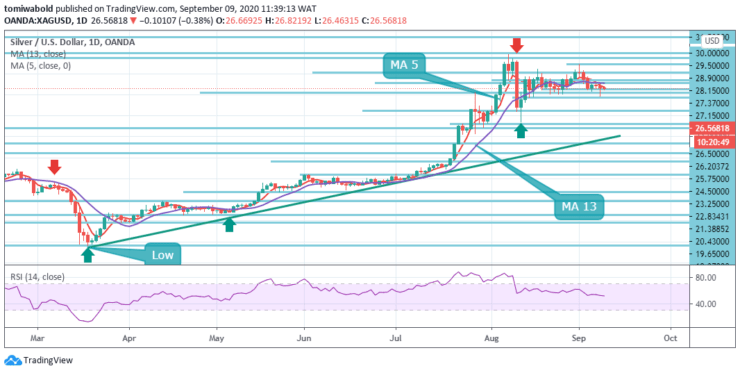

XAGUSD Price Analysis – September 9

Silver is expected to extend its sideways move while past the $26.00 range during Wednesday European session. The trend may turn higher again above the $28.90 mark in the next few sessions, but for now, the white metal is feeling the brunt of a stronger US dollar.

Key Levels

Resistance Levels: $30.00, $28.90, $27.15

Support Levels: $26.50, $25.00, $23.78

Silver has been trading sideways but the price came close to horizontal support at the $25.75 level and bounced back. We might see a continuation of the consolidation. Besides, we can also see the confluence of the recent daily high re-attempted at $28.90 level.

The first target is the $27.15 level followed by a $28.15 level. As long as the level at $26.50 holds we won’t see sellers taking over. Therefore buying on the dip may continue. Below $25.00 level would warn of a deeper corrective setback with support next at the $24.50 level, then $23.78 level.

XAGUSD is expected to extend its consolidation phase with near term support at $25.75 level still ideally holding further setbacks. Above $28.90 level would suggest the trend is turning higher again with resistance above the $29.50 current cycle high seen next at the $30.00 level.

Meanwhile, an ascending trend line from August 12, at $26.20 level now gains market attention. However, the $25.75 area including the latest low and the bottoms marked during mid-August can offer immediate support to the quote.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.