Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

ZKsync Market Analysis – January 19

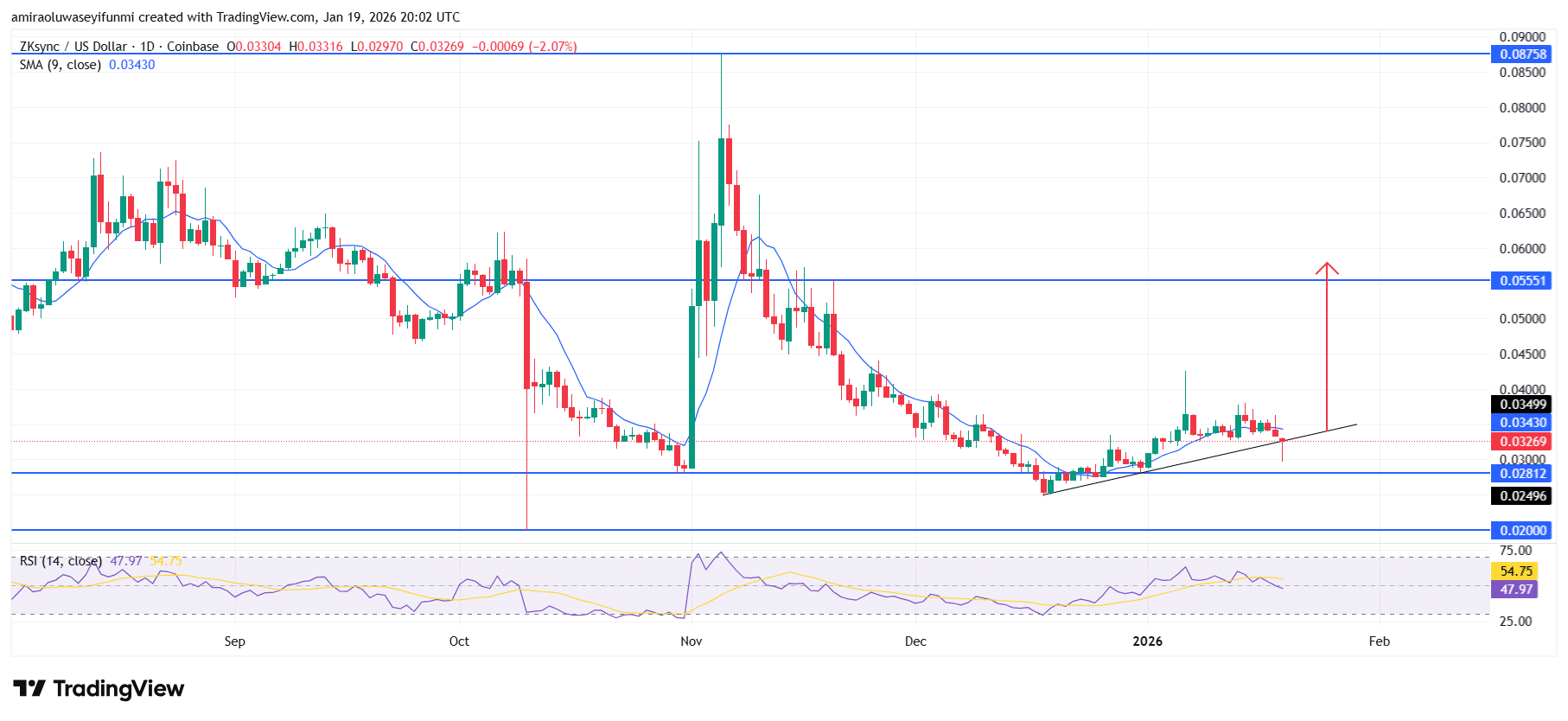

ZKsync market structure signals emerging accumulation and a bullish reversal phase. ZKsync is beginning to display early indications of a bullish transition, with price stabilizing above the short-term moving average around $0.030 while momentum indicators show gradual improvement.

The RSI has rebounded from oversold territory and is now holding near the neutral 50 level, indicating that selling pressure is diminishing as buyers slowly regain control. Overall price behavior suggests a transition from distribution into accumulation, aligning with the development of a more constructive and bullish market environment.

ZKsync Key Levels

Resistance Levels: $0.0560, $0.0880

Support Levels: $0.0280, $0.0200

ZKsync Long-Term Trend: Bullish

From a technical perspective, price has maintained a higher-low structure above the $0.030 demand zone following a rebound from the broader base between $0.020 and $0.030. Recent consolidation has remained orderly, with pullbacks staying shallow and consistently supported above previous demand, signaling healthy price acceptance. This structure implies that downside liquidity has largely been absorbed, allowing price to compress beneath overhead resistance near the $0.040 level.

Looking ahead, a sustained hold above $0.030 is expected to support bullish continuation toward the $0.050 resistance zone, which stands as the next significant upside target. A decisive break above $0.050 could open the path toward higher recovery objectives near $0.080 as momentum participation increases. As long as price holds above the $0.030 structural base, the medium-term outlook for ZKsync remains bullish.

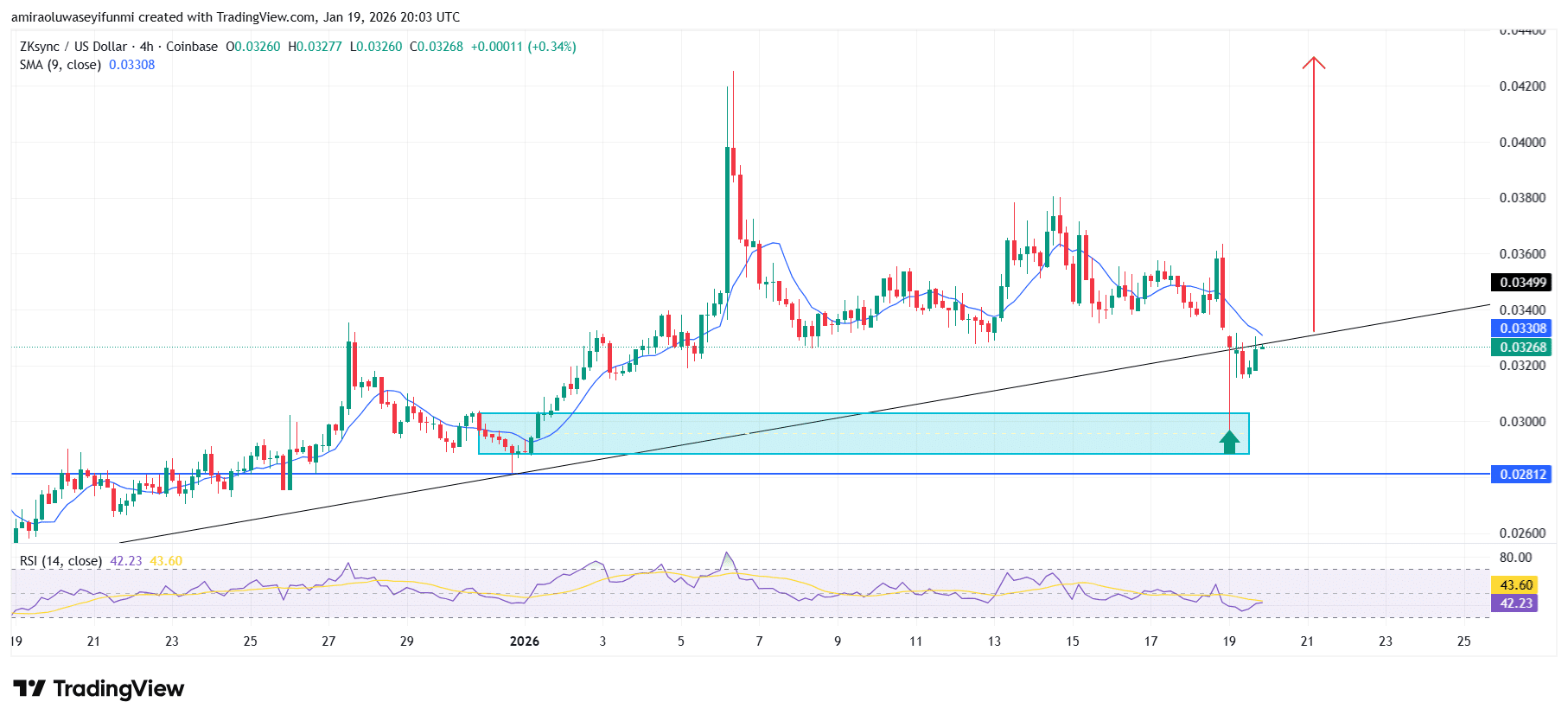

ZKsync Medium-Term Trend: Bullish

On the four-hour chart, ZKsync continues to exhibit a constructive bullish structure, with price stabilizing above the rising trendline and defending a clearly defined demand zone. The most recent pullback appears corrective, as buyers stepped in around support to prevent a deeper decline and maintain the higher-low formation. Short-term momentum is attempting to recover, with price pushing back toward the 9-period moving average, signaling renewed upside participation and reinforcing bullish expectations reflected in evolving crypto signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.