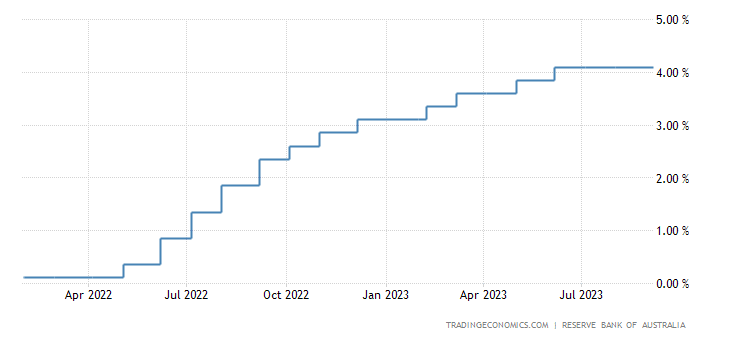

The Australian Dollar (AUD) has taken a hit against the US Dollar (USD) following the Reserve Bank of Australia’s (RBA) decision to maintain its cash rate at 4.10%, as widely anticipated by market experts.

Governor Philip Lowe, who is set to retire in just two weeks, presided over this critical monetary policy decision. Lowe’s statement highlighted various factors impacting Australia’s economic landscape. These included concerns about the inflation outlook, the repercussions of previous interest rate hikes, consumer spending trends, and the precarious state of China’s property sector, which could have ripple effects on the Australian economy.

This marks Lowe’s final policy decision, paving the way for Michele Bullock, the current Deputy Governor of the RBA, to assume the mantle. With an impressive career spanning back to 1985, Bullock is a distinguished economist expected to maintain a policy stance in line with her predecessors.

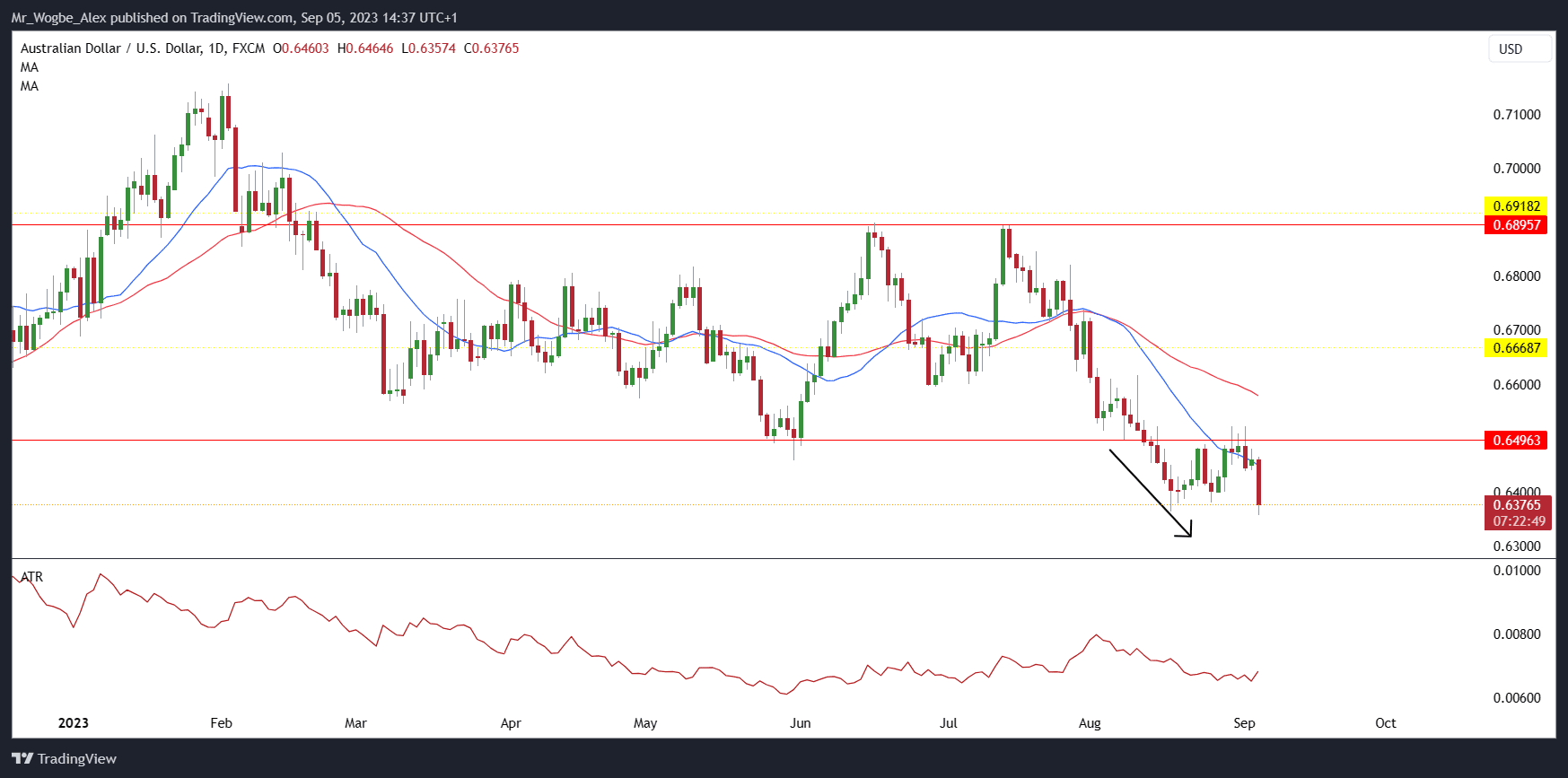

Australian Dollar Drops to 10-Month Low

The AUD/USD currency pair was already grappling with downward pressure even before the RBA announcement. This can be attributed to the USD gaining strength across the global market despite a public holiday in the US the day prior.

Adding to the Australian Dollar’s woes, recent current account data revealed a lower-than-expected surplus in the second quarter. However, a silver lining emerged in the form of robust net exports, underscoring Australia’s stellar trade performance. Market watchers keenly anticipate the release of August’s trade balance figures this Thursday, which could potentially breathe some life back into the AUD.

As of the time of writing on Tuesday, the AUD/USD stood at 0.6384, marking a 1.2% decline from the previous day’s position. This recent downturn has seen the Australian Dollar sink to its lowest point against the US Dollar since October 2022.

Final Word

The Australian Dollar’s dip against the US Dollar is primarily attributed to the RBA’s decision to keep rates steady amidst economic uncertainties and Governor Lowe’s impending retirement. With Michele Bullock set to steer the ship, all eyes are now on upcoming trade balance figures, as they could offer the Aussie some much-needed support in these uncertain times.

Interested in becoming a Learn2Trade Affiliate? Join us here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.