Investment Apps for Beginners in 2023

Although we have offered up five comprehensive reviews of the best investment apps for beginners – it’s good to know what to look for in a brokerage yourself.

As such, we have listed below some of the key things to think about when searching for the best investing app – to suit your own trading endeavors.

Licensing and Regulation

We touched on licensing in our review of the best investment apps for beginners. This is because the regulated brokers behind the applications have to follow rules set out by watchdogs such as the FCA, ASIC, and CySEC (to name just a few).

The aforementioned regulatory bodies govern the online trading space to preserve order and keep online brokers free from financial crime. As you can imagine, knowing that a licensed platform maintains a certain standard is a good start when looking for the right one to sign up with!

Access to an Assortment of Markets

Another noteworthy feature of a great investment app for beginners is one that lists a wide assortment of markets. Sure, some traders might not be too concerned with diversification.

But, active day or swing traders might want to span several asset classes – so it does not commit them to just one. This might involve leveraged swinging of both forex and crypto-assets such as IOTA.

This is notably more effective for medium to long-term traders. This strategy will probably require access to different types of markets – for the purposes of hedging against inflation, interest rates, or economic turmoil.

Many assets behave in contrast to one another when world events happen – so the aim is to maximize returns by diversifying and not putting all of your eggs in one basket.

Low Commission and Spread

Low commission fees and spreads are vital when choosing the best investment app for beginners. Trading fees that seem reasonable can soon affect your profit potential over time.

The best investment apps for beginners often offer a commission-free trading experience with competitive spreads. If you are still making your mind up and weighing up your options – feel free to recap by checking out the five reviews featured earlier on.

Investment App Ease of Use

Whilst seemingly obvious, it’s easy to get carried away with the low spreads or passive trading features of an investment app – neglecting to see whether or not it’s easy to use. If you are still on the lookout for the best- each of the mobile applications we reviewed today is simple to navigate for beginners.

Another simple way to find your feet in a new trading space is to practice placing a few orders. This can be done via the free demo account included in many investment apps for beginners. We talk about this shortly. Remember, some will also require you to hook your account up to MT4 – to access this and many other useful tools and features.

Investment App Features

Speaking of features – the best investing apps for beginners will have the benefit of trading tools and other extras. This will enhance your experience and decision-making power – before hitting the market of your choosing.

See below the most commonly featured trading tools offered by the best investment apps for beginners.

The Option of Long or Short

The vast majority of investment apps enable you to trade both a rising or falling market – via CFDs or tokenized assets. As we touched on, this means that you can speculate in either direction – and make gains if you are correct.

See an example below of going short on a tokenized asset via your investment app:

- You are trading tokenized currencies – specifically NZD/USD. (New Zealand dollar/US dollar)

- You think this is overvalued and likely to decline, so you place a $500 sell order – to short the forex pair

- Within hours the underlying pair falls in value by 4%

- Your prediction was right – you close the position by placing a buy order on your investment app

- From your initial $500 sell order – you made a profit of 4% which equates to $20

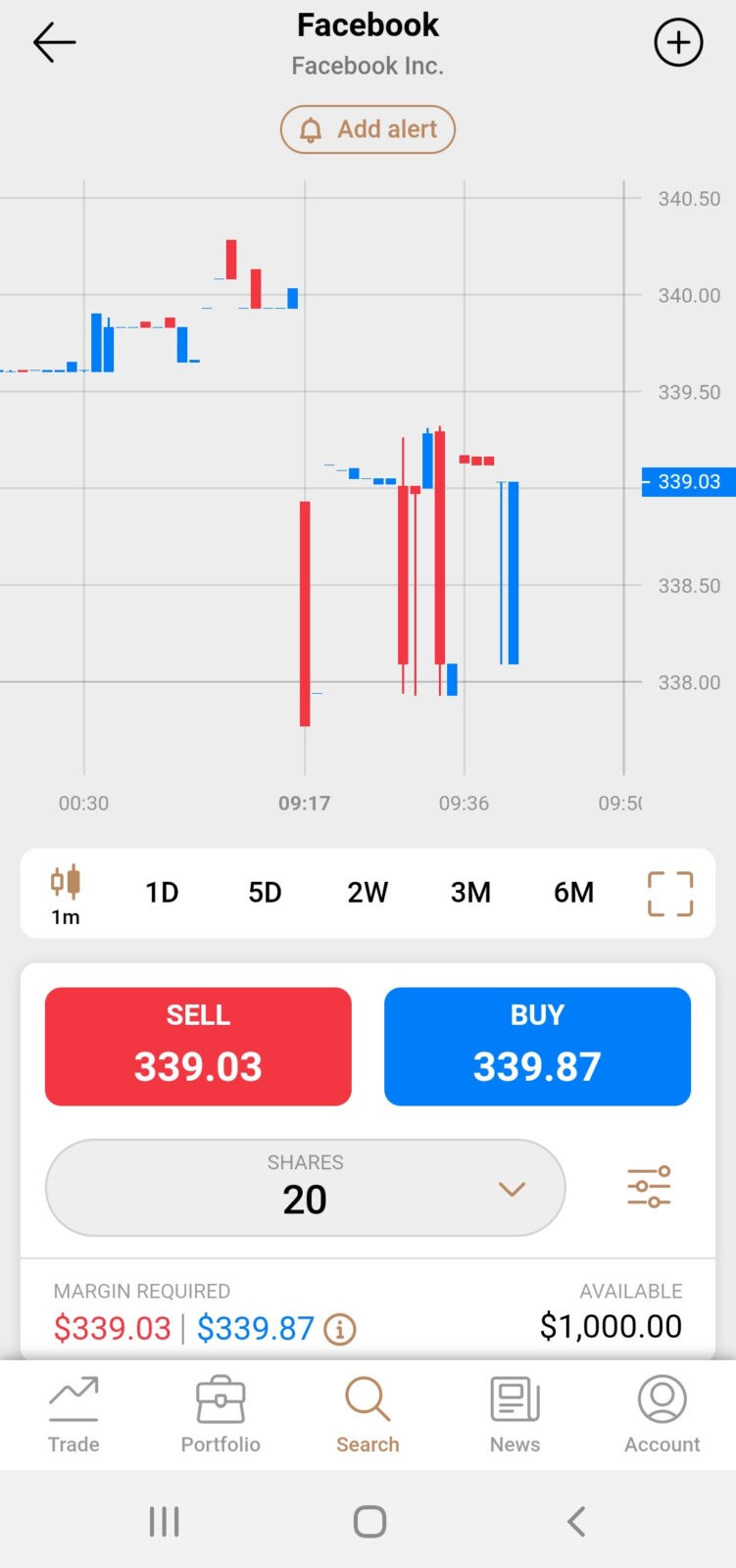

- Let’s say that Facebook shares are valued at $335

- You think this is an underevaluation – so place a $1,000 buy order via your chosen investment app

- Facebook experiences a price increase and rises by 6%

- This means you were right to go long – you made 6% gains

- From your initial buy order of $1,000 – you made a profit of $60

As you can see, many investment apps allow you to trade in either direction – without needing to own anything. If you had added leverage of 1:5 to the above CFD long position, you could have magnified your gains by a multiple of five – resulting in a profit of $300, instead of $60. Always use this feature carefully as it is essentially a loan from the investment app to boost your buying potential.

Risk Management Tools

The best investing apps will provide you with access to a free demo trading account – which is just one way to practice risk management. The reason being, you will have thousands of dollars worth of paper trading funds to hone in on your skills – without using a cent of your real capital!

You should also look for investment apps for beginners that allow you to easily incorporate stop-loss and take-profit orders on every position you take. This enables you to prepare yourself for both profit and loss – very specifically.

See an example below to explain further:

- Let’s say you are trading EUR/GBP, which has a current value of 0.8811

- You place a sell order with your investment app to short the pair

- Your forex trading system includes a risk/reward of 1:3

- As such, you place your stop-loss order 1% above the currency value – £0.8899

- Naturally, your take-profit will be set to 3% below the price – £0.8546

- If EUR/GBP increases by 1% – your position will be closed automatically

- Alternatively, if the minor pair falls by 3% – your trade will be closed

As you can see, if an investment app enables you to include these orders on each trade – you are able to be price specific about your entry and exit into your chosen market with ease. This is a tried and tested way to actively manage risk.

Notably, if you are taking a long position – these orders will be reversed. Some applications will also include a ‘hedging mode’ feature – as well as calculators, trading plans, risk management courses, and more.

Passive Investment Tools

For those who want a little more from an investment app for beginners – you might look for a few passive tools to be included.

You will see below the most common ways to partake in a hands-off trading style.

Trading Signals

If the idea of spending hours looking at indicators and charts to predict the rise or fall of the markets fills you with dread – you may consider a trading signal service.

For instance, here at Learn 2 Trade, we offer trading tips for forex, stocks, and cryptocurrencies. Our highly experienced team performs advanced technical analysis and updates are sent to our 20k+-strong Telegram group.

We always include the following information:

- The asset to trade

- A suggested entry price

- Stop-loss and take-profit prices

- Whether a long or short order is likely to be most profitable

It’s up to you whether you use this information to create an order on your chosen investment app for beginners.

Copy Trading

An alternative option to cut down studying time is ‘copy trading’. This is sometimes referred to as ‘mirror trading’ and will see you investing in a successful investor and mirroring them like-for-like.

Anything that person buys or sells will appear in your own investment app portfolio. This obviously includes any gains and losses. As we said, some platforms require you to hook up to a third party to access such features – like DupliTrade for example.

Support for EAs/Trading Bots

For an almost completely passive way to trade via an investment app – you might try trading bots. These are also called EAs (Expert Advisors) and can be controlled by people. With that said, it is usually pre-programmed algorithmic software – designed to scour the markets for opportunities – and place buy or sell orders on your account.

If you decide to sign up with an investment app for access to EA’s, you will probably need to connect your account to MT4 or MT5. Furthermore, it’s always recommended to take software like this for a test drive first. You can do this via a demo trading facility – using virtual equity, or a free trial offered by the creators of the application.

Advanced Technical Analysis

Unless you want to use the aforementioned passive trading features – you will need to access technical analysis tools to gain insight into market sentiment. As such, you can check what the investment app is able to offer in this respect.

Where some investment apps for beginners come with heaps of indicators, charts, and drawing tools – others will need to be connected to third-party platform MT4. With that said, linking your trading account with this technical analysis haven is probably easier than you think.

See below a quick walkthrough of how to connect your investment app to MT4 to access state of the art technical analysis tools:

- The first thing to do is download your chosen investment app and create an account

- Next, download MT4

- Select ‘add new broker’

- Enter the name of the platform behind your chosen investment app (for instance, ‘AvaTrade’ or ‘Capital.com’)

- Click ‘scan’ to search for the investment app broker – hit ‘next’ when you find it

- Now you can select ‘account type’. As you have already created one on the investment app – you can click ‘existing trade account’

- That’s it – enter your investment app login credentials to link your accounts together

As we said, not all investment apps for beginners will require you to go through a third-party – but it’s handy to be aware of how to link the two accounts if you do.

Sign-Up With the Best Investment Apps for Beginners 2023 Today!

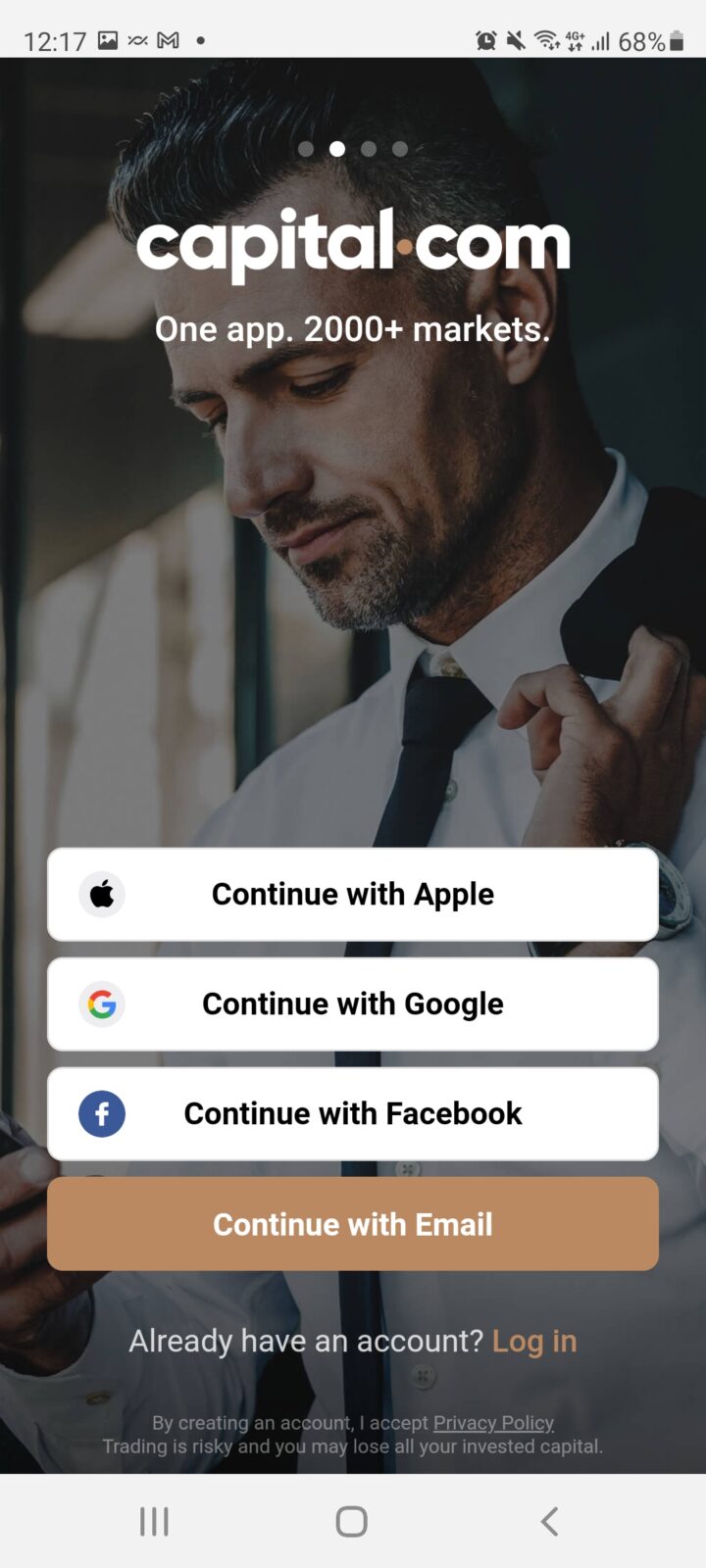

First, you need to download the investment app – here we are using Capital.com as an example, but you can choose whomever you wish.

Step 1: Create a New Account

Visit the Capital.com website and open an account You can do this by entering your name, address, email – and any other information the investment app needs to learn your identity.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

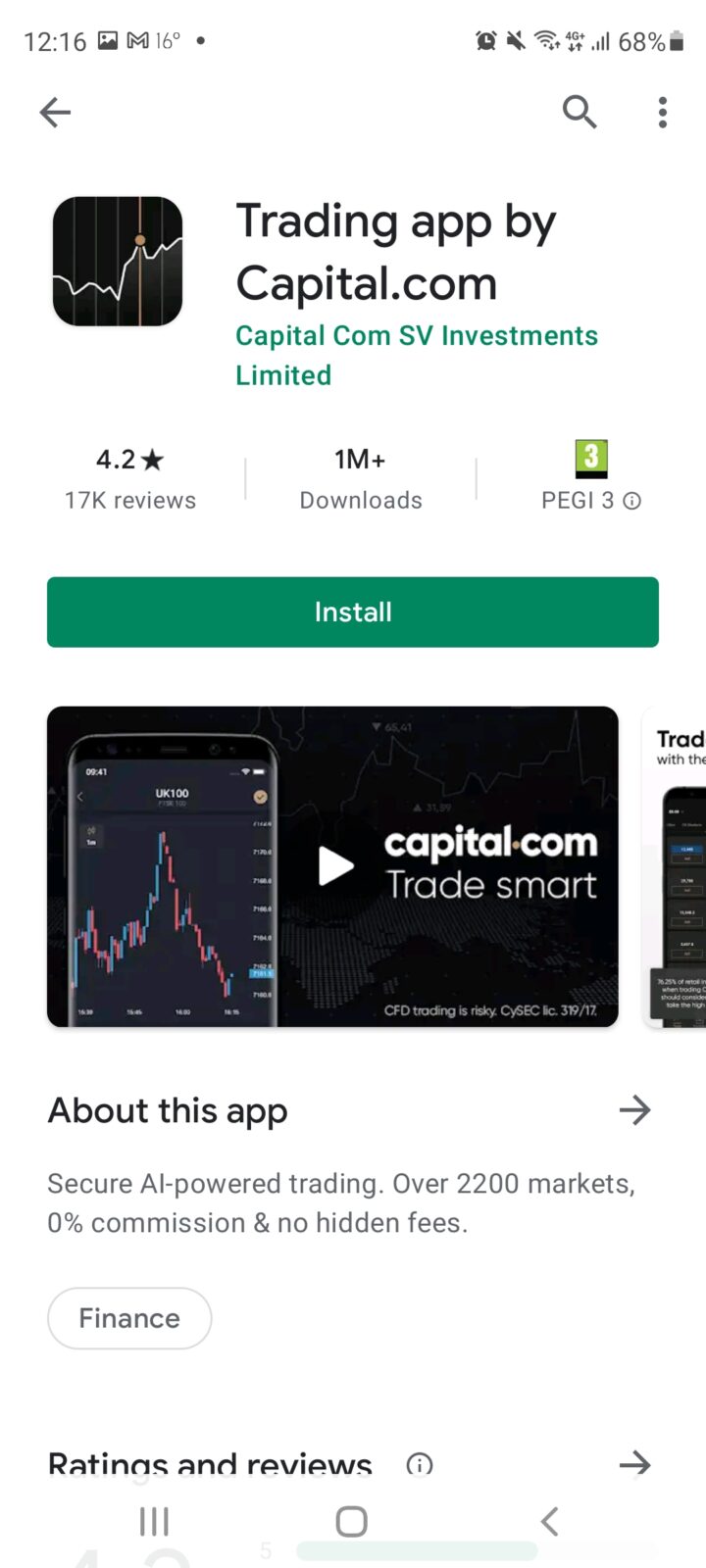

Step 2: Download the Investment App

Now you can head over to the relevant app store. This will be ‘The App store’ for iPhone users, or ‘Google Play’ for Android. Here you can use the search box to find your chosen investment app.

Step 3: Upload ID

You will need to upload some form of documentation at this stage to prove your name and address. This guide found that most investment apps will accept a driving license or passport for the first step.

For proof of address – a recently received utility bill, bank statement, or official tax letter is usually sufficient. The best investment apps for beginners will confirm your new account within minutes so you can get started right away.

Step 4: Make a Deposit

Before you can start your trading endeavors and use the investment app to full effect, you need to add some money to your account.

Take a look at which payment types are accepted by the investment app, enter an amount to deposit, and confirm all to move forward and start trading.

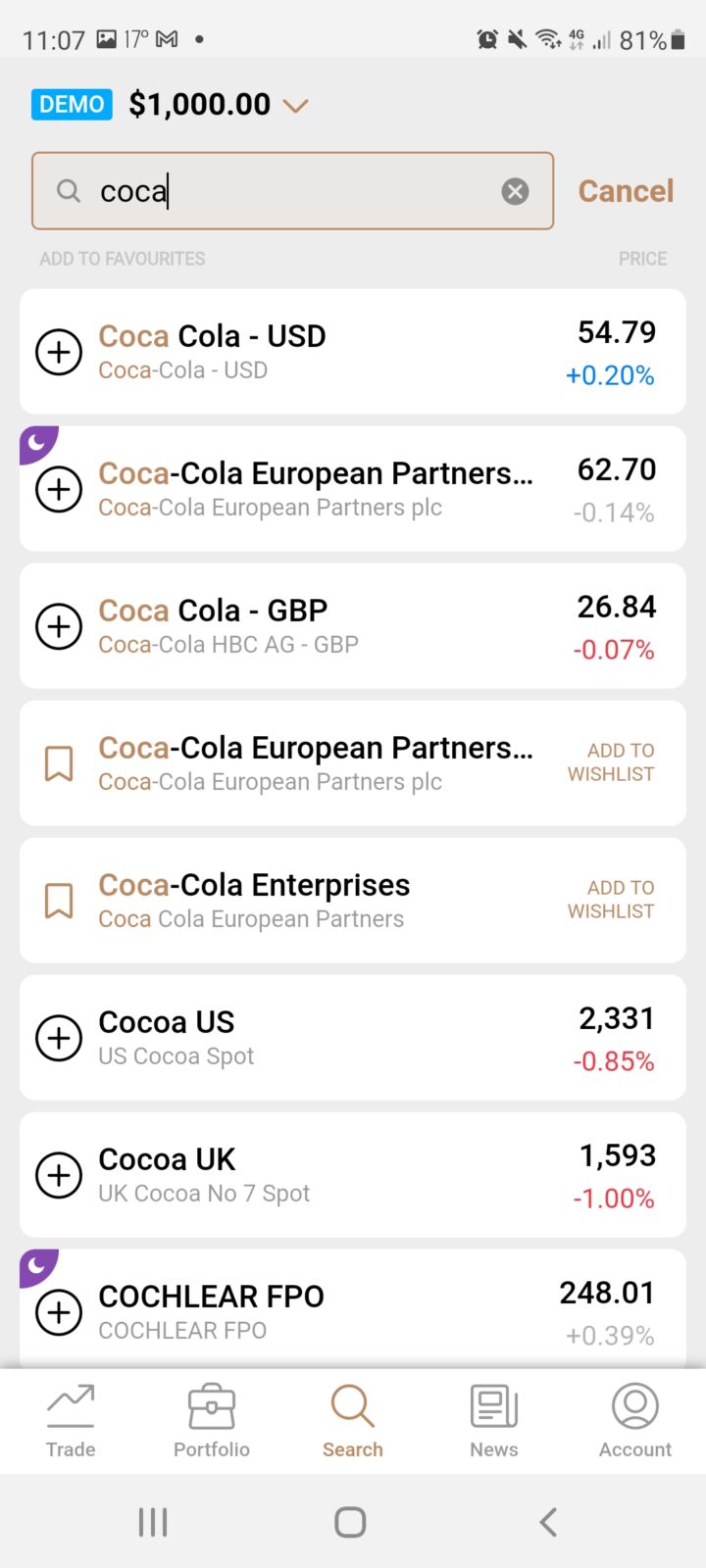

Step 5: Find an Asset to Trade

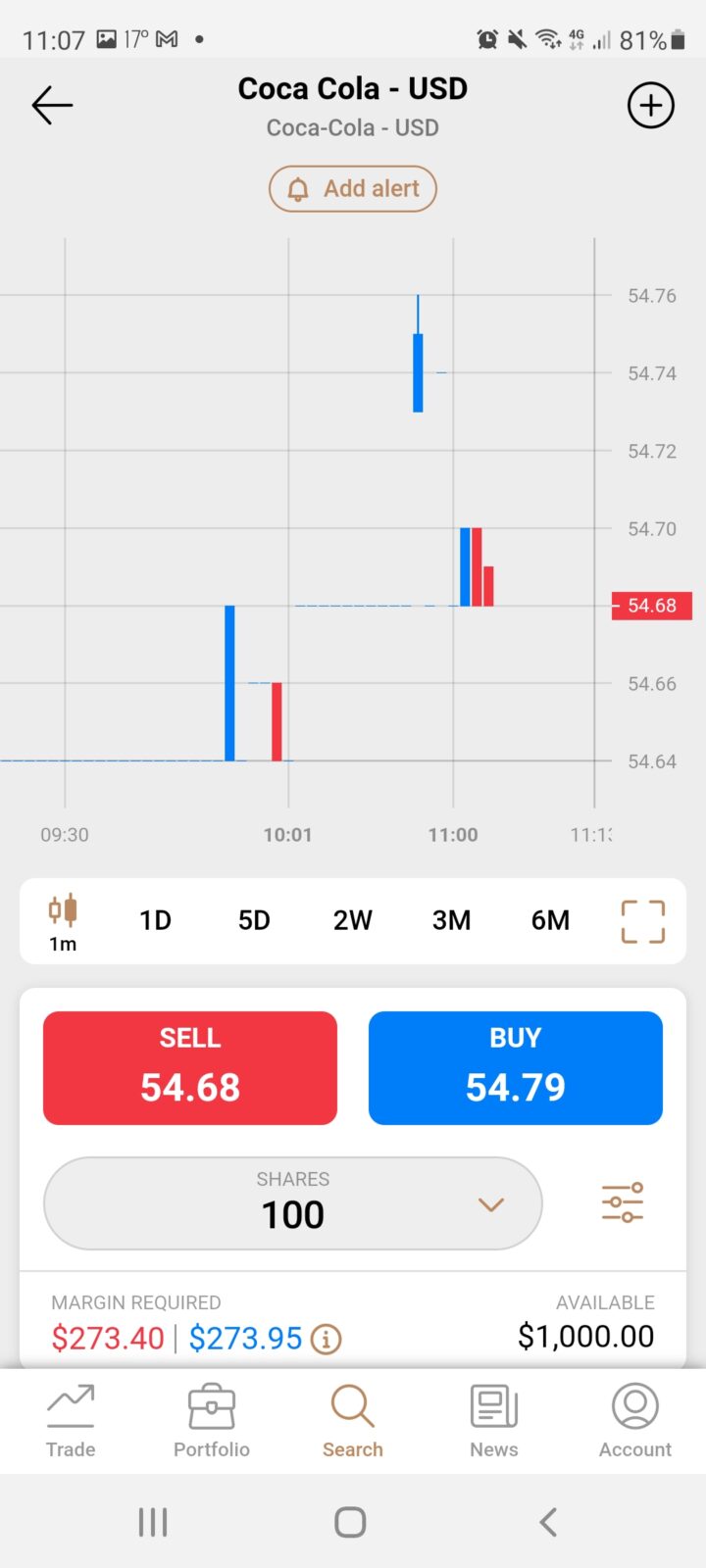

Now, you can look for something to trade. As you can see, here we are looking for Coca-Cola shares via the app’s demo account.

Step 6: Place an Order

Next, based on your hypothesis – place a buy order if you forsee a price rise or a sell order if you think it will fall.

That’s it – you’ve just placed your first trade via an investment app!

Best Investment Apps for Beginners 2023: Full Conclusion

We live in a world where our phones are like another limb to most of us. Technology has progressed so rapidly that it’s said over 90% of people now own a mobile device. With this in mind, it’s no surprise that online brokers everywhere are catering to this by offering convenient investment apps to buy and sell on.

The best investment apps for beginners enable you to trade a diverse range of markets from the palm of your hand – wherever you have an internet connection. You should also look for key features such as low trading fees, a simple interface, demo facilities, technical analysis tools, and passive investment options like signals.

Today, we reviewed the five best investment apps for beginners of 2023. Each of the online brokers behind the applications excelled in aspects such as regulation, offering tight spreads, low trading fees, a huge assortment of tradable markets, and accepting various payment types.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts