When you’re looking for investment guidance, AI chatbots might seem like the perfect solution. They’re available 24/7, they don’t charge fees, and they can process huge amounts of data in seconds.

But here’s the problem: artificial intelligence systems aren’t ready to handle your money decisions, and using them could cost you more than you bargain for.

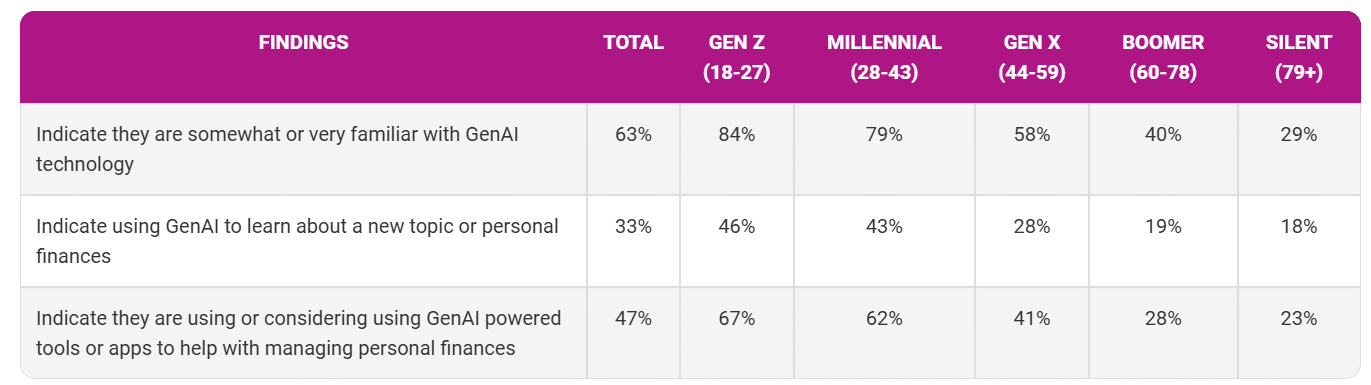

Recent research shows that nearly half of investors have turned to AI for financial advice. This trend makes sense on the surface. These systems can analyze market patterns, crunch numbers, and explain complex concepts faster than any human advisor.

Yet beneath this impressive facade lies a troubling reality that every investor needs to understand.

The Accuracy Problem That Nobody Talks About

Independent testing reveals serious flaws in how AI handles financial questions. When researchers tested popular chatbots with 100 investment-related queries, the results were alarming. Only 65% of responses were completely accurate.

The remaining 35% contained errors, incomplete information, or completely fabricated details presented as facts.

These weren’t obscure technical questions either. Basic topics like retirement planning, education savings, and precious metals investing triggered incorrect responses.

The systems confidently provided wrong information about pension calculations, misrepresented tax implications, and gave outdated regulatory guidance that could lead to costly mistakes.

What makes this particularly dangerous is how these errors are presented. AI systems don’t express uncertainty or admit knowledge gaps. Instead, they deliver incorrect information with the same confident tone they use for accurate responses.

This creates a false sense of reliability that can trap unsuspecting investors.

The technical term for this phenomenon is “hallucination”—when AI generates plausible-sounding but factually wrong information. Unlike human advisors who might say, “I’m not sure” or “Let me research that,” AI systems fill knowledge gaps with convincing fiction.

Why AI Struggles With Investment Context

Investment decisions require understanding context that goes far beyond raw data analysis. Markets react to human psychology, geopolitical events, and countless variables that don’t follow predictable patterns.

While AI excels at processing historical information, it struggles with the nuanced interpretation that successful investing demands.

Consider cryptocurrency markets, where sentiment shifts can trigger massive price swings within hours. AI systems trained on historical data can’t anticipate how a regulatory announcement in one country might cascade through global markets.

They miss the subtle interconnections between seemingly unrelated events that experienced traders recognize instinctively.

Furthermore, AI lacks the ability to understand your personal financial situation holistically. It can’t factor in your risk tolerance changes due to life events, your family’s unique needs, or the emotional aspects of money management that drive real-world decisions.

These human elements are crucial for a sound investment strategy.

The Regulatory and Liability Gap

When you receive advice from a licensed financial advisor, there are legal protections in place. Advisors must follow fiduciary standards, maintain professional insurance, and face regulatory oversight. If they provide negligent advice, you have legal recourse.

AI systems operate in a regulatory gray area. No artificial intelligence chatbot holds investment licenses or carries professional liability insurance. When AI provides bad advice that costs you money, you have no meaningful recourse.

The companies behind these systems typically include disclaimers that absolve them of responsibility for financial losses.

This lack of accountability creates an asymmetric risk situation. You bear all the downside risk of following AI advice, while the technology companies face no consequences for providing poor guidance. This fundamental misalignment of incentives should concern any serious investor.

What AI Gets Wrong About Risk Assessment

Risk management forms the cornerstone of successful investing, yet AI systems consistently struggle with risk assessment concepts. They often provide generic risk profiles that don’t account for individual circumstances or market timing considerations.

AI might recommend high-risk investments to someone approaching retirement simply because their age falls within a certain demographic range. It can’t assess whether someone’s job security, health situation, or family obligations should modify standard risk recommendations.

These nuanced decisions require human judgment that current AI technology cannot replicate.

Moreover, AI systems often fail to communicate risk effectively. They might present statistical probabilities without explaining what those numbers mean in practical terms for your financial future. This technical accuracy without practical understanding can lead to poor decision-making.

The Path Forward: Using AI Responsibly

This doesn’t mean AI has no place in investment research. These systems excel at data gathering, basic education, and initial research tasks. Use AI to understand fundamental concepts, compare basic features of investment products, or generate starting points for further investigation.

The key is treating AI as a research tool, not a decision-making authority. Always verify important information through multiple sources, especially licensed financial professionals who understand your complete situation.

Think of AI as a sophisticated calculator—useful for processing information but requiring human interpretation for meaningful results.

Smart investors will leverage AI’s computational strengths while recognizing its limitations in judgment, context, and accountability. Your financial future deserves better than algorithmic guesswork, no matter how sophisticated it appears.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.