Uniswap finds itself at the center of a significant legal battle while simultaneously demonstrating robust financial performance in the first quarter of 2025.

The decentralized exchange protocol is dealing with two major developments that could shape its future trajectory in the competitive DeFi marketplace.

Bancor has filed a patent infringement lawsuit against both Uniswap Labs and the Uniswap Foundation in the Southern District of New York.

The case centers on foundational technology that powers automated market makers (AMMs), specifically the constant product automated market maker structure that enables decentralized trading without traditional order books.

The lawsuit claims Bancor invented this smart contract technology in 2016 and filed patent applications in January 2017, months before launching the first fully decentralized exchange using AMMs in June 2017.

Bancor alleges that Uniswap has operated infringing systems since launching version 1 in November 2018, continuing through the recent announcement of version 4.

This legal action raises important questions about intellectual property protection in blockchain technology. If successful, the lawsuit could force fundamental changes to how decentralized exchanges operate or require substantial licensing payments.

The case highlights ongoing tensions between innovation and patent protection in the rapidly evolving DeFi sector.

Strong Financial Position for Uniswap Despite Legal Uncertainty

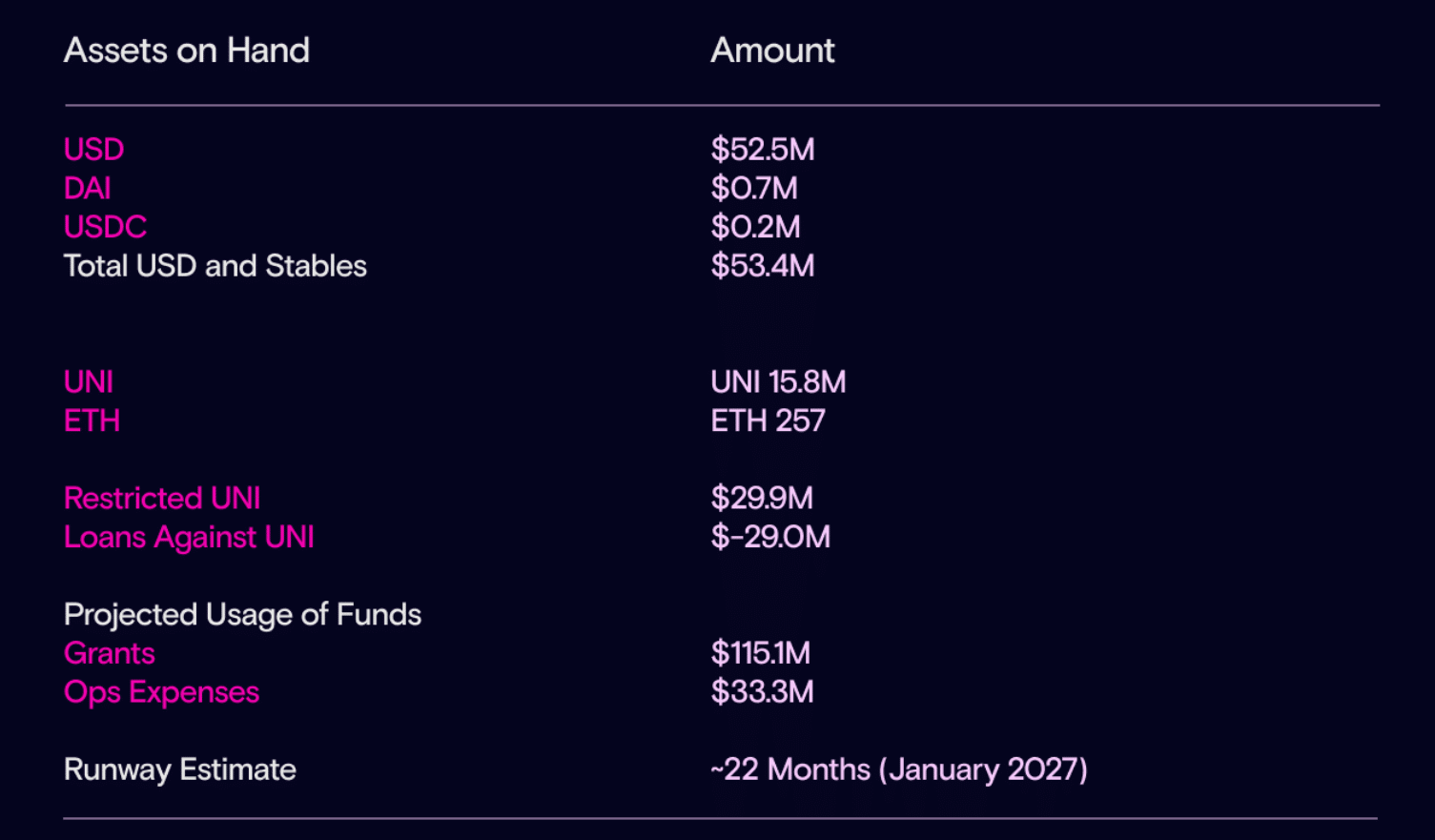

Despite legal challenges, Uniswap Foundation reported impressive financial metrics for Q1 2025. The organization holds $53.4 million in USD and stablecoins, plus 15.8 million UNI tokens and 257 ETH, totaling approximately $95 million in digital assets at quarter-end pricing.

The Foundation committed $12.4 million in new grants during Q1, with $9.9 million allocated for multi-year projects extending through 2029. This long-term commitment strategy demonstrates confidence in the protocol’s future despite current legal uncertainties.

Strategic Focus on Infrastructure Development

Uniswap’s Q1 strategy emphasized four key priorities:

- Enhancing capital efficiency across EVM chains through targeted liquidity programs

- Developing premier DeFi platforms by supporting developers and infrastructure

- Activating sustainable revenue streams while equipping governance with advanced tools

- Onboarding protocol-aligned core contributors

The foundation’s approach includes potential legal entity formation and validator network support, positioning Uniswap for adaptive governance and high-impact funding decisions.

With an estimated runway extending through January 2027, the protocol appears financially prepared for extended legal proceedings while continuing technological development.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.