US30 Analysis – April 22

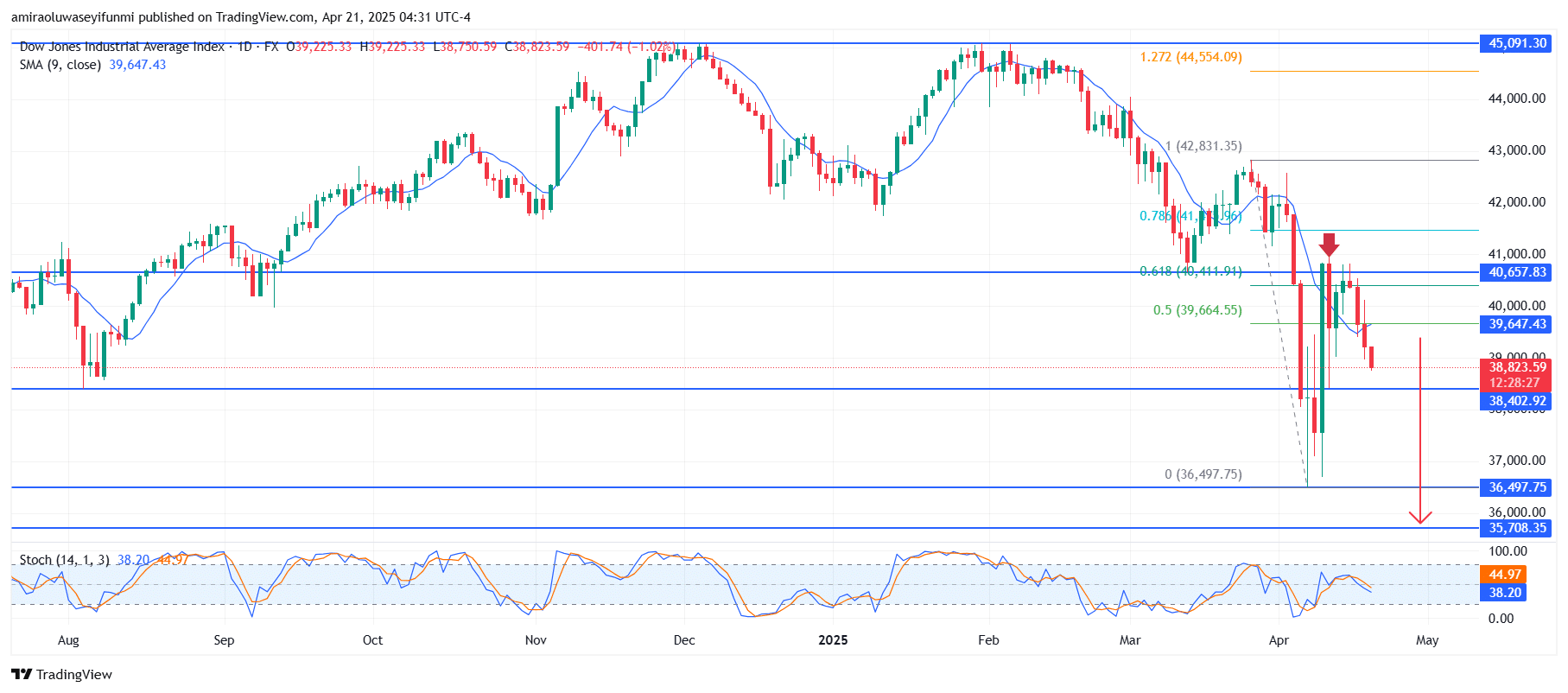

US30 displays signs of weakness as sellers regain short-term control. The 9-day Simple Moving Average (SMA) is trending downward and currently hovers around $39,650, reinforcing the prevailing short-term bearish outlook. The Stochastic Oscillator has also crossed downward from the overbought region and now sits around 38.2, indicating increasing bearish momentum. This alignment between the moving average and oscillator weakness confirms a decline in bullish strength as sellers assert dominance in the market.

US30 Key Levels

Resistance Levels: $40,660, $42,830, $45,100

Support Levels: $38,400, $36,500, $35,710

US30 Long-Term Trend: Bearish

Price action shows a clear rejection near the $40,660 resistance zone, which aligns with the 61.8% Fibonacci retracement level of the prior downturn. The failed retest of this zone, marked by a strong bearish candlestick, confirms its role as a supply area. After this rejection, price broke below the $39,660 level and is now consolidating near the $38,830 area. This decline follows an unsuccessful attempt to reclaim the previous range high, suggesting a continued move lower.

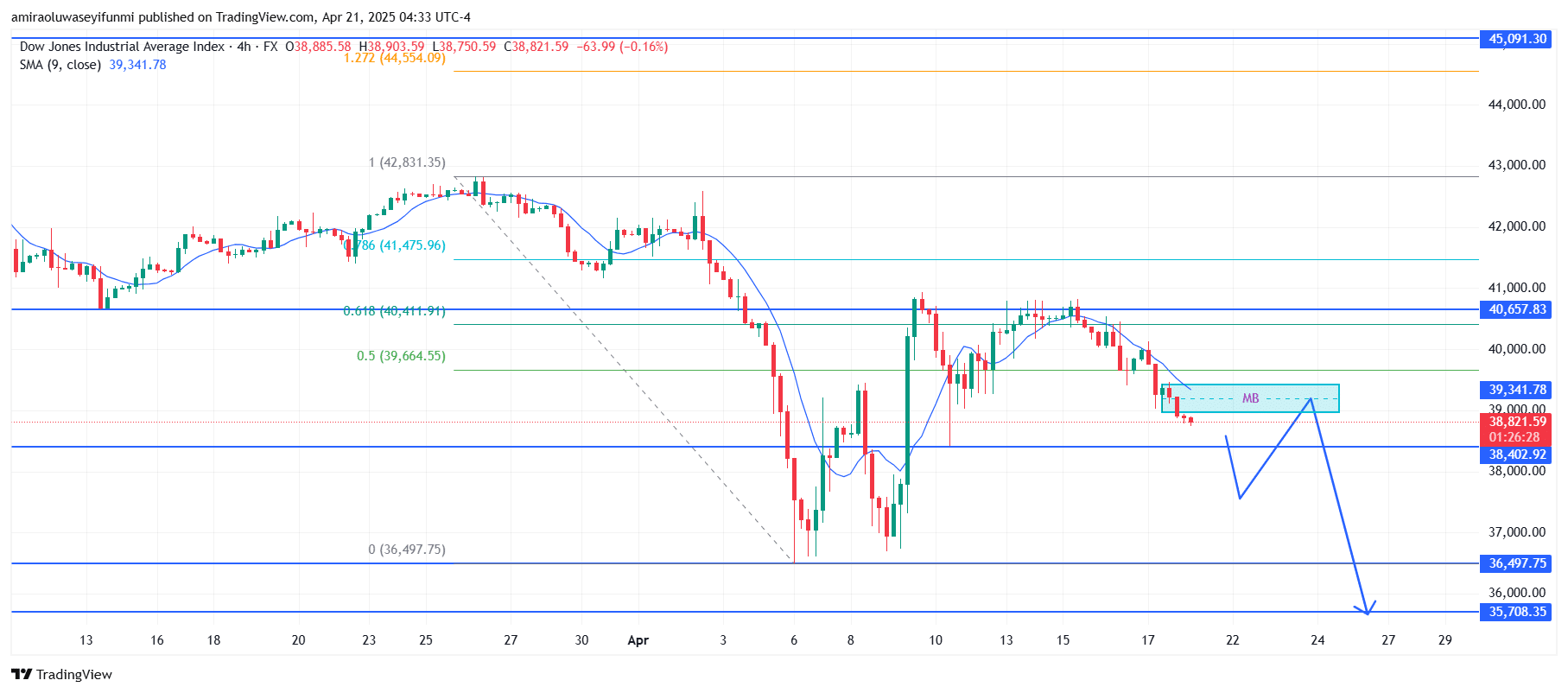

US30 Short-Term Trend: Bearish

US30 maintains a bearish tone as price remains below the 9-period SMA, which is currently sloping downward around $39,340. A newly formed mitigation block near the $39,000 psychological level may act as resistance, further reinforcing the supply zone. Price is now approaching the $38,400 support level, and a breakdown below this area could validate further downside potential. The expected move would target the $36,500–$35,710 demand zone, consistent with the broader bearish market structure.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.