XAGUSD Price Analysis – March 7

The price of the white metal came under immense pressure in the prior session and briefly dipped below the $25.00 level. A move beyond the $25.00 breakpoint will negate the selling bias. The lack of lasting downside probably owes itself to the fact that US government bond yields, which spiked in reaction to the strong NFP report, have fallen back to pre-release levels.

Key Levels

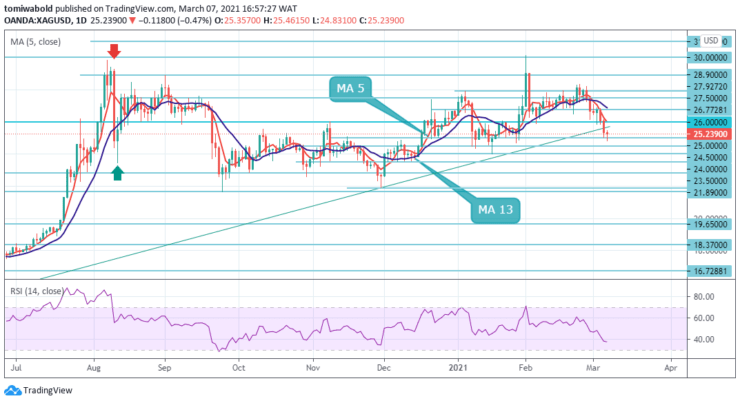

Resistance Levels: $28.90, $27.50, $26.00

Support Levels: $24.50, $23.50, $21.89

From the daily technical analysis perspective, the bearish bias also gains support from the XAGUSD failure to recover from recent lows while staying below ascending trendline support at $25.50 amid bearish moving averages 5 and 13. On a correction, the bears can target the old daily lows of a bearish impulse at $24.01 on Jan 18, 2021.

On the flip side, any meaningful recovery attempt might still be seen as the selling opportunity may run the risk of fizzling out rather quickly near the trend-line support breakpoint. A fresh bout of short-covering might then push the XAGUSD back towards the $26.00-77 supply zone en-route the $27.00 round-figure mark.

In the near term future, the XAGUSD price is expected to continue to trade sideways until it flips moving averages 13 into support, which is located above the $25.50 level. Bears may eye an immediate target of $24.50, violation of which would risk extension towards $24.00 level.

Bearish analysis of the short-term frame and negative sentiment help bears which for now ignores oversold conditions, but some price adjustment could be anticipated. In the next session upticks under the ascending trendline are expected to provide better opportunities to re-join the bearish market.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.