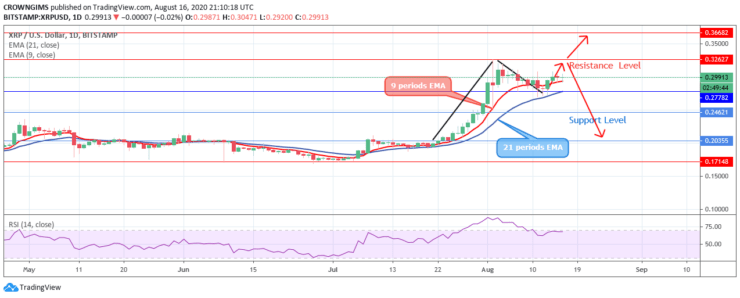

XRP Weekly Price Analysis – August 16

The price is moving towards the resistance level at $0.32, in case the level does not hold the price; the next targeted resistance level will be $0.36 and $0.39. Should the resistance level at $0.32 holds, the price action may form a double top chart pattern and the price may fall to the demand level at $0.27, $0.24, and $0.20.

XRP/USD Market

Key Levels:

Resistance levels: $0.32, $0.36, $0.39

Support levels: $0.27, $0.24, $0.20

XRP/USD Long-term Trend: Bullish

The bulls were in control of the XRP market since July 25. It has been increasing steadily to the resistance level at $0.32 on August 02. The long-legged daily Doji candle formed on 02 August indicates indecision in the market. The bears pushed down the price to retest the support level at $0.27. Bullish movement may continue as the price is currently repelling from $0.27 demand level.

The price is moving towards the resistance level at $0.32, in case the level does not hold the price; the next targeted resistance level will be $0.36 and $0.39. Should the resistance level at $0.32 holds, the price action may form a double top chart pattern and the price may fall to the demand level at $0.27, $0.24, and $0.20. The relative strength index period 14 is at 70 levels with the signal line bending down to indicate the sell signal.

XRP/USD Medium-term Trend: Bullish

XRP is bullish in the 4-hour chart. XRP eventually found resistance at $0.32 price level. The coin carried out a price retracement towards the demand level at $0.27. The bullish engulfing candle formed on August 13 indicates that the bulls defended the demand level at $0.27 and that is the reason why it is increasing towards the resistance level at $0.32.

The price may test $0.32 level second time before it continues bearish movement or breaks up the mentioned resistance level. The price is hovering around the two EMAs and the RSI indicator is not displaying specific direction connotes that the price is consolidating at the moment. The price may fall after retesting $0.32.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.