Market Analysis – March 2

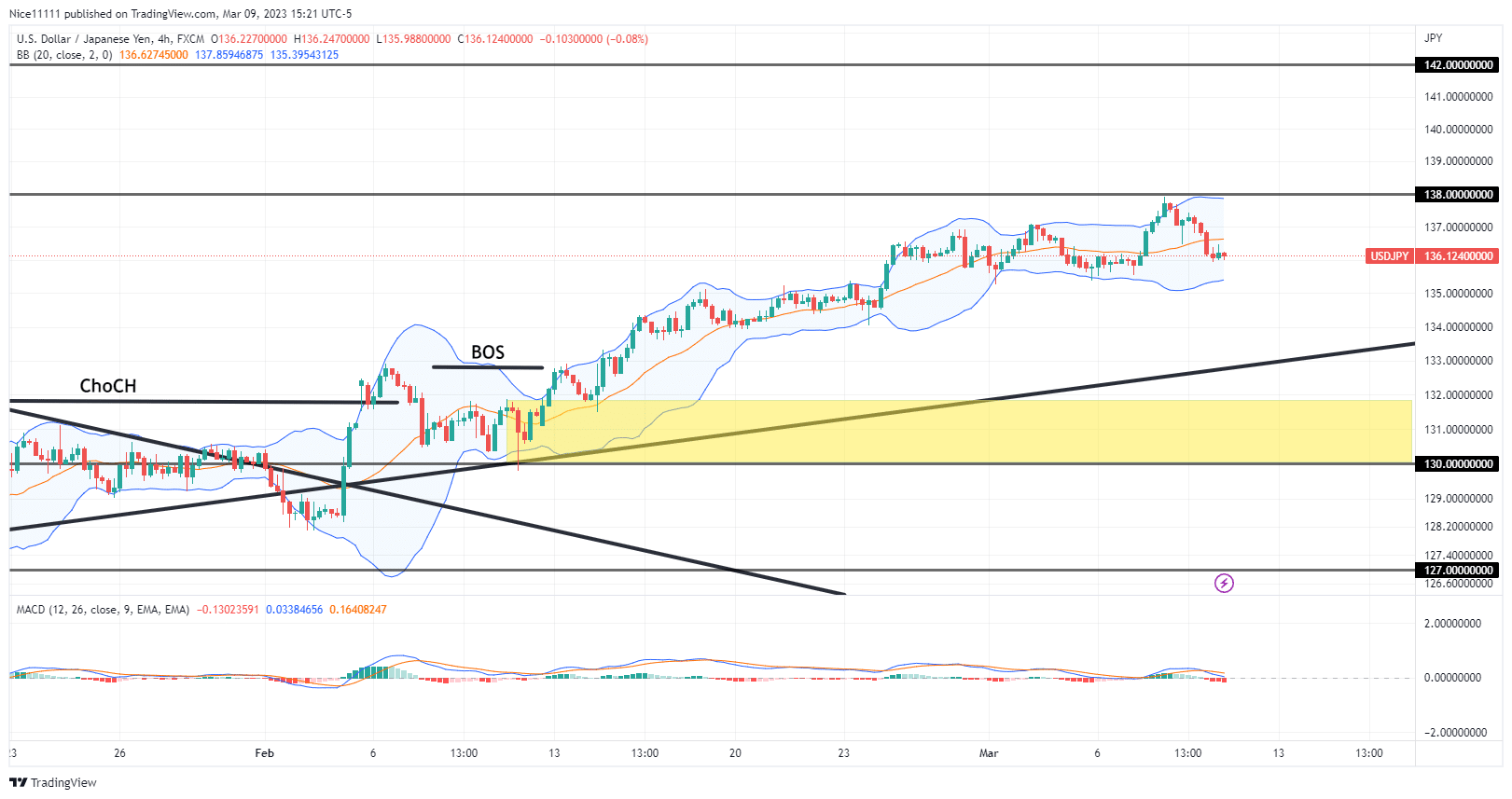

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade price is rising steadily on the daily timeframe. The Bulls have reached their first resistance level of 138.00 after the trend reversal in January.

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Key Levels

Demand Levels: 127.0, 130.0, 124.00

Supply Levels: 138.0, 142.0, 150.0

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Long-term Trend: Bullish

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade turned bearish in October after the daily candles pushed above the upper Bollinger Band. The bears seized the opportunity for a selloff. The MACD (Moving Averages Convergence and Divergence) indicator gave a sell signal after the supply level of 150.0 was tested. The daily candles swerved to rest below the Moving Averages within the Bollinger Band.

The bearish channel guided the price action to the support level of 127.0. Large bearish candles with gaps aided the speed of the fall in price.

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Short-term Trend: Bullish

The Buyers engaged the market aggressively in January. This fostered the ascent to form a Change of Character (ChoCh) pattern. A bullish order block rests at the support level of 130.00. The Moving Averages are currently resting below the daily candles, showing an uptrend. The price has ascended to the next supply level of 138.0. The 138.0 supply level is threatened as the Buyers seek liquidity at 142.0.

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.