USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Analysis – May 11

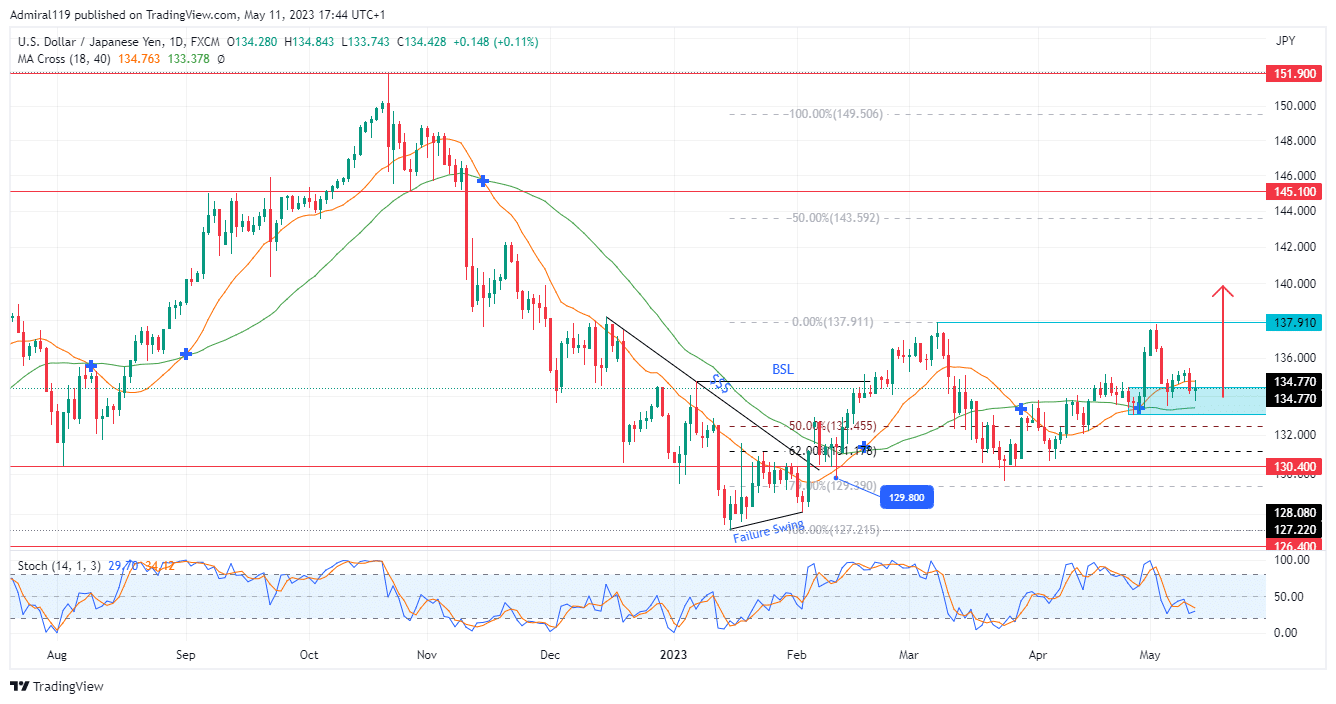

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade continues upward after the market structure shifts to the upside. The market’s trend was confirmed bullish after the failure-swing in January 2023 and the market structure shift in February. The market is currently expanding upward in fractals as it heads to invalidate the previous high of 137.910.

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Significant Zones

Demand Zones: 130.400, 126.400

Supply Zones: 145.100, 151.900

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Long-Term Trend: Bullish

Between August 2022 and late October 2022, the market was in an uptrend. However, a reversal ensued following the failure of the price to create a higher high as October ended. According to the MA Cross (Moving Average Periods 18 and 40), USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade was in a downtrend. The downtrend lasted until January 2023. Before the end of the downtrend in January 2023, the Stochastic Oscillator already indicated a weak bullish divergence. The weak bullish divergence was a result of the price’s continuous lower lows while the Stochastic Oscillator posted higher lows.

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade surged upward after the failure swing, which resulted in the invalidation of a diagonal resistance. A low of 129.800 was created as the price continued upward. After the invalidation of the 134.770 old high, the price returned to the discount zone to execute the buy orders. As of now, the market is heading upward to invalidate the previous swing high of 137.910. The bullish order block around the 134.700 price level is expected to fuel the expansive move to the upside. According to the Stochastic Oscillator, USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade is about to become oversold, thereby increasing the probability of the projected surge occurring.

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Short-Term Trend: Bullish

On the four-hour chart, the Stochastic Oscillator shows that the market is already oversold. The market is currently in an uptrend as it keeps respecting the rising trendline. The uptrend is likely to continue as USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade hits the rising trendline.

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.