Crypto markets usually move together. When Bitcoin drops, altcoins follow. When sentiment turns, everything turns. But lately, something different has been happening with Bittensor.

Bittensor’s TAO recently hit a year-high while broader markets declined on Bitget, showing unusual strength against typical market movements.

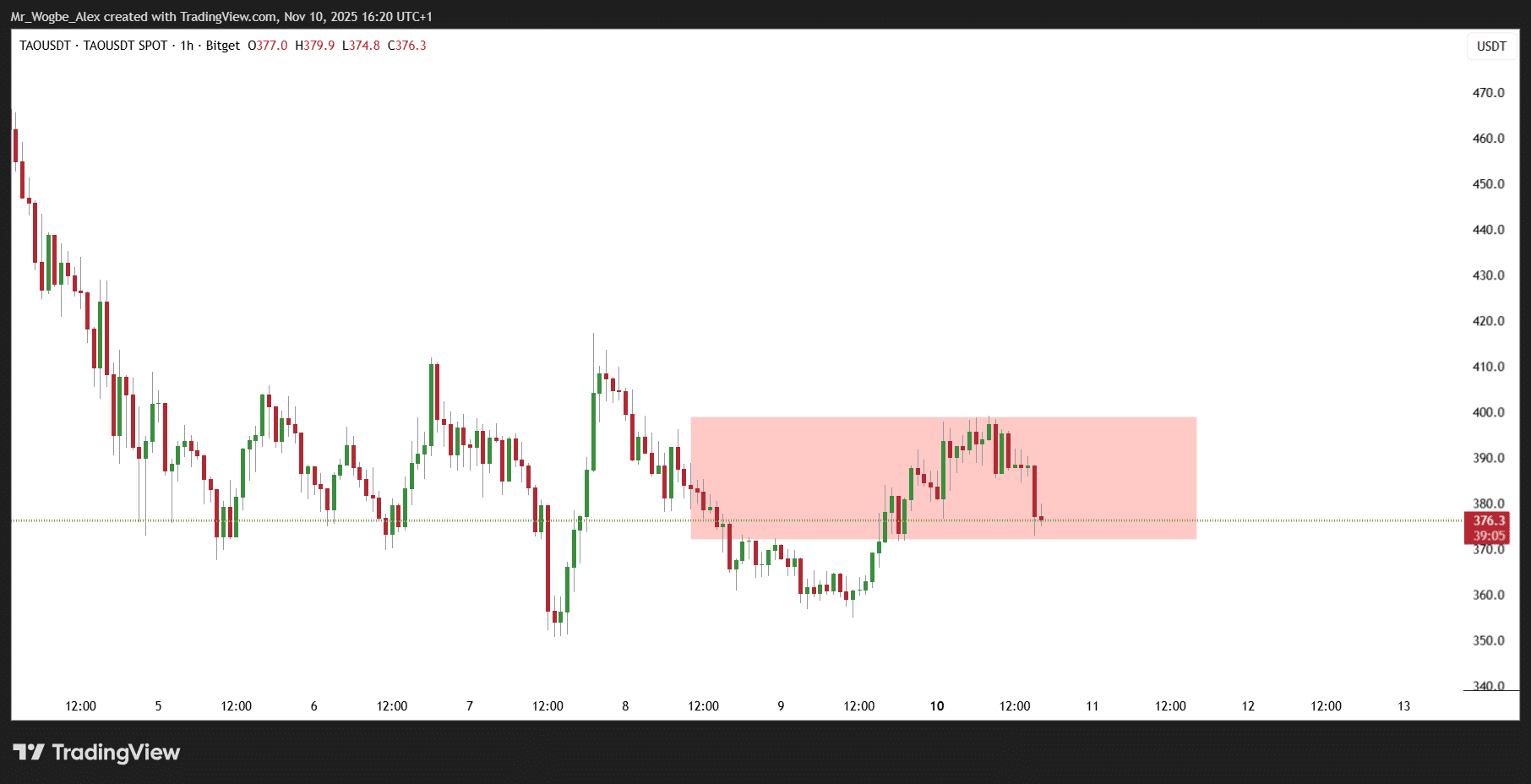

As of November 10, 2025, Bittensor is trading between $372 and $399 on Bitget. And while prices have pulled back from peaks, the underlying momentum signals something bigger than normal price action.

How Bittensor Actually Works

Most AI development today requires permission. You need funding from venture capitalists. You need chips from Nvidia. You need licenses from governments. This creates bottlenecks that centralize power in a handful of companies.

Bittensor operates differently. It’s a network where developers, miners, and validators collaborate to build AI models without needing anyone’s approval. Contributors provide computing power or train models, and they earn TAO tokens based on the value they add.

Think of it as open-source AI infrastructure powered by economic incentives instead of corporate budgets.

The network consists of subnets—specialized mini-networks focused on specific AI tasks. Some detect deepfakes. Others train language models. Some handle 3D rendering or trading predictions.

Bittensor currently operates 128 active subnets generating around $20 million in annual revenue, according to CoinMarketCap.

Each subnet has its own token called an Alpha. To buy these Alpha tokens, you need TAO. This creates constant demand pressure on the base token as subnet activity grows.

The December Bittensor Halving Changes Everything

Bittensor’s first halving is scheduled for around December 10, 2025, though the exact date shifts based on network dynamics. When it happens, daily TAO emissions will drop from 7,200 tokens to 3,600 tokens—cutting new supply in half.

Unlike Bitcoin, which halves based on block count, Bittensor’s halving triggers when total supply reaches 10.5 million TAO (half of the 21 million maximum). Token recycling from registration fees and validator deregistrations can delay the halving date, making predictions less precise.

Why does this matter for traders? Supply shocks historically create upward price pressure when demand stays constant or increases. Bitcoin’s halvings have consistently preceded major bull runs.

Whether Bittensor follows the same pattern remains to be seen, but the mechanics favor scarcity.

Miners may face profitability challenges post-halving, risking short-term sell-offs, so expect volatility around the event. However, reduced emissions combined with growing subnet adoption could push prices significantly higher through 2026.

Institutional Money Is Arriving

Retail traders often move first, but institutional capital validates long-term value. Deutsche Digital Assets and Safello launched the world’s first physically backed Bittensor ETP on the SIX Swiss Exchange on November 19, 2025.

This provides regulated exposure to TAO, opening doors for pension funds, family offices, and asset managers who can’t buy crypto directly.

Grayscale’s AI Fund reportedly holds a 41% allocation in TAO Bitget, signaling serious institutional interest. When large players allocate this heavily to a single asset, it typically indicates conviction in long-term fundamentals.

These inflows reduce circulating supply as institutions hold for extended periods. Unlike retail traders who chase short-term gains, institutional holders typically have multi-year investment horizons.

What This Means for Your Portfolio

Price predictions vary widely. Some analysts expect TAO could reach a maximum of $1,239 by December 2025, while others project more conservative targets. Long-term forecasts suggest TAO could reach an average price of $1,340 by 2030 if Bittensor achieves dominance in decentralized AI infrastructure.

Current support appears to be holding around the $370-$380 range after recent consolidation. If bulls maintain momentum, potential upside could reach $400-$450 before the halving.

The risk/reward setup looks interesting heading into December, especially if broader crypto markets maintain current strength. However, subnet failures or competition from projects like Internet Computer could divert capital and sentiment.

No one can predict exact prices, but the fundamental case centers on supply reduction meeting growing demand. If subnet adoption accelerates and institutional buying continues, TAO could see substantial appreciation through 2026. If adoption stalls or competition intensifies, the halving alone won’t save it.

AI infrastructure is moving from centralized labs to decentralized networks. Whether Bittensor captures significant market share in this shift will determine if current prices represent opportunity or speculation.

December’s halving will provide the first major test of how markets value decentralized AI infrastructure under supply constraints.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.