The FX market this week blends bullish momentum and bearish continuation. AUDNZD and AUDCAD are pressing resistance with strong upside, EURNZD is stabilizing above a key breakout level, while EURGBP and NZDCHF remain vulnerable below critical ceilings. Stochastic and ADR readings highlight potential inflection points and measured volatility across pairs.

AUDNZD

Market Bias: Bullish

AUDNZD closed at 1.16650 and is testing upper resistance. Stochastic is deeply overbought, hinting at near-term consolidation before any continuation. With ADR at 0.00483, volatility supports a potential breakout, provided price holds above 1.16360. Upside focus sits on 1.16650 and 1.17000; failure to hold could invite a pullback toward 1.14210.

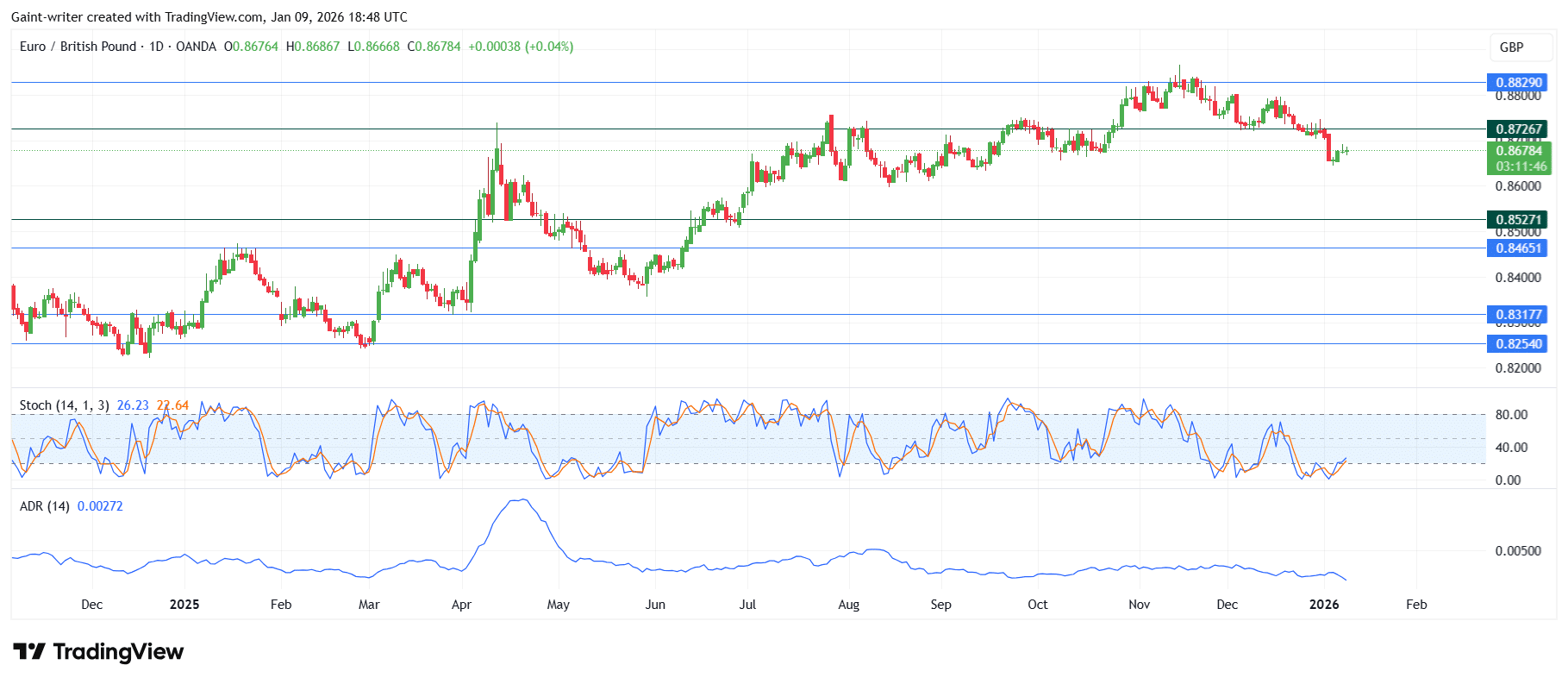

Market Bias: Bearish

EURGBP trades at 0.86784 (+0.04%) but remains capped beneath 0.87267/0.88290. Stochastic is near oversold—bounces may fade unless resistance breaks. ADR at 0.00272 suggests a grind lower is more likely than sharp moves. Sellers eye 0.86000 zone first, then 0.85270; a daily close above 0.87260 level would neutralize the bias.

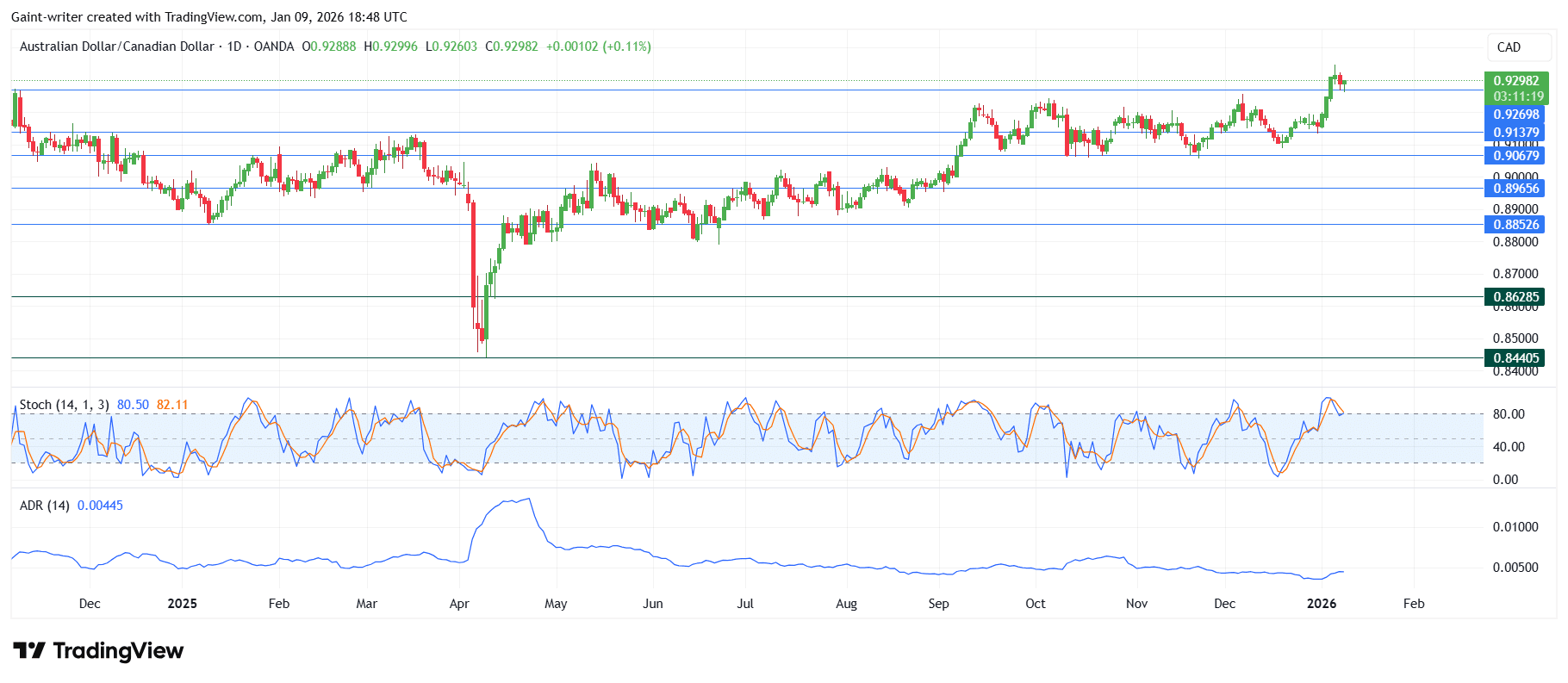

AUDCAD

Market Bias: Bullish

AUDCAD sits at 0.92980 (+0.11%) and presses 0.93000 resistance. Stochastic is overbought, signaling caution for late longs. ADR at 0.00445 provides room for swings within the resistance band. A daily close above 0.93000 opens continuation; failure at this area risks a pullback toward 0.92698, then 0.913790.

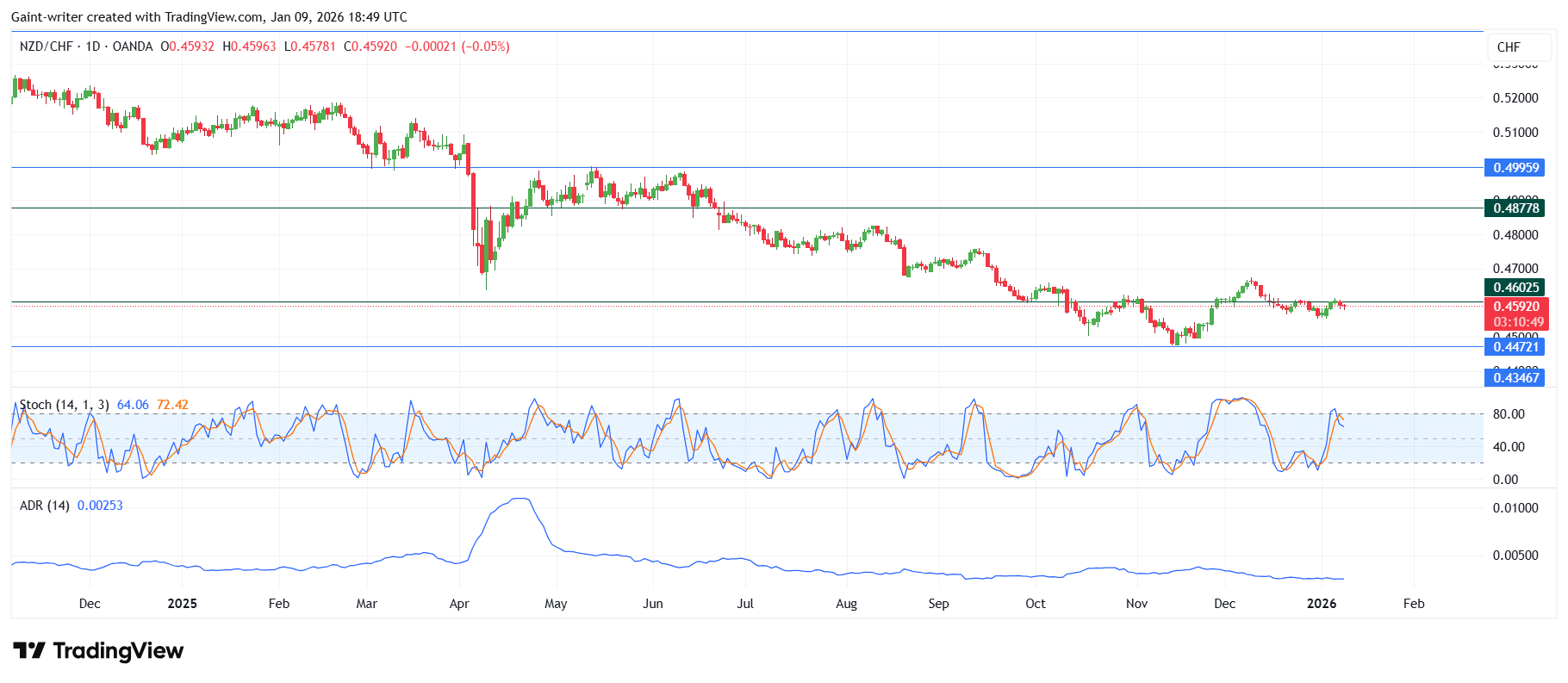

Market Bias: Bearish

NZDCHF trades at 0.45920 (-0.05%) near 0.46025 support, within a broader downtrend. Stochastic is approaching overbought, favoring rollover if resistance holds. ADR at 0.00253 points to subdued ranges and a potential slow drift lower. A break beneath 0.46025 exposes 0.44720 and 0.43467; rallies face resistance at 0.48770.

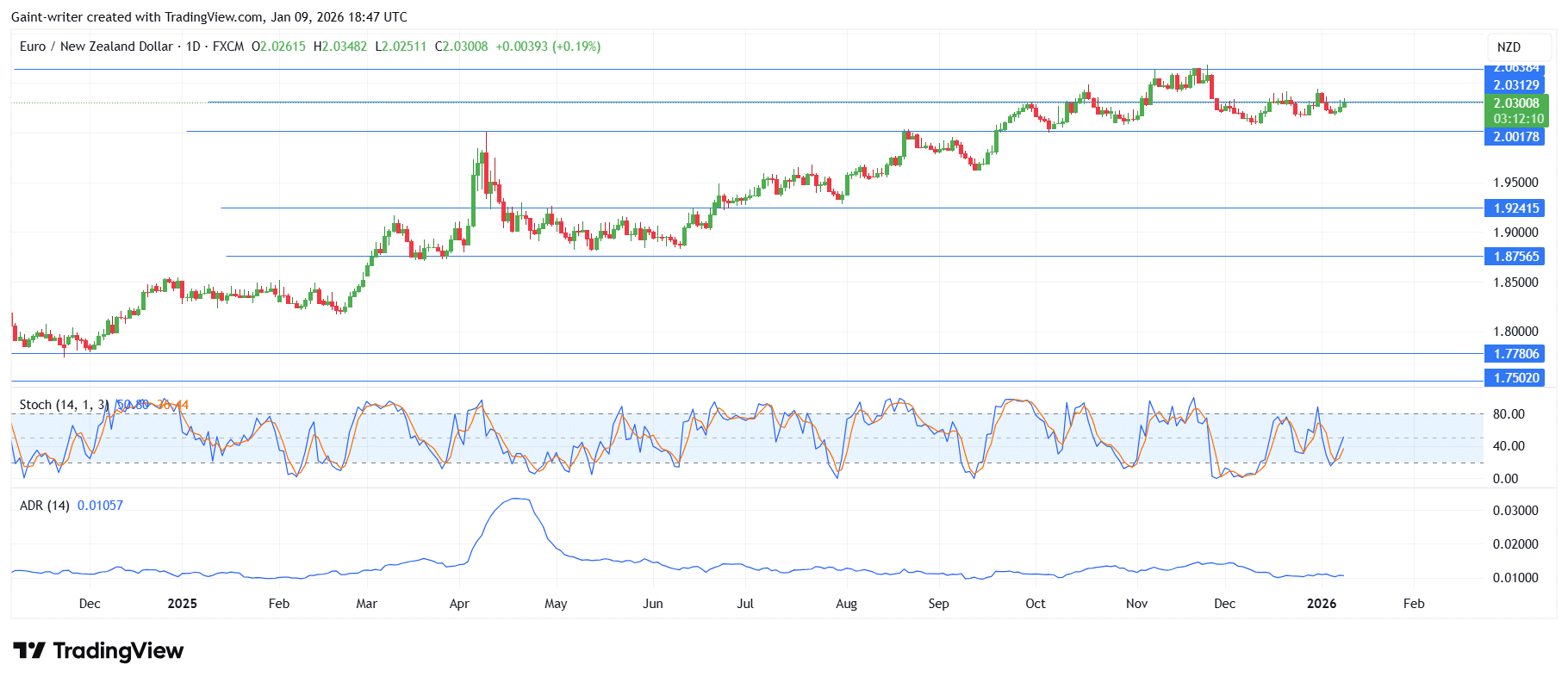

Market Bias: Bullish

EURNZD is at 2.03000 key level, holding above 2.00178 and challenging the 2.03120 resistance. Stochastic is elevated, consistent with strong momentum, while ADR at 0.01057 indicates high potential range once price expands. A sustained move above 2.03129 targets 2.05000; a close below 2.00178 would dampen the bullish structure and shift focus back to consolidation, making this pair particularly sensitive to emerging forex signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.