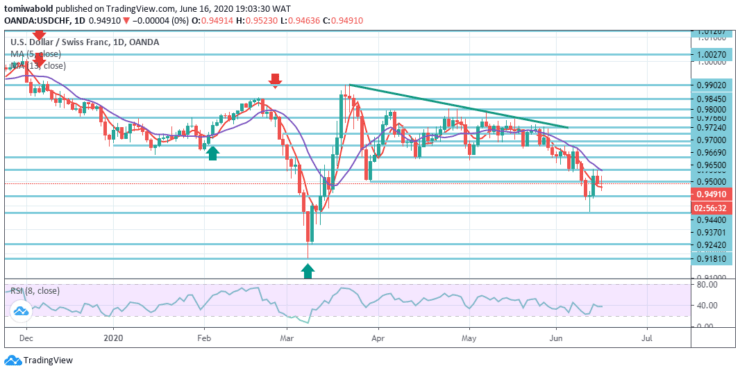

USDCHF Price Analysis – June 16

The USDCHF pair bounced back across the market from two-day declines amid a US dollar rally, rising back beyond 0.9500 level. It has recently printed a fresh daily high at 0.9523 level and stays close to the top, with a strong buying momentum.

Key levels

Resistance Levels: 1.0027, 0.9766, 0.9650

Support Levels: 0.9440, 0.9370, 0.9181

The USDCHF is testing the recent high of around 0.9520/23 level; beyond this, its focus may shift to the level of 0.9550, a key resistance that may bolster the bullish bias if breached. On the flip side, the initial support now is the level 0.9440, followed by the level 0.9370 (low).

The 0.9902 level breach may extend the 0.9181 level rebound through 1.0027 level resistance. However, medium to long term range trading can intensify for some longer around level 0.9181/1.0237.

For the moment, the intraday bias in USDCHF holds firm. On the upside, the 0.9550 level breach may continue the rebound from the bottoming of the short term level of 0.9370.

Continuous trading beyond the horizontal level of resistance (now at 0.9650) may pave the way back to the resistance level of 0.9902. On the downside, though, a break of 0.9370 will instead continue the decline from level 0.9902.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.