Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The Vulcan Forged token has appeared on the list of top crypto gainers today after recording a 2.33% price increase at the time of writing. However, the broader market trend appears to lack strong bullish momentum, as the token’s price action remains relatively subdued.

Vulcan Forged Statistics

PYR Current Price: $1.098

Market Capitalization: $46.25M

Circulating Supply: 42.28M

Total Supply: 50M

CoinMarketCap Rank: 481

Key Price Levels

Resistance: $1.500, $2.000, $2.500

Support: $1.000, $0.750, $0.500

PYR Upside Rebound Wanes Quickly

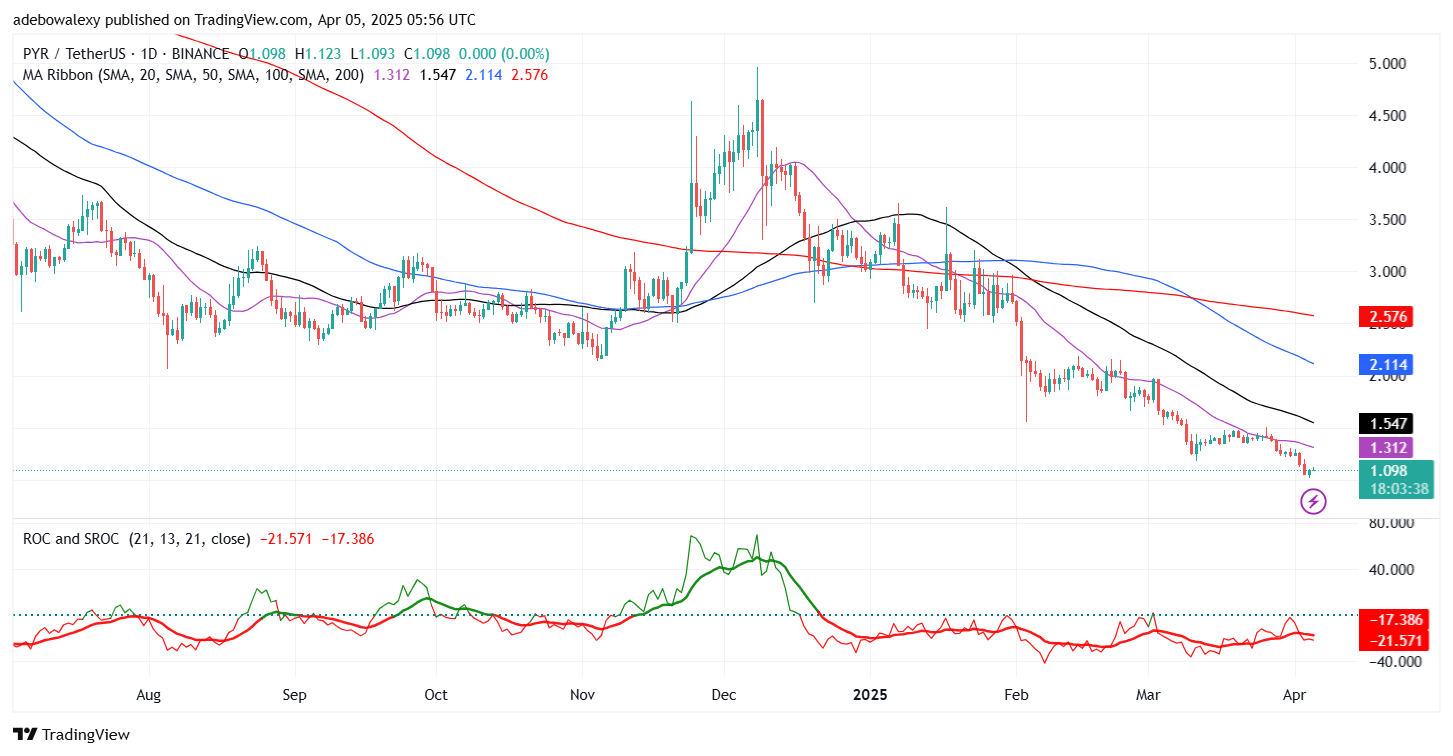

Price activity in the Vulcan Forged daily chart has been trending downward since the market touched the $5.00 level in December last year. Since then, a persistent correction has pushed prices below multiple support levels. Currently, the market is hovering just above the $1.00 level and remains beneath all major Moving Average (MA) lines.

Additionally, both the Stochastic Rate of Change (Stochastic ROC) and the standard Rate of Change (ROC) indicators are positioned below the 0.00 level. The downward trajectory at the terminal ends of these indicators suggests that bearish sentiment still dominates the market.

Vulcan Forged Bulls Remain Vulnerable

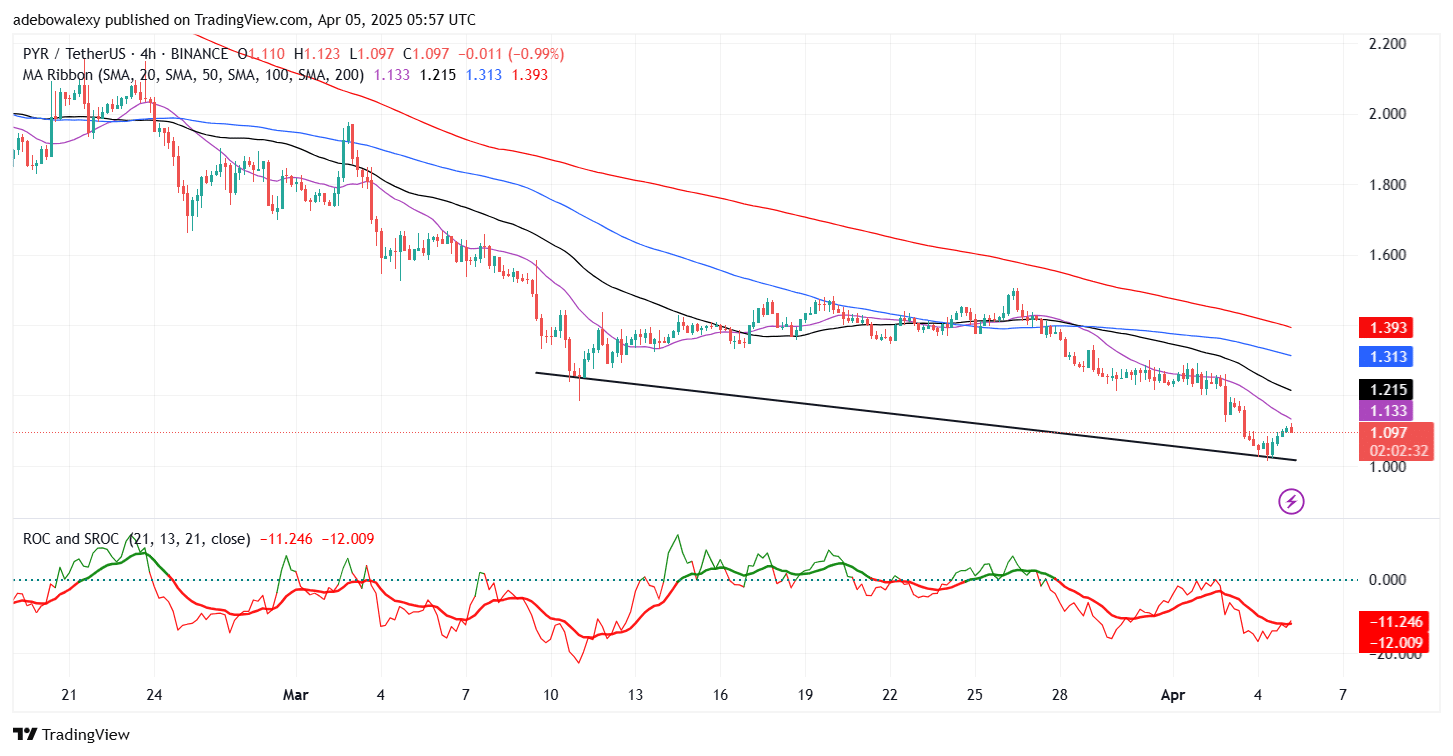

The 4-hour time frame of the PYR market shows that the overall trend remains bearish. However, price action recently rebounded off a downward-sloping trendline. Despite this, as the price approached resistance at the 20-day MA, it reversed slightly, resulting in a minor downward retracement at the time of writing.

Meanwhile, both the Stochastic ROC and ROC indicators are trending upward, though they remain below the equilibrium level. This reflects the recent modest upward retracement from the drawn trendline. As such, while a bullish stance may be considered, it should be approached with caution due to the prevailing bearish pressure.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.