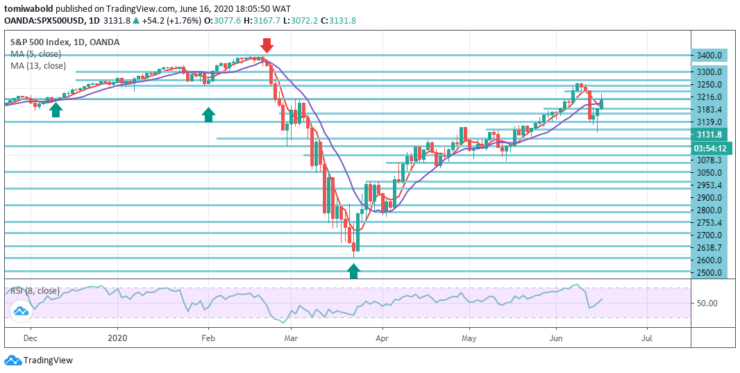

S&P 500 Price Analysis – June 16

After a strong start to 3167.7 level on Tuesday, the S&P 500 index is giving off advances as investors’ concerns about the second wave of coronavirus infection and geopolitical frictions in Asia have overwhelmed the excitement amid up-to-date macroeconomic reports from the US. The S&P Index trades at a level of 3115 about 2 percent below intra-day highs.

Key Level

Resistance Levels: 3300, 3250, 3216

Support levels: 3050.4, 2953.4, 2900

The S&P 500 appears to maintain pivotal support on a closing premise from its soaring moving average of 13 to level 3078.3, and also the March/June rally’s at 23.6 percent pullback.

With daily MA’s momentum-shifting lower and an ‘island pinnacle’ in position, the bias stays for the emergence of a wide-ranging consolidation/correction phase.

On the 4-hour time frame, amidst the turnaround seen from the prior session, its initial resistance stays unchanged at Friday’s high at 4-hour moving average 13 slopes around 3080/88 levels and beyond here is still required to pave the way back to last week’s gap, seen continuing at 3139 levels and pushing to 3183 levels, albeit with that anticipated to limit as of now.

Support is initially seen at 3050 levels, then the moving average of 13 curves at 3000 level shifting at 4 hours. A close beneath here may indicate that wider lower retracement support may be obtained as seen back at level 2953.4, then level 2900, in which it may at first hold.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.