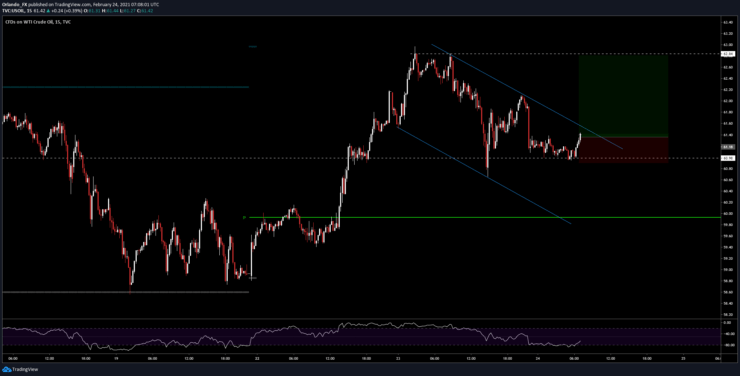

Key Resistance: 62.00 – 62.85

Long Term View

After negative crude prices back in April 2020, price in WTI has rallied more than 1,000% and is now rejecting a previous low for a possible continuation.

Historic Negative Prices

Prices in $CL (crude futures) went negative in April 2020 because of the specificity of WTI futures. At expiry, if you are holding a futures contract you have to take delivery of the commodity.

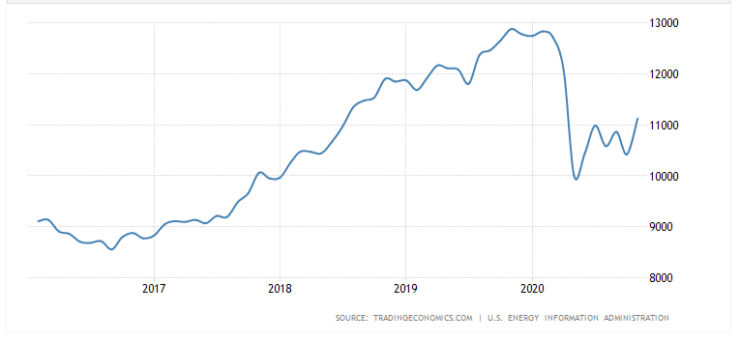

During the pandemic petroleum based products suffer a mayor hit since lockdown measures were put in place and international air travel was halted. This big dip in demand whilst supply (output/production) was at all times high (see US crude oil production chart below) impacted crude prices.

Markets are an auction, and in this case there were no buyers for that product. Heavy selling hitting every possible bid and swiping all and every order created that scenario.

This is why my preferred product to trade oil is Brent. Brent futures are settled in cash not in the actual delivery of the barrels like WTI.

But in this case WTI has a better risk to reward scenario.

1H Analysis and setup

very simple dip buy at the previous base whilst in a very strong bullish move. We{re targeting the previous highs for a short term trade

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.