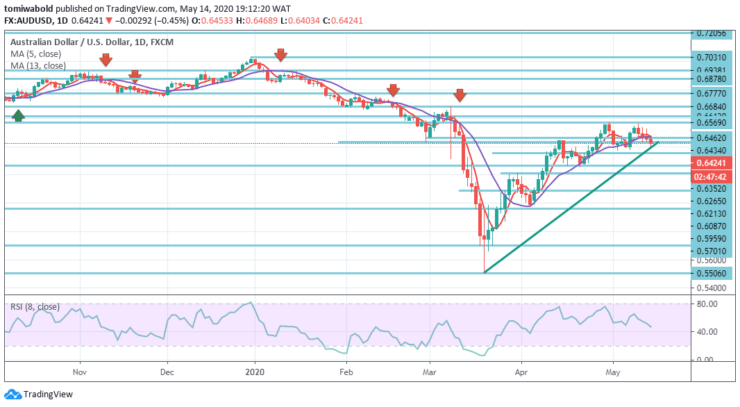

AUDUSD Price Analysis – May 14

The Australian Dollar dropped significantly in the previous session by 78 pips or 1.20 percent against the US Dollar and yet today the currency pair plummeted even more in Thursday’s American session. The Covid-19 trajectory in Australia is quite optimistic but global harsh economic data and uncertainties in China indicate that near-term risk stays as price trades at 0.6400 level.

Key Levels

Resistance Levels: 0.7031, 0.6878, 0.6569

Support Levels: 0.6352, 0.5959, 0.5506

AUDUSD Long term Trend: Ranging

There’s no obvious indication of a trend turnaround in the wider sense yet. The greater downward trend from 1.1079 level (high in 2011) is still very much in favor of expanding the projection of 1.1079 by 61.8 percent to 0.6878 from 0.8135 at 0.5506 level.

There may be a continuous split opening the way for a level of 0.4773 (low 2001). Moreover, on the upside, a continuous break of 0.6612 level may imply bottoming in the medium to long term and shift the focus to the next resistance level of 0.7031.

AUDUSD Short term Trend: Ranging

At this point, the AUDUSD intraday bias stays neutral as range trading continues. A further increase can be seen through the resistance level of 0.6569. But bearing in mind bearish divergence condition in 4 hour RSI and upward trendline, upside may be confined by 0.6684 key resistance level, at least on the initial attempt.

On the contrary, a breach of 0.6352 support level may validate a short-term reversal and move a further decline of 0.5506 to 0.6569 at the first level of 0.6213 to 38.2 percent retracement.

Note: learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.