Yesterday’s decline was met with strong support at the $1906 line (the 50 SMA on the daily chart), where it was able to facilitate a modest bounce. The bounce was likely as a result of the fresh flight to safety amid a strong sell-off in the US stock markets.

With the global Coronavirus cases still increasing and lingering doubts over a strong US economic recovery in the near-term, AstraZeneca’s recent halt of its Coronavirus vaccine testing spurred panic in investors. This, consequently, bolstered demand for safe-haven assets, including gold.

The global risk sentiment was further disrupted by the renewed risk of a no-deal Brexit. Worries erupted after the U.K. Prime Minister Boris Johnson threatened to abandon the Brexit talks if a deal was not agreed on by mid-October.

However, a decent uptick in the US equity futures ensured that the yellow metal stayed beaten-down. Additionally, steady buying interest for the US dollar (DXY) limited further gains for the dollar-denominated commodity, which has kept it range-bound on early Wednesday.

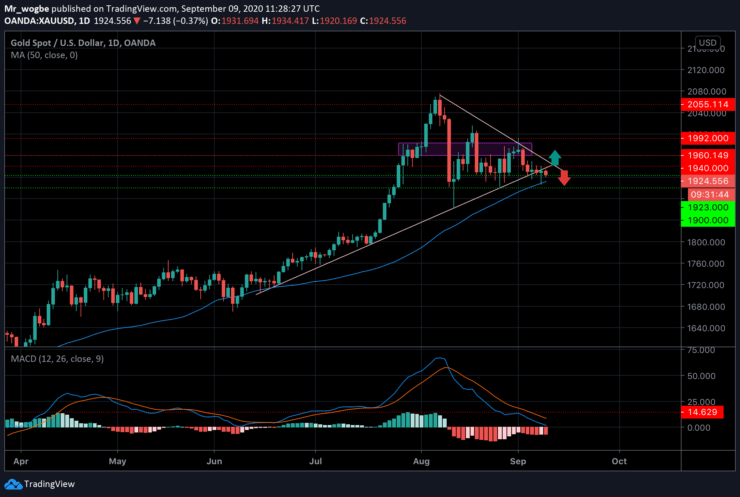

Gold (XAU) Value Forecast — September 9

XAU/USD Major Bias: Bearish

Supply Levels: $1940, $1960, and $1983

Demand Levels: $1923, $1906, and $1900

Based on an indication from our chart, gold is on the verge of a strong breakout to the downside. On the daily chart, we can see that a triangle pattern has emerged, which is usually indicative of a breakout. However, given gold’s consistent failure to climb above the upward-facing line, a bearish breakout could occur as bulls have run out of steam.

That said, strong support remains at $1906 (50 SMA). A break below that level could open gold up to the upper-$1800 levels.

On the flip side, a sustained move above the $1940-45 resistance area could ease the bearish pressure significantly.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.