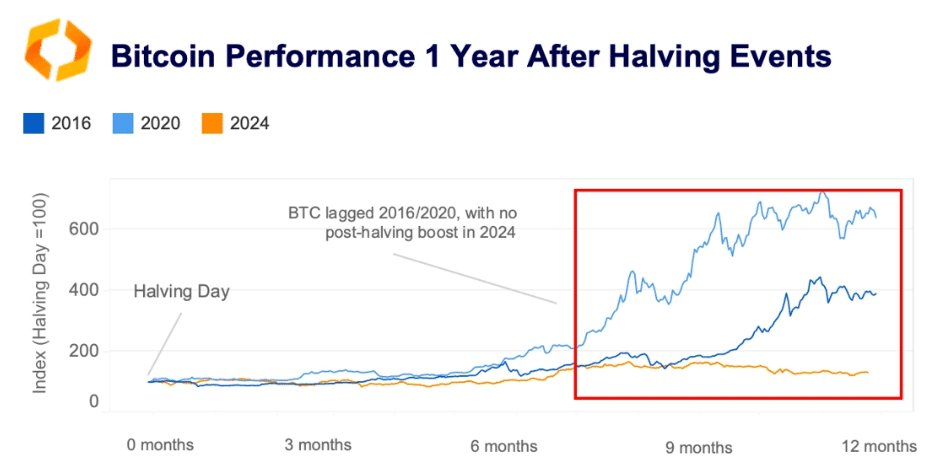

One year after Bitcoin’s halving anniversary, the cryptocurrency’s performance has surprised market watchers. Instead of following historical patterns of strong post-halving growth, Bitcoin has traded in the $80,000-$90,000 range, marking a significant shift in behavior compared to previous cycles.

The crypto community has closely tracked this halving anniversary because these events—when Bitcoin mining rewards are cut in half—have historically triggered major price rallies. But this time has been different.

Bitcoin’s Halving Anniversary Highlights Changing Market Dynamics

According to Kaiko, several key factors explain this unusual pattern. Global economic tensions have spiked in early 2025, with new tariffs between major economies creating market uncertainty. This challenging backdrop has coincided with Bitcoin’s halving aftermath, unlike the relatively calmer economic environments of previous cycles.

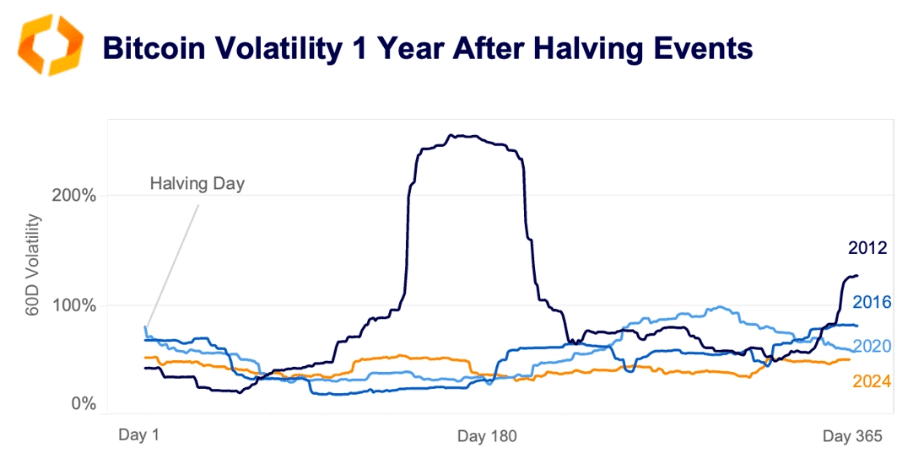

Bitcoin’s volatility has also decreased dramatically. Data shows that price swings have settled to around 50% on a 60-day basis, down from the wild 200%+ volatility seen after earlier halvings.

This suggests Bitcoin might be growing into a more stable asset, though potentially with more modest growth expectations.

The mining sector tells an interesting story as well. Despite reaching record-high network security levels (measured by hash rate), miners face profit challenges.

The combination of halved block rewards and relatively low transaction fees has squeezed mining operations. While transaction activity briefly surged after the halving due to new token protocols, fee revenue has fallen significantly short compared to previous cycles.

What This Means for Bitcoin’s Future

The evolving relationship between Bitcoin’s network strength and its price performance highlights important questions about sustainability.

Miners collected substantially fewer Bitcoin in fees during this cycle compared to previous ones, raising questions about long-term mining incentives if price growth doesn’t compensate for reward reductions.

Meanwhile, regulatory developments in the United States could potentially stabilize the market. As clearer frameworks emerge for digital assets, institutional confidence may grow, potentially providing support for prices.

For investors, this unusual halving cycle might signal a maturing asset class—one where explosive growth gives way to more measured, steady performance.

The days of 7,000% post-halving surges appear to be behind us, replaced by more nuanced market dynamics where Bitcoin behaves more like traditional financial assets, responding to broader economic conditions.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.