XAGUSD Price Analysis – August 19

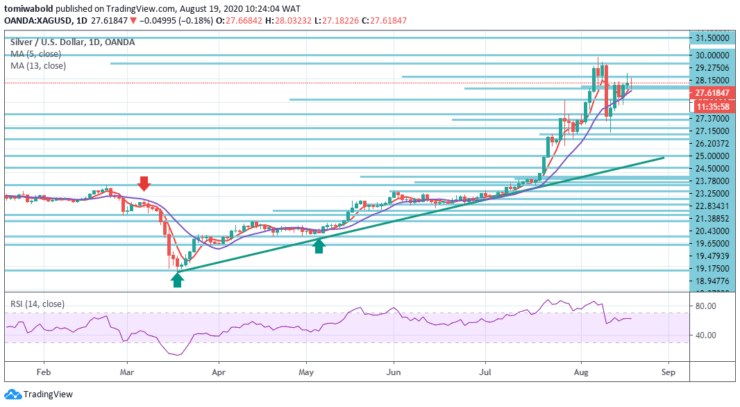

The price of silver has reached a prior barrier structure which now acts as a temporary limit for buyers from where we have seen a sharp pullback on the daily time frame. XAGUSD reverses early gains from a $28.03 level amid positive investment demand for the white metals which has been strong.

Key Levels

Resistance Levels: $30.00, $29.27, $28.15

Support Levels: $25.00, $23.78, $21.38

Silver prices seesaw around $28.03 level, down 0.35% on a day, during the European session on Wednesday. Despite the recent weakness to refresh the weekly top, the metal’s ability to keep the upside break of the horizontal resistance level at $28.15 level remains intact and a one-week-old horizontal support line at $25.00 level favors the buyers.

The pair is expected to find support at $27.15 level, and a fall through could take it to the next support level of $26.20 level. The pair is expected to find its first resistance at $28.15 level, and a rise through could take it to the next resistance level of $29.27 level.

Silver (XAGUSD) bulls are gathering pace for a fresh leg higher while consolidating the break above the $27.37 level. The 4-hour Relative Strength Index (RSI) trends beyond the midline territory of 50, implying there is more scope for the upside.

A break below the latter could call for a test of the horizontal support level at $27.15 level. A close below the moving average 5 and 13 is needed to negate the near-term bullish momentum. In the alternative bias, short positions below the $28.15 level will target levels at $27.37 & $27.15 in extension.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.