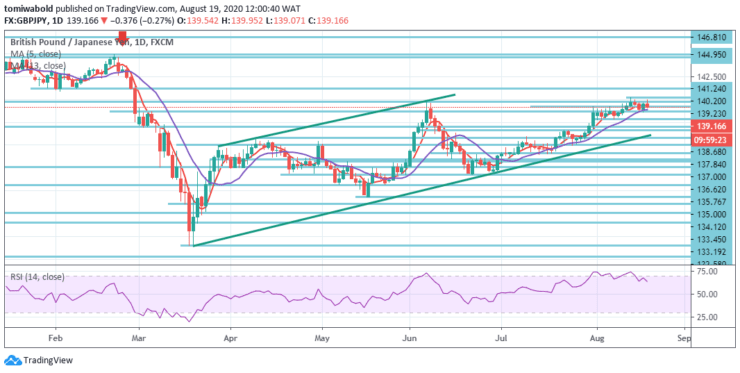

GBPJPY Price Analysis – August 19

GBPJPY sits on a shaky footing while retreating from level 139.95, down 0.19 percent, during the trading of the early European session. The sterling continued to be bolstered by mixed expectations as Brexit talks linger ahead. The EU and British negotiators are expected to kick-start the final round of difficult negotiations.

Key Levels

Resistance Levels: 147.95, 144.95, 141.24

Support Levels: 137.84, 135.76, 134.12

In the wider sense, a surge from level 123.99 is seen as a rise from level 122.75 (low) of the sideway consolidation trend. So long as the resistance level of 147.95 holds, the pattern remains supportive of an eventual downside breakout.

A steady breach of 147.95 level, nevertheless, may increase the risk of a long-term bullish reversal. Validation of the emphasis will then be shifted to the resistance level 156.59.

At this point, the intraday bias in GBPJPY holds steady. An additional rally is required as long as it maintains a support level of 137.84. The growth from 123.99 level has just returned and a breach of 140.20 level may reach a 100% forecast of 123.99 to 135.76 levels, from 129.29 to 141.24 levels.

Nevertheless, a break of 137.84 may suggest a short-term topping in a relative strength index of 4 hours on bearish divergence condition. The intraday tendency for pullback should be shifted over to the downside.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.