Blockchain network health stands as a critical foundation for institutional investors, market makers, and traders operating in cryptocurrency markets.

Similar to how traditional financial markets rely on key performance indicators, blockchain networks require specific metrics to evaluate their operational efficiency, security, and overall stability. As institutions commit larger amounts of capital to crypto markets, understanding these health indicators becomes increasingly vital.

Why Network Health Matters in Institutional Crypto

Major financial institutions managing substantial crypto portfolios need reliable networks for their operations.

When a hedge fund executes time-sensitive arbitrage strategies or a custodian transfers large volumes of assets, network performance becomes paramount. These institutions can’t afford disruptions or delays that could cost millions in missed opportunities or failed transactions.

Consider a DeFi protocol managing billions in total value locked across multiple blockchain networks. For such protocols, network health isn’t just a technical consideration—it’s a critical business factor that directly impacts user trust and operational success.

The same applies to custodial services, ensuring secure transfers of large asset volumes while minimizing network fees.

Key Components of Blockchain Network Health

Understanding network health requires monitoring several essential metrics. Each component provides unique insights into the network’s performance and stability, helping institutions make informed operational decisions. Here are the critical elements to consider:

- Block Time Consistency: Regular, predictable block production suggests a well-functioning network. For Bitcoin, this means maintaining consistent 10-minute block intervals, while Ethereum aims for shorter block times. Variations in block times can signal network stress or technical issues.

- Transaction Processing Efficiency: A healthy network should process transactions promptly and maintain reasonable fee levels. When transaction queues grow unusually long or fees spike unexpectedly, it may indicate network congestion or underlying technical issues. High inclusion rates of transactions in the mempool suggest a healthy, uncongested network.

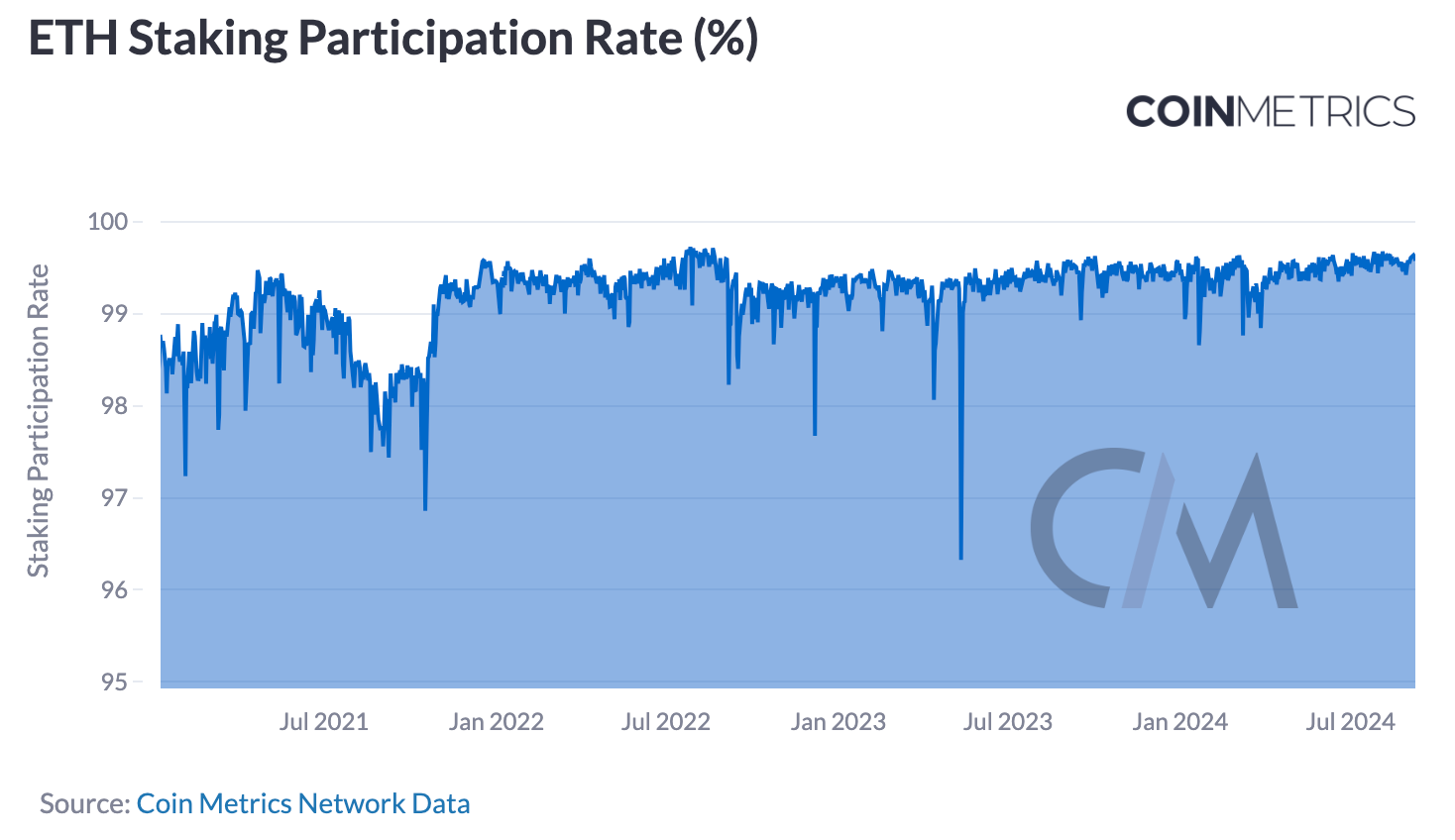

- Network Participation: High validator engagement, particularly in Proof-of-Stake networks like Ethereum, indicates strong network security. Participation rates above 99% are considered optimal. Regular monitoring of validator performance helps identify potential security risks early. Here’s an example:

Image via Coin Metrics - Fee Stability: Consistent and predictable transaction fees suggest a well-functioning network. Sudden spikes in fees often signal network stress or congestion. For institutional users, fee predictability is crucial for cost management and transaction planning.

The Role of Decentralization in Blockchain Network Health

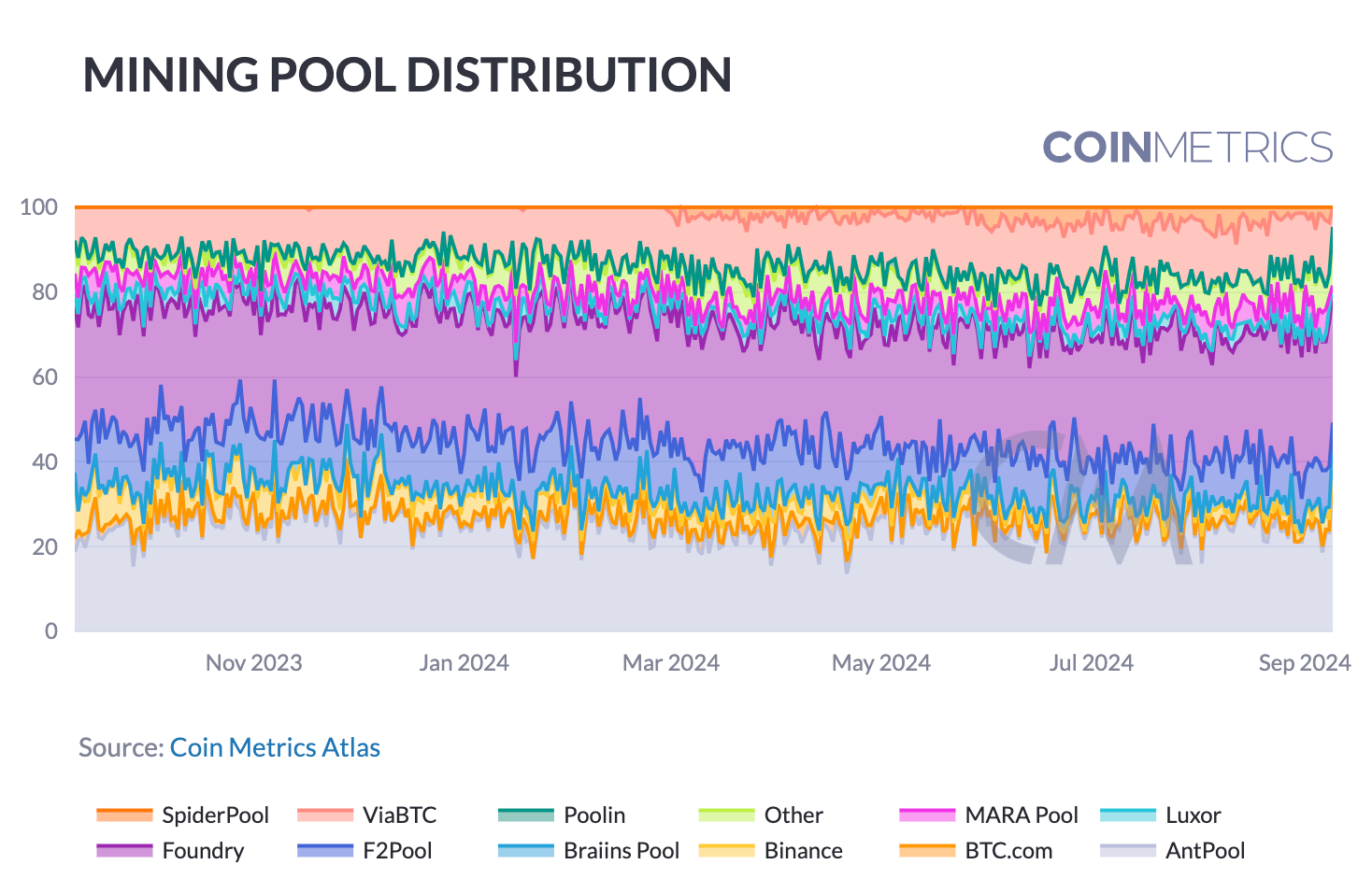

Network decentralization plays a fundamental role in blockchain health. For Proof-of-Work networks like Bitcoin, mining power distribution among multiple pools helps prevent centralization risks.

Recent data shows major mining pools like Foundry, AntPool, and MARA maintaining significant hashrate shares, while smaller miners collectively contribute to network diversity.

In Ethereum’s Proof-of-Stake system, validator participation rates above 99% indicate strong network security. However, the increasing concentration of block-building power among a few major players raises important considerations about centralization trends.

By September 2024, two dominant block builders were responsible for constructing nearly 80% of all blocks, highlighting potential centralization concerns.

Advanced Monitoring Systems

Modern institutional crypto operations require sophisticated monitoring tools to track network health metrics in real time. These systems analyze block production patterns, transaction flows, and network participation rates to identify potential issues before they impact operations.

For instance, sudden changes in mining pool distributions or validator participation rates can trigger early warning alerts.

Validator performance tracking in Proof-of-Stake networks helps identify systemic risks. Regular penalty events typically reflect minor issues like missed attestations, while rare slashing events indicate more serious protocol violations. The ability to monitor these events helps institutions assess network stability and adjust their operations accordingly.

Market Impact and Risk Management

Network health directly influences market dynamics and risk management strategies. Poor network health can lead to increased settlement risks, higher transaction costs, and potential losses from failed trades. Institutions must factor these considerations into their trading strategies and risk models.

For example, arbitrage traders need to account for block time variations and fee spikes when executing cross-exchange strategies. Similarly, market makers must monitor network congestion levels to adjust their quote sizes and spread calculations appropriately.

The Evolution of Blockchain Network Health Standards

As institutional participation in crypto markets grows, network health monitoring continues to advance. Financial institutions now incorporate these metrics into their risk management frameworks, using them to optimize transaction timing and manage operational risks.

The development of standardized health metrics helps institutions compare different networks and make informed allocation decisions.

Looking ahead, the increasing institutionalization of crypto markets will likely drive further developments in network health monitoring. As traditional financial institutions expand their crypto operations, expect to see more sophisticated tools and metrics emerge to meet their risk management needs.

Success in the crypto markets increasingly depends on understanding and monitoring these vital network health indicators.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.