XAUUSD Price Analysis – February 25

Gold (XAUUSD) continues to struggle to stay afloat selling pressure within a confined range below the $1800 level through the mid-European session. The XAUUSD pair altered south in the early trading hours of Thursday and dropped to a low of $1787. A modest pickup in the US Treasury bond yields collaborated to cap the non-yielding yellow metal.

Key Levels

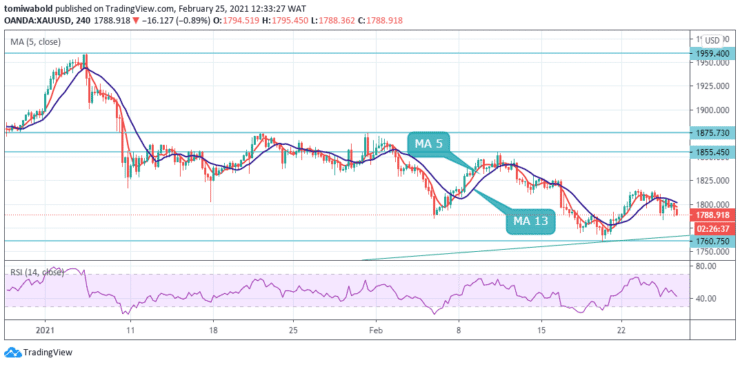

Resistance Levels: $2015.00, $1959.40, $1875.73

Support Levels: $1760.75, $1670.00, $1572.82

After closing the prior day past the $1800 level, the bears retain control amid a technical break to the downside at the day’s start. The price of Gold confirmed a breakdown towards the ascending trendline support while trading at lows of 1787 level.

The bearish break calls for a retest of the prior day’s low at the $1783 level, below which the measured target of the horizontal support at $1760 could be challenged at the ascending trendline zone. The downside bias also got additional credence after the price breached the MA 5 around $1795, where the moving averages 5 and 13 converge.

From a technical perspective, the commodity has been oscillating beneath its downside channel beneath horizontal resistance at $1875 as seen in the lower time frame. With the latest decline, the Relative Strength Index on the four-hour chart dropped below its midline at 50, suggesting that the bearish momentum is building up in the near-term.

On the downside, the initial support is located at $1760, where the 38.2% retracement of the prior week’s low is registered. If a four-hour candle manages to close below that level, XAUUSD could extend its slide to the next level (23.6% retracement) around $1700 marks.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.