Following the extended downward retracement that started from the 2nd until the 7th of December 2022, USOil has been able to recover a significant part of the losses incurred during those times. Furthermore, market signs are still positive about more upside price moves.

Major Price Levels:

Top Levels: $78.37, $80.00, $82.00

Floor Levels: $76.00, $74.00, $72.00

USOil (WTI) Now Trades Above the $76.00 Support level

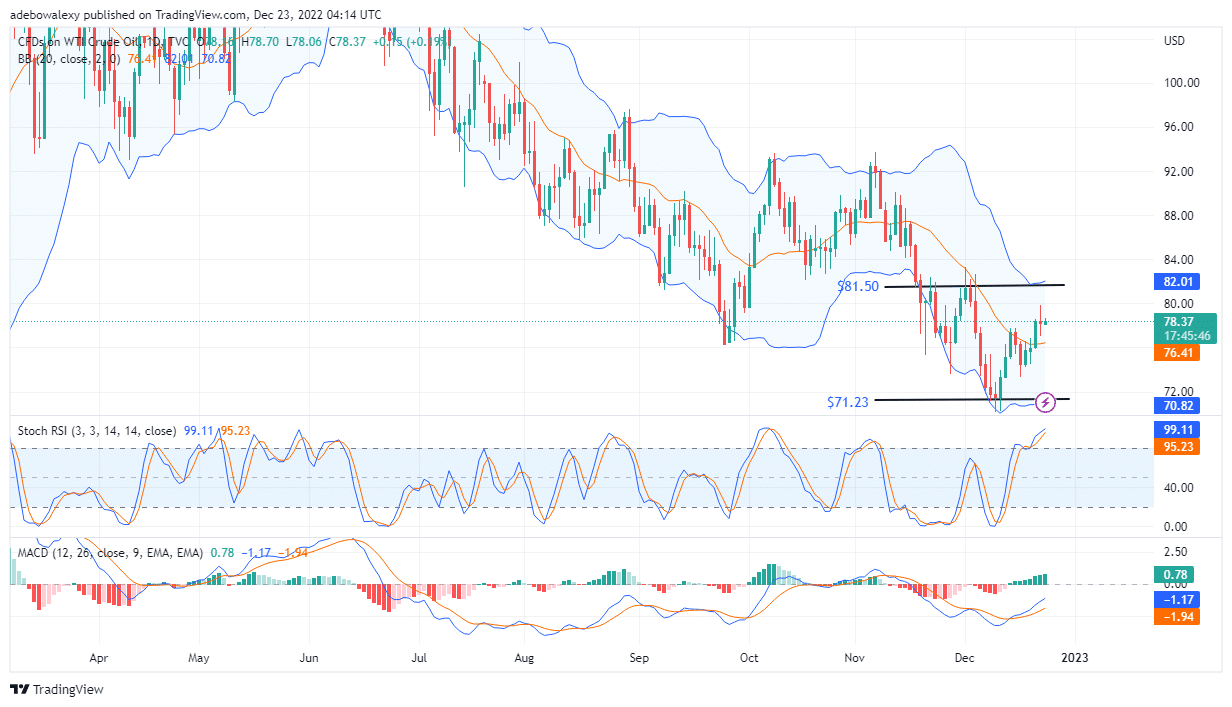

USOil is now trading above the $76.00 price level on the daily chart. This could be interpreted as the market’s attempt to recover from its recent dip to around $71.23. At this point, price action has recovered around 96% of the losses recorded from the 2nd to the 7th of December 2022. The Stochastic RSI lines have reached the overbought region, and are still pointing upward as if to indicate a further gain in upside momentum at 99.11 and 95.2 levels. Likewise, the MACD indicator continues to show that the upside momentum is still strong and increasing. As a result, traders can expect additional price increases before Christmas.

USOIL (WTI) Maintains a Fair Upside Focus

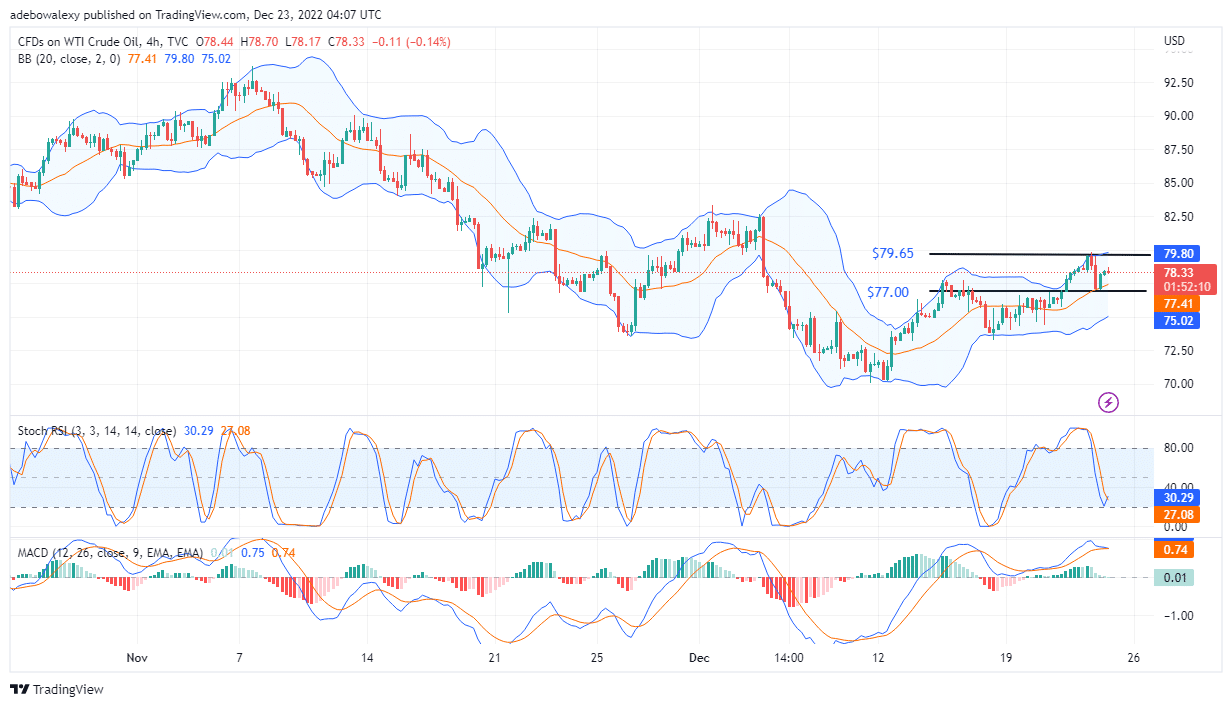

Price action in the 4-hours USOil market continues to indicate a further price increase over the last 16 hours. The bearish price candle for the past four trading sessions could be seen bouncing off the support created by the Moving Average. However, the latest price candle on this chart formed bearish, resulting in a small downside retracement. Nevertheless, the WTI/USD market has recovered 98% of the losses recorded within the last five to four sessions. Furthermore, the lines of the RSI indicator seem to deliver a crossover in the oversold region at levels 30.29, and 27. Meanwhile, the MACD lines appear to be coming closer to each other for a bearish crossover but are now moving sideways above the equilibrium point. Traders can assume that price action is keeping a fair focus on additional price increases, towards the $82 level, based on the signals from used technical indicators.

Do you want to take your trading to the next level? Join the best platform for that here.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.