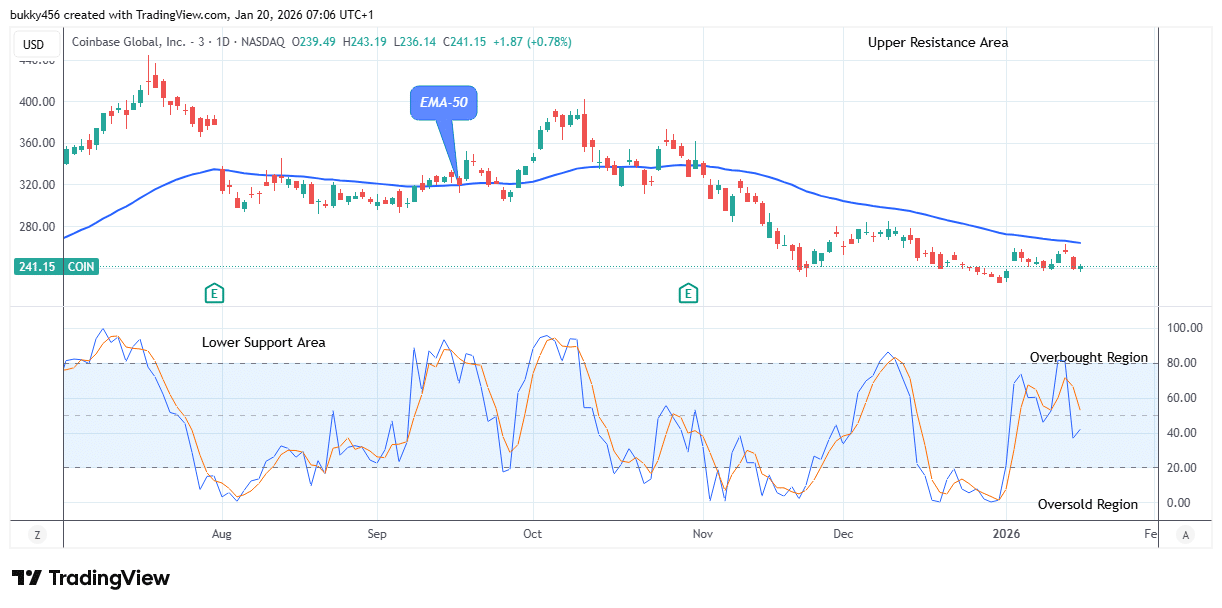

$COIN (NASDAQ: COIN) Forecast: January 21

The Coinbase Global (NASDAQ: COIN) market price could see another increase sooner, following the pullback from the daily bullish candle at $243.19 today. As demand for the $COIN continues to soar gradually, an aggressive push from the current price above the supply level will put the stock in a more bullish trend and may reach the upper resistance level of $405.88, resulting in a massive price pump.

Key Levels:

Resistance Levels: $392.00, $393.00, $394.00

Support Levels: $292.00, $291.00, $290.00

COIN Long-term Trend: Bearish (Daily Chart)

As it begins its upward trend below the supply level, the NASDAQ: COIN market price is expected to rise and make a modest long-term recovery.

Its current bearish momentum has been influenced by the involvement of short-term traders, which led to a low of $237.43 in the prior action.

Meanwhile, the $COIN hopes to continue its positive trend today on the daily chart by rising to a $243.19 barrier level below the EMA-50, suggesting buyers are making a recovery attempt.

Hence, a big potential rally for stock buyers may occur if the price can hold above the $392.16 prior peak mark and reach a significant level at the upper channel.

Notably, the daily stochastic indicates an uptrend. Thus, there is a tendency for the NASDAQ stock to rise further if the support level holds.

As a result, buyers might push the share price to an upper resistance level of $405.88 in the days ahead in its higher time forecast.

While South Korea’s stablecoin legislation has encountered yet another obstacle, Coinbase (NASDAQ: COIN) is cautioning Congress not to tamper with its stablecoin revenue.

Coinbase (NASDAQ: COIN) is warning Congress not to mess with its stablecoin revenue, while South Korea’s stablecoin legislation has hit yet another snag.https://t.co/CeeRwpjrA3

— CoinGeek (@RealCoinGeek) January 5, 2026

COIN Medium-term Trend: Bearish (4H Chart)

The NASDAQ stock price is on the verge of an upside reversal and has a bearish trend in the medium-term perspective.

The sell traders’ movement to the $242.33 support level before the end of the last session has given more strength to the share’s recent low.

Hence, the stock value is poised for a retracement as the market is already oversold.

At the time of writing, the $COIN price dropped even further today, reaching a low of $240.13 below the EMA-50, due to sellers’ actions.

In the meantime, buyers could take advantage of this opportunity to purchase the asset at a discount for future gains.

However, the share price may see an upside reversal at the mentioned support to retest the previous high of $370.26 if there is a fresh surge in buyers’ interest.

In conclusion, the NASDAQ: COIN price suggests an upside reversal as the market has fallen to the oversold region of the daily stochastic, implying that selling pressure may subside soon.

In light of this, the emergence of buyers is imminent, and the next bullish corrective pattern may extend to the $405.88 upper high mark in the upcoming days.

Trade your favorite stocks using a premium broker. Open an account here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.