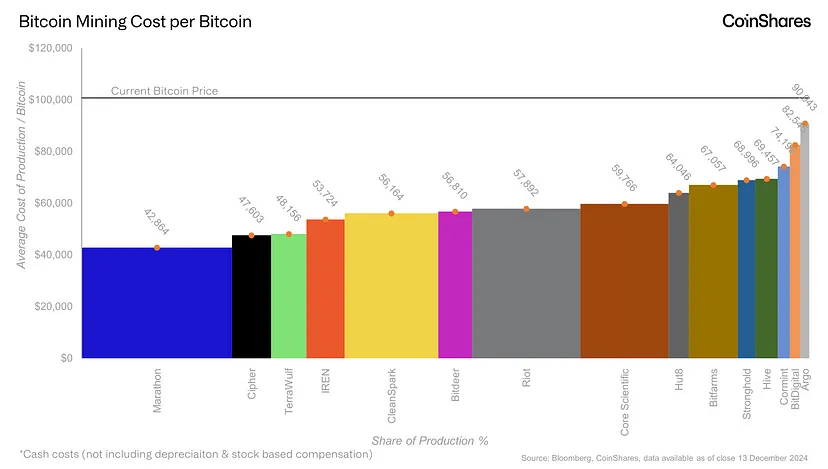

Leading cryptocurrency research firm CoinShares reveals that Bitcoin mining expenses continued rising in 2024’s third quarter, with the average cash cost to produce one Bitcoin climbing to $55,950. This marks a 13% increase from Q2’s $49,500 figure, according to the firm’s latest report.

The Growing Challenge of Bitcoin Mining Economics

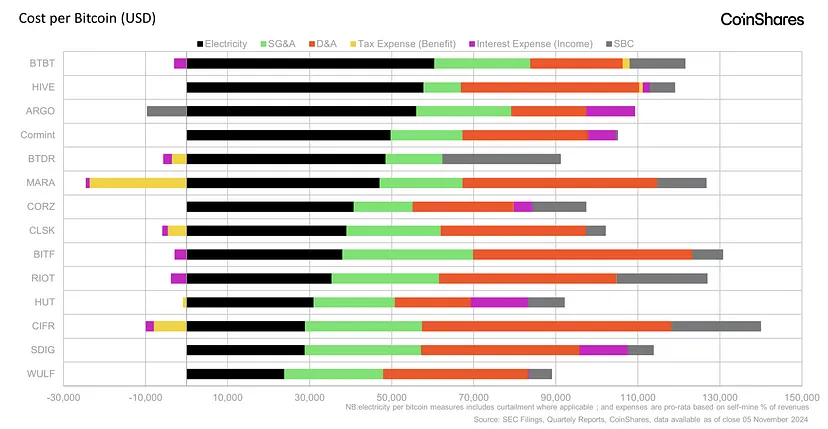

When including non-cash expenses like equipment depreciation and stock compensation, the total cost to mine one Bitcoin shoots up to $106,000.

Despite these high costs, CoinShares’ report highlights that mining operations remain profitable, with Bitcoin trading around $100,000. However, public mining companies face increasing pressure as their share of newly mined Bitcoin decreases due to rising network competition.

Several factors drive this cost increase. First, the AI computing boom has redirected potential mining investment toward data center infrastructure.

Additionally, many miners now focus on holding Bitcoin rather than expanding operations, even as overall network computing power keeps growing. Texas-based operations face extra challenges from high summer electricity rates and the need to reduce power usage during peak demand.

Notable Shifts in Mining Company Performance

The competitive landscape saw significant changes in Q3. Terawulf emerged as a top performer, moving from fifth to third-lowest cost producer after cutting its interest expenses by 92%. This improvement came from early repayment of a major loan.

Marathon also showed strong results, reaching the lowest cost position among public miners. They achieved this through steady Bitcoin production and tax benefits from rising Bitcoin prices.

However, some companies struggled. Private miner Cormint faced setbacks due to a $20 million loss on power price hedging strategies. Riot, despite improving operational metrics like hashrate (up 52%) and Bitcoin mined (up 31%), dropped one position in cost rankings.

Looking ahead, CoinShares expects continued cost pressures from several sources: competition with AI companies for power infrastructure, correlation between Bitcoin prices and mining equipment costs, and increased debt expenses as miners access more financing options.

However, Q4 might bring temporary relief due to higher Bitcoin prices offsetting reduced mining rewards after the upcoming halving event.

The report highlights how Bitcoin mining economics keep evolving, forcing companies to balance operational efficiency, power costs, and strategic decisions about holding versus selling mined Bitcoin. Success increasingly depends on managing these complex trade-offs while maintaining profitability in a highly competitive market.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.