Profit is what drives traders in the market, and for the Forex traders, there’s nothing more significant than learning and understanding the dynamics of the market. First, the signals aid any trader in making crucial decisions about selling and buying.

FX market leaders (FXML) came into the mix majorly to help other Forex traders to be involved in the FX traders and at the same time enjoy its rewards.

FXML is responsible for assembling the various tools as well as services that one might require to start forex trading. The FXML signals’ system is based on the analysis of the trading analysts making decisions and then combining them in a sell/buy scheme.

So do you need to have a report on the forex leaders signals?

As a forex trader, you definitely need to follow carefully any indicators in the market to ensure that you stay at the top of your game. For that reason, having a comprehensive report about the signals from experts is a no brainer.

Last year (2018) went down well, although it was indeed a long year. It was a year that saw a plethora of events of which some were expected while others not expected. Moreover, a lot of volatility was observed.

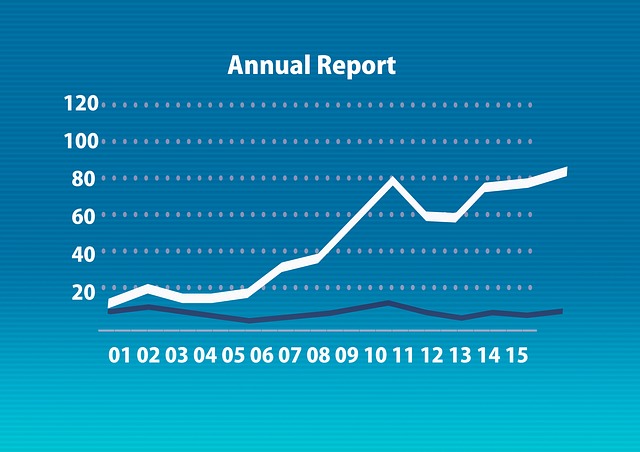

However, despite all the things that happened, the year ended well with an impressive profit. Precisely, during the year, 9073 pips were made across all markets.

It’s also a year that saw stock markets make significant moves, which offered the opportunity to get a few pips. Most of the profit during the year came from indices forex was second, cryptocurrencies on third, and commodities resting in third place.

We can’t fail to point out the political events that took center stage during the year. As always, Brexit never fails to surprise. UK Prime Minister Theresa May agreed with the EU but was unable to bring the deal to the British Parliament as she had pulled back later on.

The Stock Market and Political Stand

Towards the end of 2018, the stock market went down as a result of the civil and political nervousness across Europe. However, most of the market events were connected to US President Donald Trump.

It was pretty clear of the trade tariffs war he started on the EU, China, Mexico, and Canada. At first, the markets took a shock but later adopted, which resulted in volatility. However, then in November, the market cooled following an agreement between Trump and the Chinese President Li in the G20 Summit.

Apparently, those are some of the main events that took place in the year. But what are the details of the trading signals for 2018?

Forex Signals

During Q1 of 2018, the markets were extraordinary following a terrible loss of the USD the previous year (2017). Despite all the fundamentals going up as well as the FED hiking interest rates, the USD was declining.

However, some profit was made in February and March with Q1 closing with a loss of about 88 pips. There was then a complete turnaround for USD until the end of the year.

Perhaps, the main reason for the strength of the USD was the Federal Reserve increasing the interest rates from 2016 and continuously via 2017 to 2018.

Precisely, from forex signals, a high profit of 2048 pips was generated with the AUD/USD being the best pair making a total of 727 pips.

Index Signals

At the start of the year, it was somehow hard to trade the indices market. In fact, the indices went down dramatically as a result of the fear of the Chinese markets going through yet another crisis. However, it didn’t happen anyway, although the damage was already done.

However, trade Arslan Butt did something to smile about. On indices alone, Butt in January made about 317 pips, in February 58 pips, and in March 291 pips, and total closing with a 1,196 pips profit.

In Q2, the start was slow with only 1 pip profit in April, but May and June produced a total profit of 256 and 198 pips respectively. Collectively, a total of 1,650 pip profit was made on indices alone.

July came strong as well, especially the CAC as well as the Nikkei signals. During that month, a total of 586 pips were made followed by 790 pips in August. The following month of September 297 pips profit was attained. The total number of pips profit ended at 6,114 from index signals.

Trading commodities was not something to smile about as there were major trend reversals; however, the year finished with 249 pips. During the year, Oil was on the uptrend with US WTI crude Oil almost reaching $80/barrel as well as the UK Brent crude hitting $85 in September.

Everything then reversed in October as Oil started to decline and globe economy slowed down its recovery. At the end of the year, Oil was at its 2-year lows, and hence there were hard times with the signals in crude Oil.

With Gold, it was a similar case but upside down. It experienced a downward trajectory and started tumbling in spring losing over $200 until halfway of August. After consolidating, it went higher gaining 2/3ds of losses closing the year at almost $1,300. 381 pips were made from gold signals during the year with 249 pips from commodities.