Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

ZKSync Price Forecast – March 18th

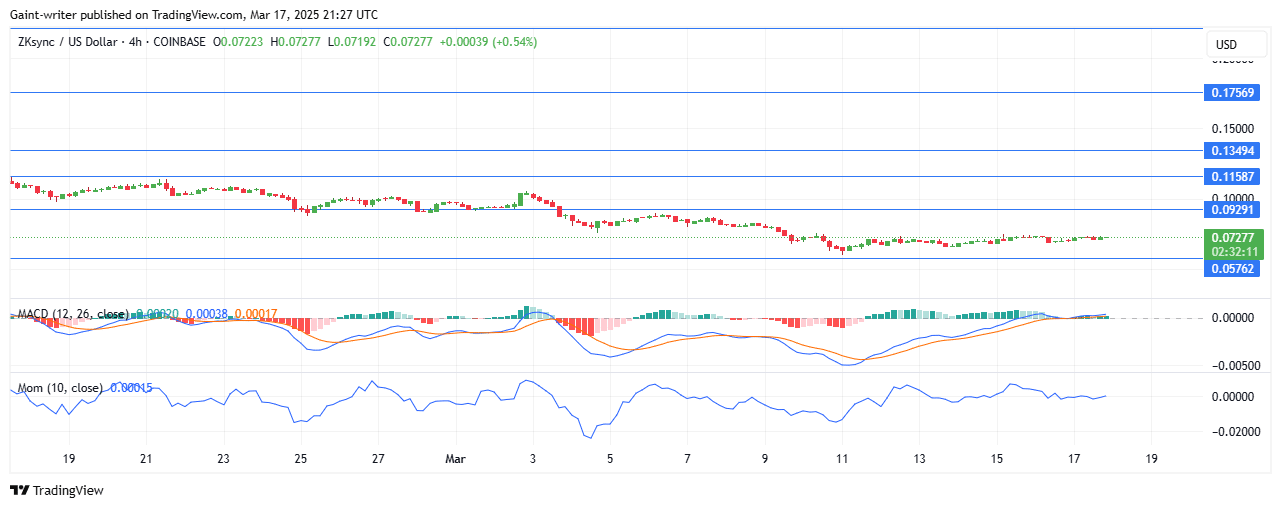

ZKSync price forecast is gradually recovering from recent selling pressure, with buyers attempting to regain control above the $0.0570 key level.

Key Levels:

Support Levels: $0.0570, $0.0500

Resistance Levels: $0.1000, $0.1150

ZKUSD Long-Term Trend: Bearish (Daily Chart)

Despite a challenging start to the year, the market is beginning to show signs of bullish resolve. At the moment momentum remains uncertain.

The beginning of March saw sellers in control, pushing ZKSync down from $0.1158 resistance toward $0.0570 support.

ZKSync Price Forecast – Outlook

However, buyers have started to emerge, signaling a potential recovery phase. The MACD (Moving Average Convergence and Divergence) indicator remains below the midline. This confirming that bearish pressure is still dominant.

The Momentum indicator has yet to show renewed strength, suggesting that buying pressure is still weak. For a stronger bullish breakout, buyers must surpass the $0.1000 resistance level. Failing to do so could result in another downward move toward $0.0570 support.

If buyers push beyond $0.1000 key level, the next target is $0.1158, which could confirm a trend reversal. The overall market sentiment remains uncertain, and traders should watch for stronger bullish confirmation before expecting a breakout.

ZKUSD Medium-Term Trend: Bullish (4-Hour Chart)

On the 4-hour chart, buyers are slowly regaining ground, though momentum remains weak. The MACD indicator is still positioned lower, confirming that sellers still have the upper hand.

The Momentum indicator shows steady flow, but it needs stronger bullish participation to confirm a market shift. If buyers continue to apply pressure, a move toward $0.1000 resistance is possible in the short term.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.