IG has become one of the leading names in the forex industry

Following our previous broker review on ETX Capital, we have decided to review the broker ‘IG’. We have had an account with them for nearly two months now, and have employed various different trading methods with forex pairs throughout the day to get a better opinion of the way they operate. We have also tried their features and checked their website thoroughly to understand their service better. IG is a reputable name in the trading and investing industry, and was founded in 1974 as a spread betting firm by Stuart Wheeler under the name ‘IG Index’ (aka Investors Gold Index). Now, the mother company is IG Group Plc., is listed in the London Stock Exchange, and is one of the companies of FTSE 250. During the previous decade, the company has acquired several other brokers such as the Japanese fxonline and HedgeStreet. Although the group´s main operation is in the UK, they also have offices in Chicago, Dusseldorf, Luxembourg, Madrid, Melbourne, Milan, Paris, Singapore, Stockholm and Tokyo which employ over 800 people. They used to operate under IGmarkets.com, but now the website is simply www.IG.com. In this review, we will share with you our experience with IG over these two months.

To start, the account opening process was a little lengthy, but that was partly our fault. We filled in the online application form and received an automated email asking us for three documents to verify our identity and address. Almost all brokers require two documents, so it may be costly to send three documents, especially if you have to verify them by a legal notary. On the other hand, this applies further legitimacy to IG and proves their compliance with the UK FCA regulations. We sent the documents more than a week later and expected to receive a response in 2-3 working days. After six working days, we contacted them through their online chat support. The assistant lacked some basic telephone service, such as introducing themselves… but overall, they were helpful. The other customer service assistants were more professional and well-mannered, though. They answered all my questions promptly and assured me that a manager would contact me regarding our new account. Well, this took another two weeks to get a call and complete the account opening! The customer service for clients is 24/7 during the week, but 9 – 5 on weekends. You can reach them through phone, email or live chat as we did. The chat service is very convenient for foreign clients, because they usually struggle to understand a native speaker on the phone – but it also reduces the international phone costs. But there are many brokers who don´t offer this service and that´s a large plus for the IG customer service. They also offer customer support service on twitter, which is pretty fast.

After we opened our account, it was time to start funding it and trading. The funding process was simple and quite fast. The funds appeared in the account balance just one working day after we made the wire transfer. The withdrawal took some more time though, four working days. We have accounts with other brokers and the average withdrawal time is two working days, although, four working days is still a reasonable time. The widening of spreads during the after hours and the execution delay during certain events, such as news releases, is not very convenient – especially if you are a scalper. Sometimes our trades were delayed up to 10 seconds, which makes it impossible to scalp. There was also one occasion when our pending order wasn´t filled and when we asked them they told us that the price spiked up and down quickly and that´s why the pending order wasn´t triggered. Other than that, the spreads are great in normal times. EUR/USD spread is usually about 0.6-0.8 pips, while GBP/USD and USD/JPY have a one pip spread.

While the account opening process should be faster in our opinion, we appreciate that IG did not insist on opening and funding the account. I have tried about a dozen brokers, interacting with both demo and live accounts, and most of them have called me many times pushing me to go forward with the process of live account opening and funding. This can get unnerving, and the sales team of IG never called or sent me emails to push me through. This is relieving, as you want to take each step of starting to trade live at your own pace and not be rushed. It also shows that they have excellent business ethics and are a large and established broker. They are unlike smaller brokers which aggressively try to persuade potential clients into going live as soon as possible.

One of the downsides is that they don´t offer minimum margin guarantee. Minimum margin guarantee means that whatever happens in the market, the funds in your account cannot decline below this set margin, which might range from $50 to $50,000, depending on the broker and on the type of the account. If the equity in your account reaches the minimum margin or goes to zero, all open positions close automatically and you are protected from further losses. But IG doesn´t guarantee the minimum margin, which means that your account can go into a negative value. In such cases, you have to pay the negative amount which is owed. When the SNB removed the 1.20 EUR/CHF peg on the 15th of January 2015, this pair fell about 45 cents in a matter of seconds. So many people, including myself, who had long open positions in this pair lost more than their accounts. That doesn´t happen every day, but high volatility is always present in this game… so it would be safer for the traders if IG did guarantee the minimum margin. This point becomes even more important for inexperienced traders.

Informative list of features, parameters, and services

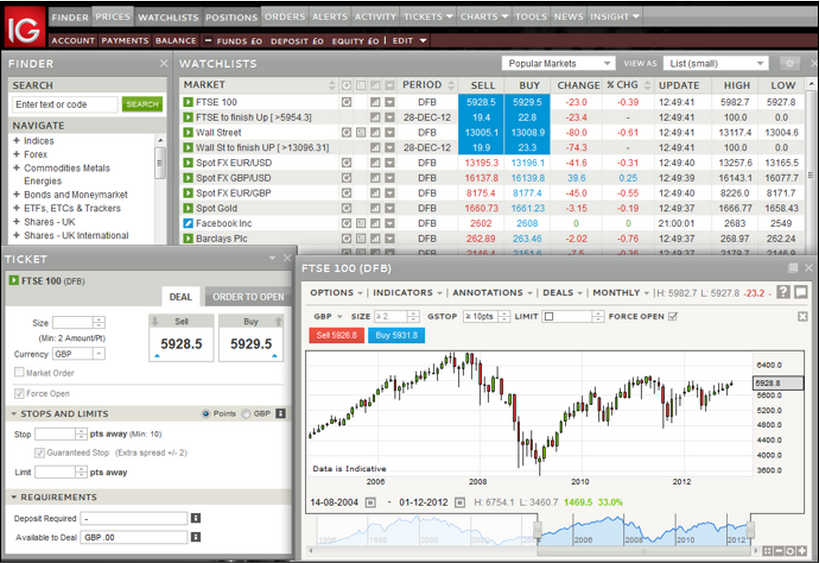

IG offer their clients a variety of platforms. They have the famous MT4 platform, web-based platforms, mobile platforms, as well as platforms developed in-house. They don´t offer the MT5 platform, which has some nice additional features compared to the MT4 – but the developed platforms make up for that. The platforms are:

- L2 Dealer

- ProReal time

- MetaTrader4

- Web-based platforms

- Mobile applications

- Tablet applications

IG offers some very advanced platforms to their clients

All these platforms are available for the three types of account they offer: Spread Betting, CFD Trading, and Stockbroking, although most non-EU nationals can only register for the “CFD Trading” account. The mobile and tablet applications are their own design and they don´t offer a mobile MT4 or MT5 platform. Apart from the PC MT4, the other platforms seem a little complicated at first, but take a couple days of practice. Their mobile and tablet applications have the option of having an economic calendar, which is very helpful in my opinion. You can also see the market sentiment (both short/long) for every pair as well as price volatility. They offer a wide range of financial instruments in all their platforms (listed below), and finding the instrument you want to trade is a little complex; you can put the ones you trade often in the watch-list so it´s easier to find them. The pro real time has a £30 monthly fee, but that´s refundable if you are an active trader placing more than 6-7 trades/month. The L2 dealer is free only if your balance is above £1,000, but all the other platforms are free. You can only get direct market access (DMA) for CFDs and stocks from their platform, however, you can manage your account from there and perform actions such as send and withdraw funds. As we mentioned above, they offer almost everything that´s tradable. Below is a list of the financial instruments they offer:

- Indices: FTSE 100, Wall Street, US 500, Germany 300, US Tech 100,

- Socks/shares: 8,000 international shares (Lloyds, Apple, BP etc.),

- Forex: Majors, Minors, Crosses, Exotics etc.,

- Binary: Majors, Minors, Crosses,

- Other markets: Commodities, Options, Interest Rates, Bonds, Sectors, Bitcoin ETPs

IG offers analyses and educational articles, seminars, and webinars for experienced and inexperienced traders. Most of their seminars are held in London, which makes it difficult for international traders to attend, but they make up for this with a large number of educational articles, guides, newsletters, webinars etc. They also offer news analysis before and after important data/news releases, explaining their effect on the forex price action, as well as a future analysis for the week ahead, which is very educational for inexperienced traders, in particular. You also get a Twitter list of the 50 most influential forex commentators for your trades. You can also find the ‘IG Live’ TV page on their website, styled with videos of trading outlooks, key trades to watch, bulletins, charting the markets, etc.

IG offers a 200:1 leverage, but this leverage will be reduced to 100:1 or 50:1 (like the USA). This is following the SNB episode in January, when the European trading legislation, under which IG falls, will change. They are a London-based brokerage firm and regulated by the European MiFID and the UK trading authority FCA. FCA offers EU-based traders a £50,000 compensation scheme in case of bankruptcy, but also compensation for foreign-based traders that varies by country. They also segregate their clients´ funds in full into separate accounts so your funds will be protected if the company experiences financial difficulty.

Many brokers offer bonuses or promotions, such as 20% extra if you fund your account with more than $3,000, so we looked for this type of information regarding bonuses on their website but were unlucky. We contacted their customer support for answers, and they confirmed our opinion – they don´t offer any sort of trading bonuses or promotions. The only bonus they offer is for referrals; if you refer a friend you get one credit which translates into £50, for 3 credits you get £200… for 5 credits you get £400. Since we were there, we asked them about account management as well. Their answer was that IG doesn´t trade for you. However, they can get a manager to help you out with trading.

On their website, they advertise the minimum lot/unit to be 0.0001 or £1, but from what we saw during our experience, the minimum amount was set at 0.0005 lots, which they refer to as ‘5 points’ on their platform. That´s £5 (about $8), which is still quite small, and compared to a $100 minimum trade, that´s very good for inexperienced traders to practice on a live account without risking much. At £1 ($1.5), the minimum step is pretty small so you can increase your position size very gradually. They don´t have a minimum limit for margin calls, so it basically means that you get a margin call when your equity is zero.

Some other brokers would freeze the platform during important news releases, but we never experienced these trade restrictions with IG. The prices of the financial instruments were continuously changing; the spreads would widen during volatile times and off-market hours, though, which might restrict some traders who use certain strategies, such as scalping.

Unusual occurrences

As we mentioned above, we applied for a live account with IG but didn´t send the requested documents for another week. During this time, the account was pending and we were unable to download one of the platforms that IG offered to clients, and we couldn´t find where to download any of their desktop platforms. The only way to try their service was to open a demo account and log in on the online platform, but the market reflection and trading in a demo account is never the same as in a live account. Another unusual event for IG was the large negative balances during the SBN EUR/CHF peg removal. We obviously did not experience it ourselves because we registered with IG eight months later, but it is all over the news that some of the clients ended up with a negative balance of up to £18.4 million in total. The IG Group has decided to pay most of the clients´ debt, though the FCA still has an open case for IG.

Rating

- Customer service – 4.2

- Spreads – 4.5

- Platforms – 4.6

- Broker security – 4.5

- Execution – 4

- Account opening process – 3

- Bonuses – 2

Summary Review of IG Brokers

After a period of more than one-month trading with IG, we can say that trading has been smooth and we haven’t had any major negative occurrences or interruptions. The spreads are very convenient; there are only a handful of brokers with slightly lower spreads, but IG ranks very high regarding spreads. Although they don´t offer the MT5 platform, the other platforms are very advanced and practical as well once you get used to them. Being one of the biggest names in the industry and registered in the UK under FCA, trading with this broker is pretty safe. We haven´t had any problems funding and withdrawing from our account, and this can also be done through the platform as well. We can also say that IG is at the top of the industry regarding educational articles and market updates. There are also some record blemishes, such as the lengthy account opening process, the lack of MT5 and no trading promotions or competitions, but overall we are very pleased with IG.

Pros

- Low spreads

- Very advanced trading platforms

- Broker security

- A wide range of financial markets

- No aggressive marketing

- Very low position size minimum

- Numerous and up to date educational and market update articles

Cons

- Very lengthy account opening process

- No MT5 platform

- No margin call guarantee

- No trading promotions

Our conclusion is that IG lives up to its name. The pros far outweigh the cons and there are several fields where this broker is at the top of the industry, including trading platforms, spreads, market range, educational articles, etc. We can rate this broker at 4.15 points out of 5, and quite a solid rating at that.