Market Analysis – October 17

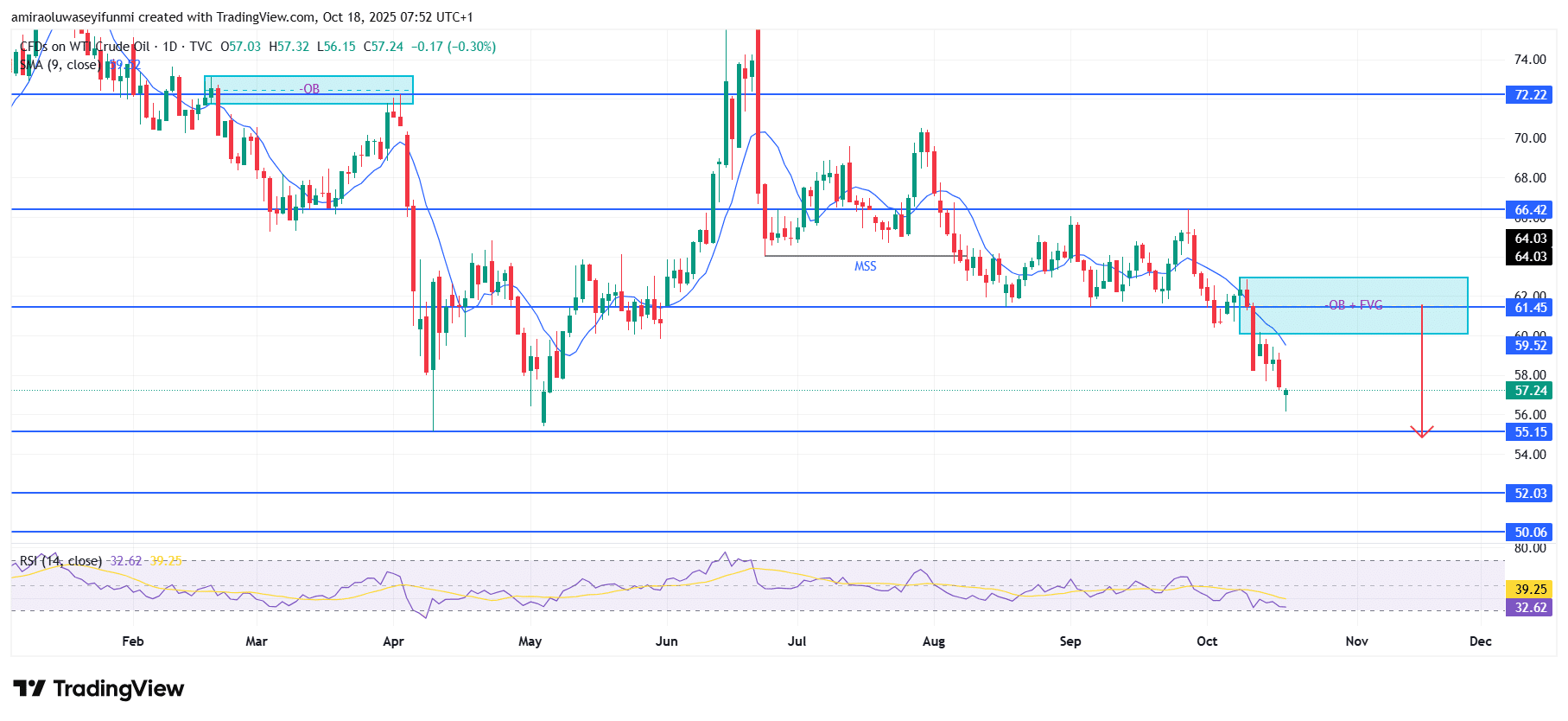

USOil extends its downside momentum amid growing bearish pressure. The commodity continues to display persistent selling interest, supported by technical indicators that confirm weakening market strengt. Currently, the price trades below the 9-day simple moving average, signaling a clear short-term downtrend. Additionally, the RSI remains below the neutral 40 level, reinforcing the dominance of sellers in directing market movement. Overall, the broader structure points to continued downward traction as investors respond to softening demand dynamics and shifting global supply expectations.

USOil Key Levels

Resistance Levels: $61.50, $66.40, $72.20

Support Levels: $55.20, $52.00, $50.10

USOil Long-Term Trend: Bullish

From a technical standpoint, price action shows a clear Market Structure Shift (MSS) to the downside, followed by a rejection within the order block and fair value gap zone between $59.500 and $61.450. This zone now serves as a strong resistance region, where institutional selling pressure may likely resume. The inability of price to rise above this area confirms continued bearish strength and validates current market sentiment.

Looking forward, if bearish momentum persists, USOil may extend its decline toward the immediate support at $55.150, with a potential continuation toward $52.030 in the medium term. A consistent break below $55.150 would expose the lower demand region near $50.060, further reinforcing the ongoing downtrend. Until the price reclaims the $61.450 resistance level, market sentiment remains decisively bearish with minimal upside prospects. Traders monitoring forex signals may find this decline consistent with broader risk-off trends in the commodities market.

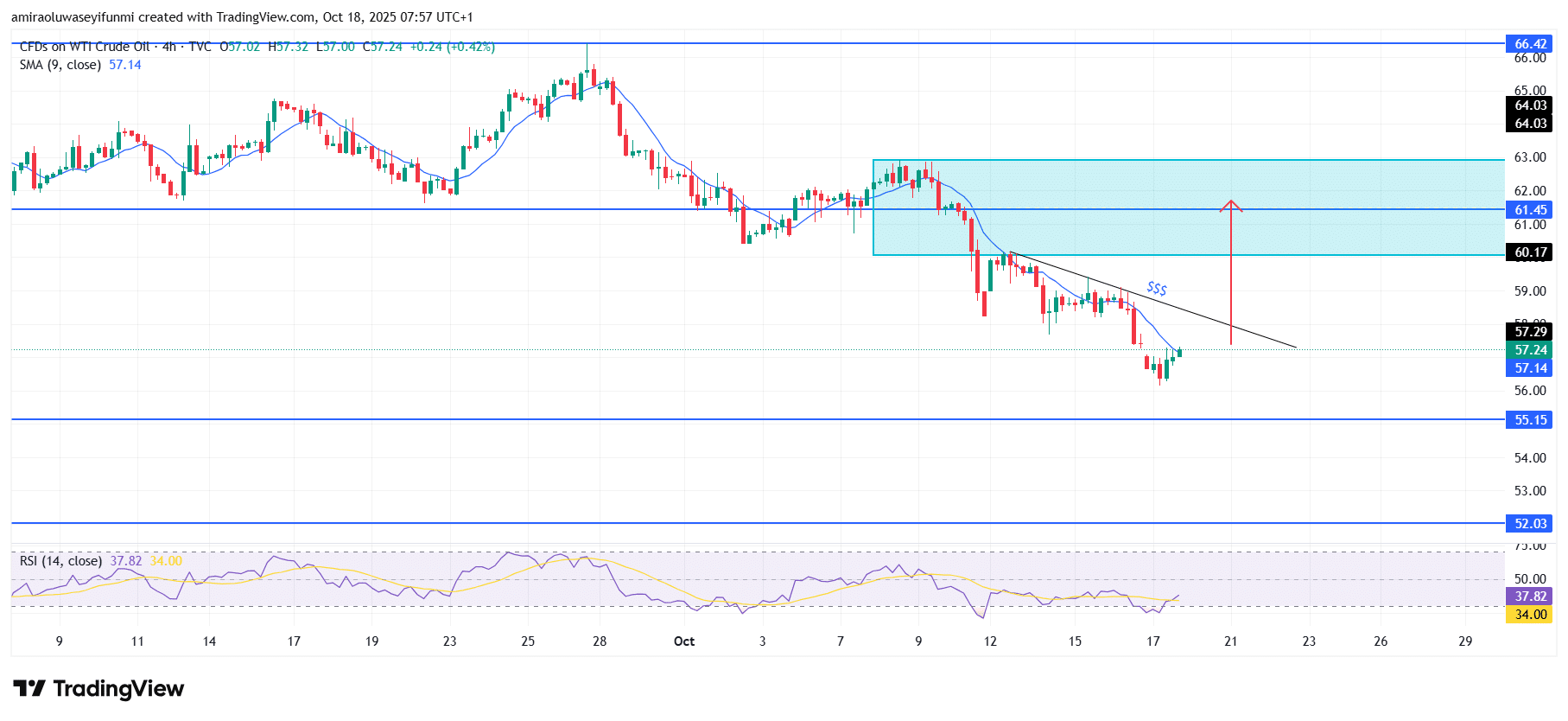

USOil Short-Term Trend: Bearish

USOil shows initial signs of recovery on the four-hour chart as price rebounds from the $55.150 support zone. The RSI has begun to move upward from oversold conditions, suggesting a possible short-term resurgence in buying activity.

Currently, price is testing the 9-period moving average near $57.140, indicating a potential shift toward short-term bullish momentum. A confirmed breakout above the descending trendline could propel price toward the $61.450 resistance region in the upcoming sessions.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.