Market Analysis – June 20

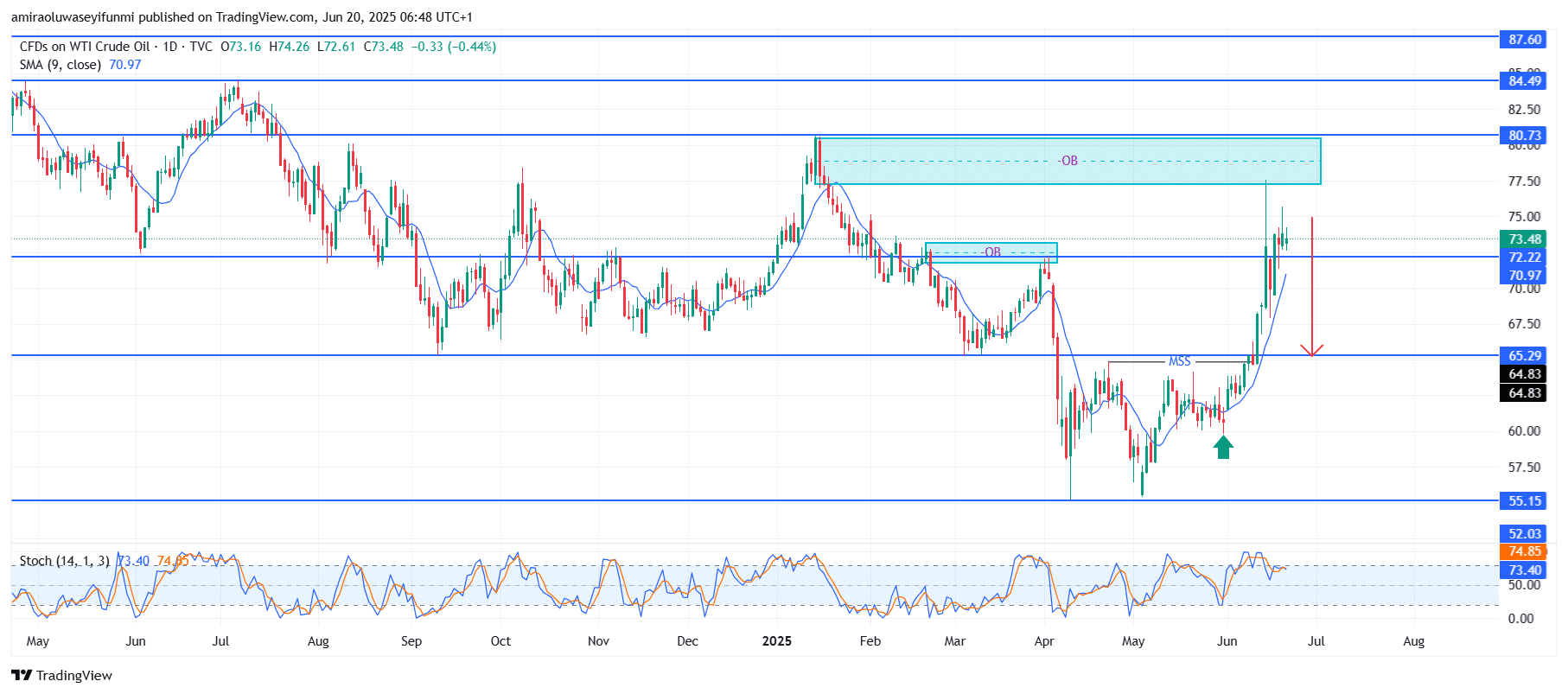

USOil has rejected a key supply zone with bearish pressure beginning to intensify. After surging into the major supply area between $76 and $80, momentum indicators—particularly the Stochastic Oscillator—are signaling exhaustion, remaining firmly in overbought territory. Price action is currently stalling just above the 9-day Simple Moving Average (SMA), indicating weakening bullish momentum. The combination of resistance from a previously formed order block and fading upward momentum suggests a potential transition in market sentiment from accumulation to distribution.

USOil Key Levels

Resistance Levels: $80.70, $84.50, $87.60

Support Levels: $65.30, $72.20, $55.20

USOil Long-Term Trend: Bullish

USOil has firmly tapped into a higher timeframe order block and is beginning to show early signs of rejection. The current bearish movement emerging from the order block is aimed toward the $65.30 level, where a prior Market Structure Shift (MSS) was observed. The presence of long upper wicks in this zone reinforces signs of selling pressure.

Looking ahead, a deeper retracement may be expected if the price fails to reclaim and hold above the $75 mark. A decline toward the $65.30 level appears likely as it represents a logical liquidity target. A break below this point could open the way toward the $55.20 support zone. However, a strong return of buying volume that pushes the price back above $76 could invalidate the bearish outlook. Until such a shift occurs, market behavior indicates that sellers are regaining control following a liquidity grab at elevated levels. Traders seeking entry opportunities may benefit from forex signals to navigate such price reversals.

USOil Short-Term Trend: Bearish

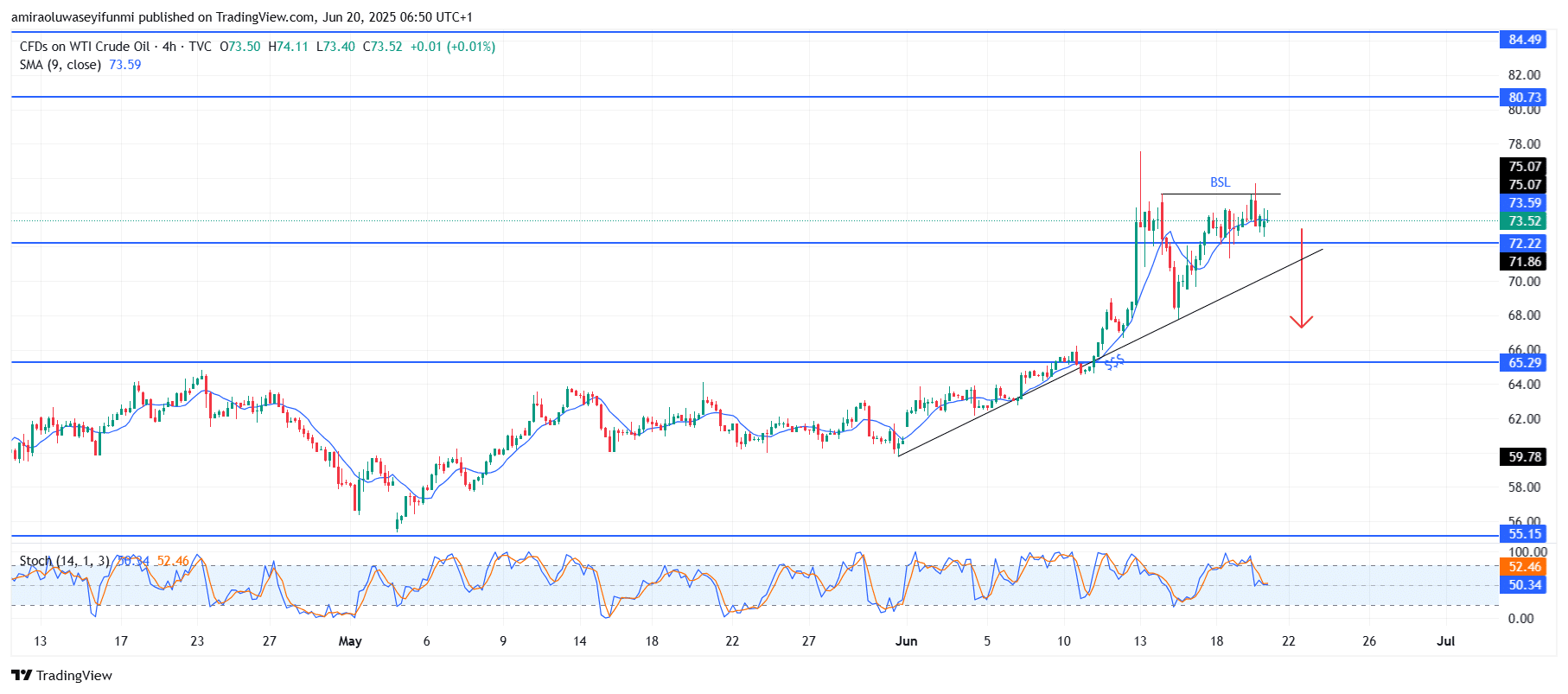

USOil has broken structure to the downside after forming a swing high at $75.10 and has since failed to create a new higher high, suggesting diminishing bullish momentum. The price is now consolidating around the 9-period SMA and is retesting an ascending trendline. A break below this trendline could lead to an accelerated downward movement.

The Stochastic Oscillator is crossing downward near its mid-level, indicating increasing bearish momentum. If the price sustains a break below $72.20, it may pave the way for a move toward the next key support at $65.30.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.