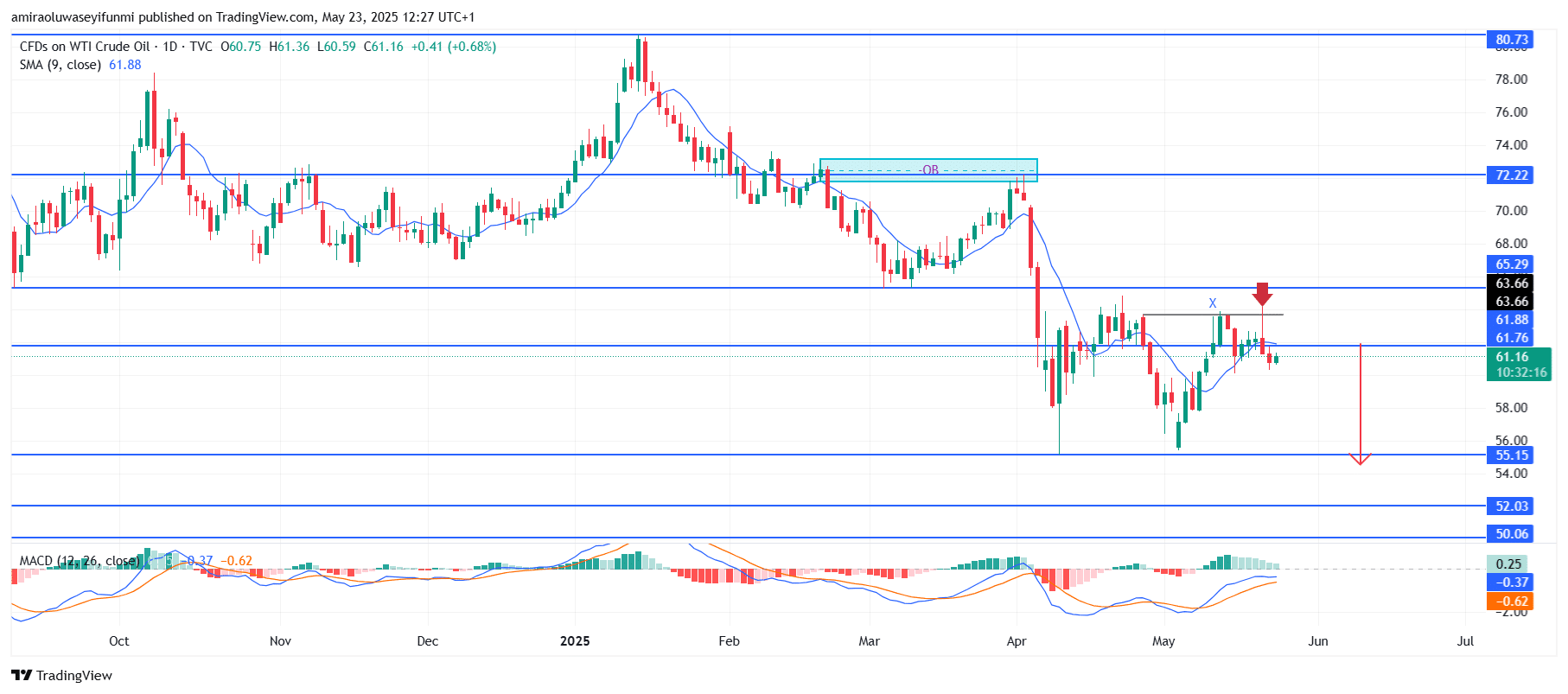

Market Analysis – May 23

USOil continues to reflect a bearish outlook driven by both technical indicators and structural market weakness. Technically, the asset displays persistent downward pressure, with the price trading below the 9-day Simple Moving Average (SMA) at $61.90. This placement highlights sustained short-term bearish momentum. The Moving Average Convergence Divergence (MACD) histogram also signals weakening bullish momentum, as the signal line has crossed beneath the MACD line. The histogram bars are drifting further into negative territory, reinforcing the loss of buying strength and a shift in market sentiment towards sellers.

USOil Key Levels

Resistance Levels: $65.30, $72.20, $80.70

Support Levels: $61.80, $55.20, $52.00

USOil Long-Term Trend: Bearish

Price action further confirms the prevailing bearish bias. USOil recently failed to surpass a significant resistance zone between $63.70 and $65.30, located near a major order block. This rejection, followed by the formation of a lower high, signals waning bullish momentum after a brief liquidity sweep above the double top. Additionally, the strong bearish engulfing pattern observed in April, combined with subsequent indecisive candles and rejection wicks near resistance levels, suggests growing market fatigue and signs of institutional selling.

The outlook remains bearish, with projections pointing toward continued downward movement. A decisive break below the current support around $61.80 could pave the way for a decline to the next key support at $55.20, and potentially down to $52.00. If selling pressure intensifies, the price could even approach $50.10, a long-term liquidity area. The overall sentiment, alongside failed bullish formations, keeps USOil in a firmly bearish structure, unless disrupted by significant macroeconomic developments or unexpected forex signals.

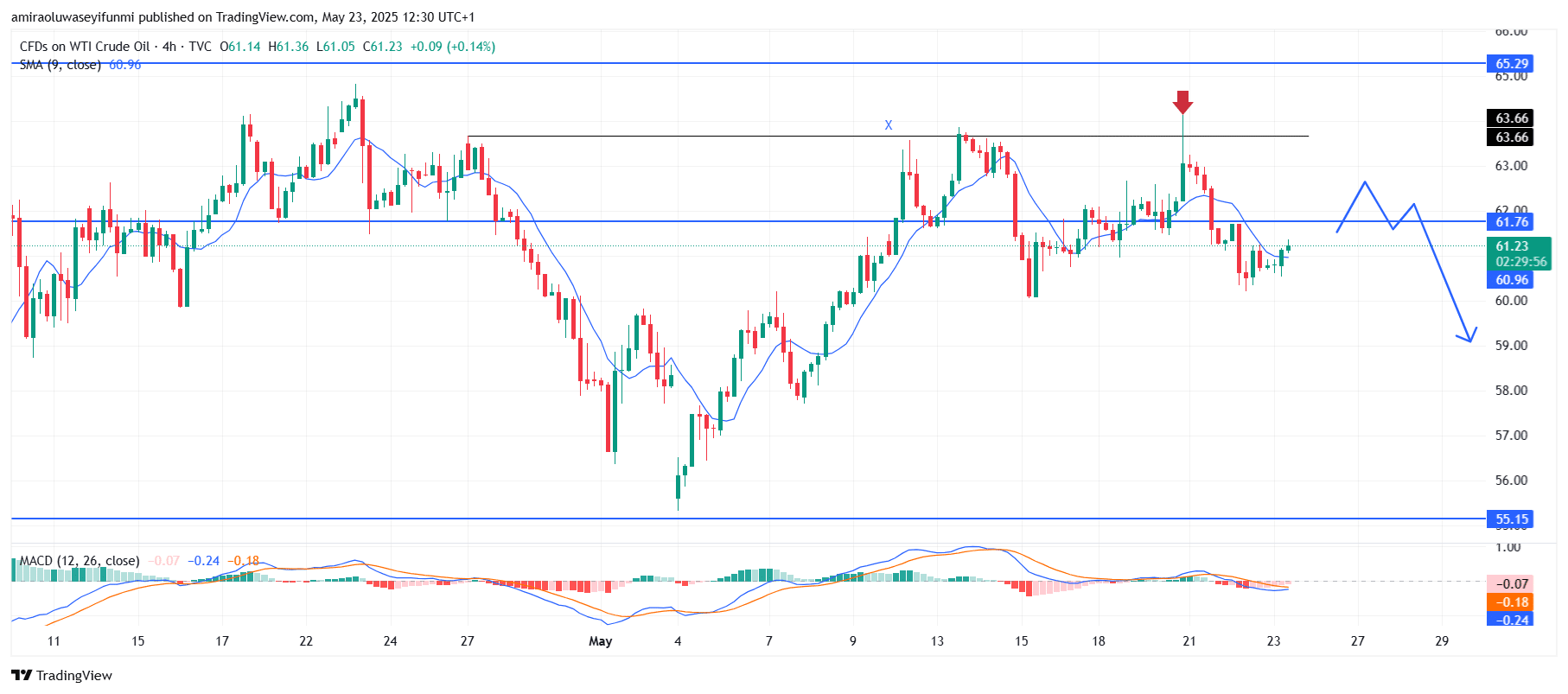

USOil Short-Term Trend: Bearish

WTI Crude Oil continues to show bearish characteristics on the 4-hour chart, having recently been rejected at the $63.70 resistance level. The MACD remains below the signal line, confirming sustained bearish momentum. While the price is currently undergoing a notable retracement, this move is likely to be short-lived as the downtrend is expected to resume.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.