XAGUSD Price Analysis – May 9

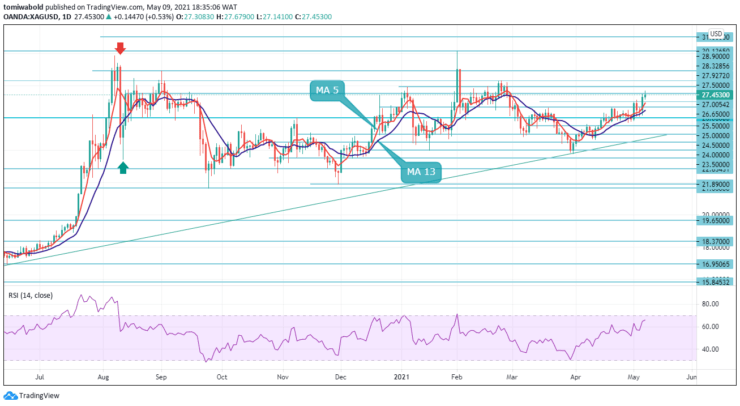

Silver (XAG) surged to two-month highs of $27.67 to close at $27.45 on Friday, gaining nearly 20 percent for the week. As XAGUSD surges higher, buyers have eyes toward the mid $28 region. A major disappointment on the headline NFP number could explain Silver’s towards the end of the prior week on a softer dollar.

Key Levels

Resistance Levels: $30.13, $28.90, $27.92

Support Levels: $27.00, $26.00, $25.00

The white metals moving averages 5 and 13 have almost a bullish pattern, but the trend does not necessarily mean a price spike. Silver is currently opening from 0.53 percent higher on the day at $27.45, and the white metals relative strength index (RSI) almost reached the 70 bullish lines, but the 70 lines do not necessarily imply an overbought region but the beginning.

To validate a bullish turnaround, XAGUSD must fall below the recent high of $27.67. For the bears, the $26.65 level is the one to beat. Since the beginning of April, that level has acted as a solid ceiling for the buyers on some occasions. As long as prices remain within the prior week’s higher trading range of $26.65 to $27.67, the initial bias may remain neutral.

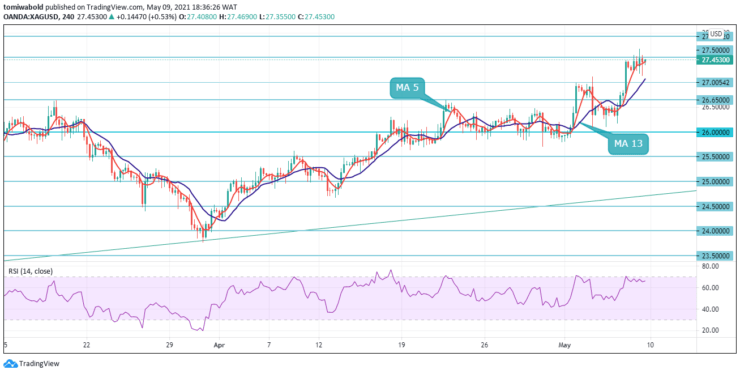

On the 4-hour chart, spot silver is gaining further upside momentum from a technical standpoint. After breaking above the $27.00 mark and overall above the short-term MA 5 support, XAGUSD is holding up well. The 13 moving average is skewed upward.

The nearest support level is $27.00, while the first and second resistance levels have been pushed up to $27.92 and $28.90, respectively. On the one hand, some upside capacity in the market is likely to persist throughout the subsequent trading session.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.