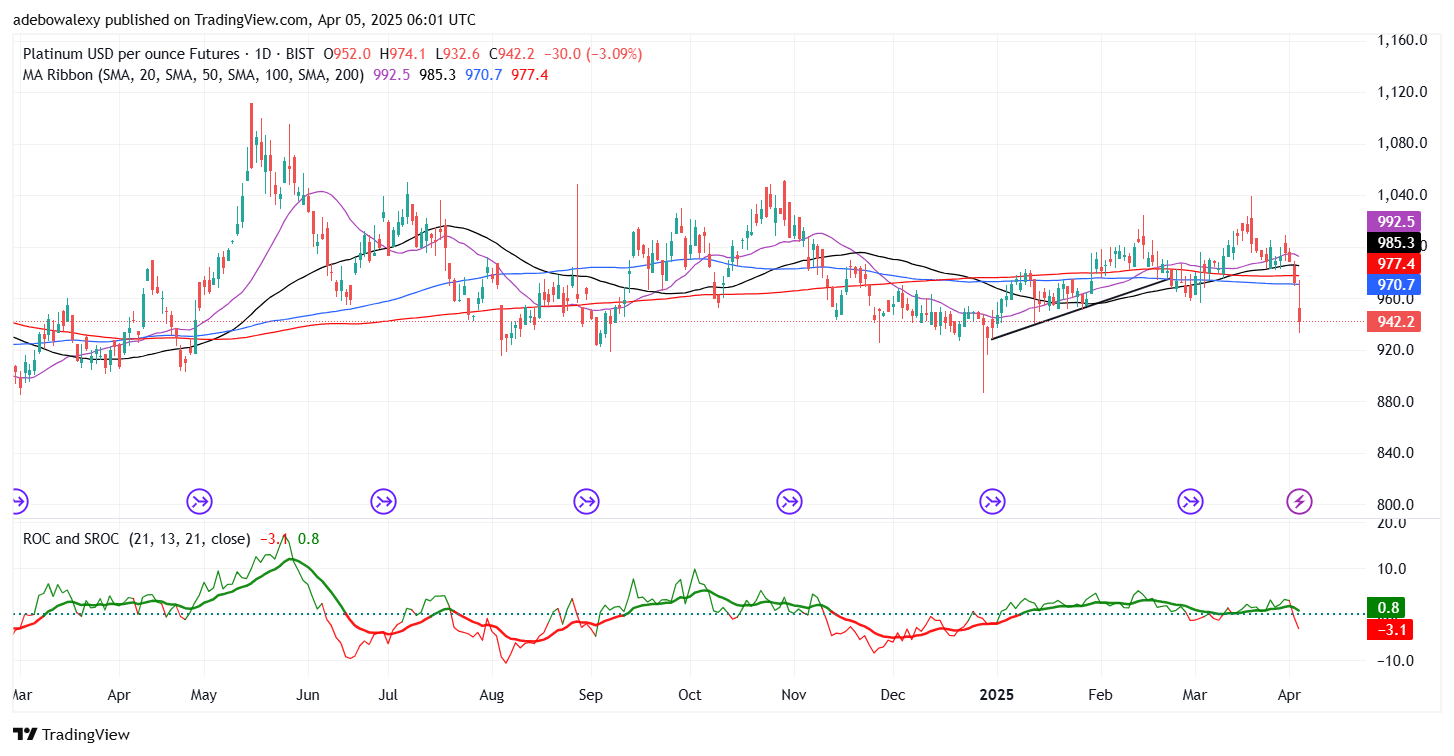

The platinum market hasn’t recorded significant gains throughout the previous week. Things worsened on Tuesday when price action began trending downward. The bearish momentum intensified, leading to a deeper retracement and lowering prices.

Key Price Levels

Resistance Levels: $950, $1,000, $1,050

Support Levels: $920, $900, $880

Platinum Heads Downward

Over the past three trading sessions, price action in the XPT daily market has continued to decline. As noted earlier, the bearish candles have been progressively larger, indicating increasing selling pressure. Currently, the most recent candle, representing Friday’s trading session, appears significantly below all the Moving Average (MA) lines.

Meanwhile, the Stochastic Rate of Change (ROC) and the standard ROC indicator have crossed above the equilibrium level of 0.00. Technically, this signals a strong downward retracement. With the ROC indicator line plunging below the equilibrium level, bearish sentiment appears dominant.

XPT Buyers May Want to Take an Optimistic Stand

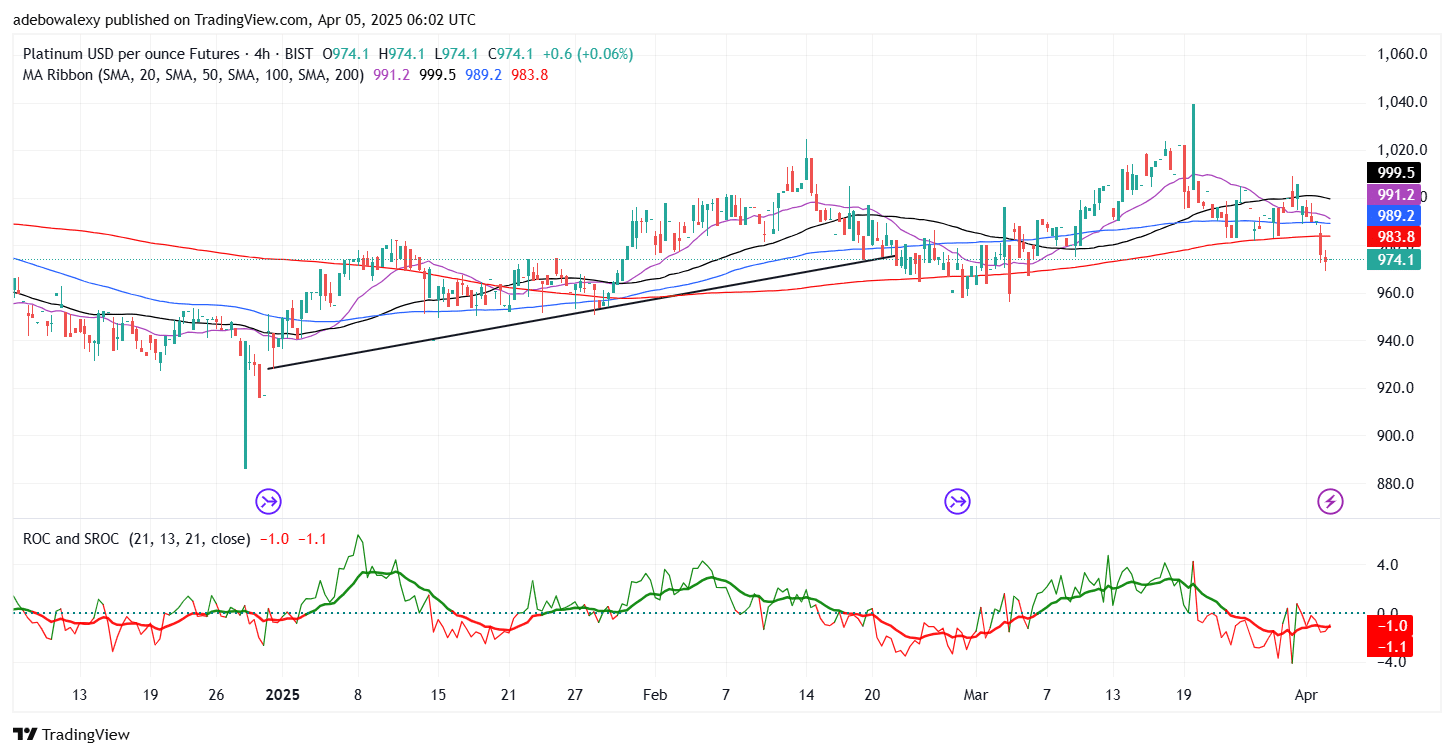

The 4-hour platinum chart suggests that buyers might be considering a long position, anticipating that the market has reached a potential low-entry point. However, price action remains subdued. The latest candle is green but appears below all the MA lines and, at the time of writing, indicates very limited buying activity due to its small, dashed appearance.

Additionally, both the Stochastic ROC and the standard ROC indicator lines have formed a bullish crossover below the equilibrium level. Therefore, while traders might consider going long, it may be wise to wait until price action breaks above the 200-day MA line before targeting the $980 price level on the daily chart.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.