Tesla (TSLA) has been at the center of attention with its new product lineup, but investors remain cautious about the stock’s performance. Despite short-term concerns, the long-term target of $400 is still in play. This is even after the stock fell 8.8% following the underwhelming Robotaxi Day event on October 10.

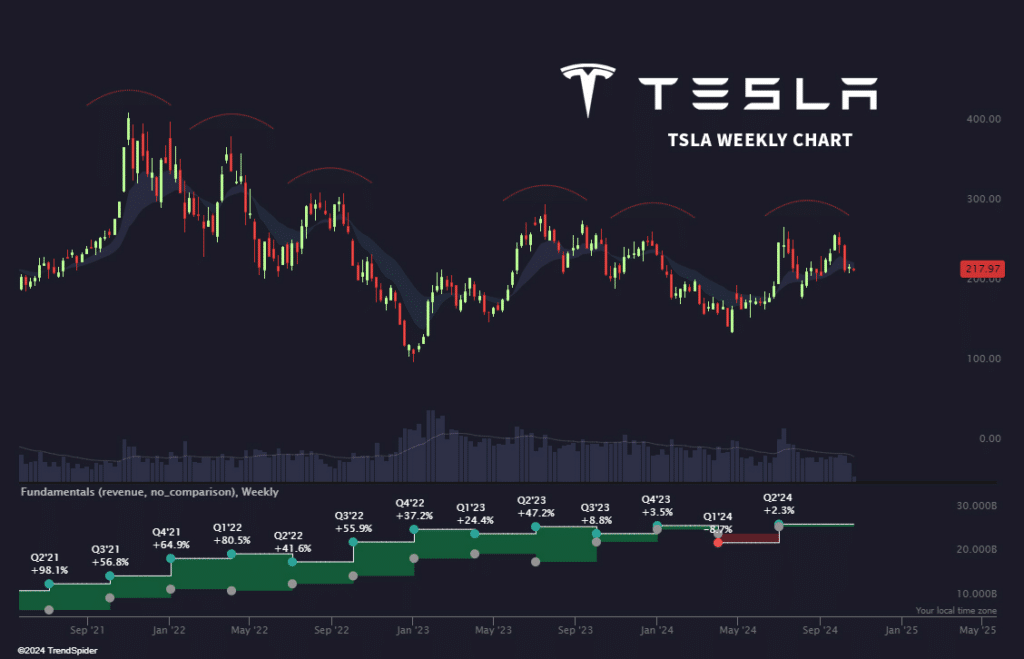

At the close of the most recent market session, Tesla’s stock was valued at $217.97, reflecting a 0.40% decline for the day and a 1.6% loss on the weekly chart. In pre-market trading on October 23, TSLA continued to show weakness, down 0.25%.

TSLA’s Path to $400

Analyst Peter DiCarlo provided an analysis of Tesla’s potential path to $400 in an X post on October 22. He predicted Tesla could hit this milestone by December 2026, basing his forecast on the stock’s monthly price movements. DiCarlo emphasized that, despite some volatility, the stock has shown underlying strength with consistent higher lows, a bullish sign for long-term investors.

$TSLA December 2026 target remains at $400 🚀🎯

In this video we break down the monthly timeframe and why I remain bullish on $TSLA 💎

We also discuss what exactly must happen for me to change my mind 🧠 pic.twitter.com/lazXKjsPuH

— Peter DiCarlo (@pdicarlotrader) October 22, 2024

DiCarlo noted that once Tesla breaks through the $275 resistance level, it could rise as high as $375 or $429, marking a 63% potential upside and nearing its 2021 all-time high. He suggested that surpassing $275 could pave the way for Tesla to reach $400 within two years.

The Impact of Tesla’s Q3 Earnings Report

Tesla’s upcoming Q3 earnings report, expected on October 23 after market close, will be a key catalyst for the stock. Analysts estimate Tesla’s revenue to reach $25.4 billion, up from $23.4 billion in the same quarter last year. However, concerns over plateauing revenue and missed delivery numbers have led to mixed expectations.

Despite delivering 462,890 units in Q3, a 6% year-over-year increase, Tesla fell slightly short of analysts’ expectations of 463,310 units. Jefferies equity researcher Philippe Houchois maintained a ‘Hold’ rating for Tesla, raising the price target from $165 to $195, citing operational issues and governance concerns.

While Tesla faces challenges, including a three-year trend of lower highs on its weekly chart, the Q3 earnings report could be a pivotal moment. If Tesla can regain momentum, it may yet push toward the $400 mark in the coming years.

Make money without lifting your fingers: Start using a world-class auto trading solution.

LonghornFX, your trusted Partner in CFDs, Cryptocurrencies and Stocks.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.