Market Analysis – April 27

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade has pushed above the rising wedge on the timeframe. The 4-hour chart shows the emergence from the wedge led by three white soldiers. The buyers are currently aiming for 138.0.

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Significant Levels

Demand Levels: 130.0, 127.0, 124.0

Supply Levels: 138.0, 142.0, 150.0

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Long-term Trend: Bullish

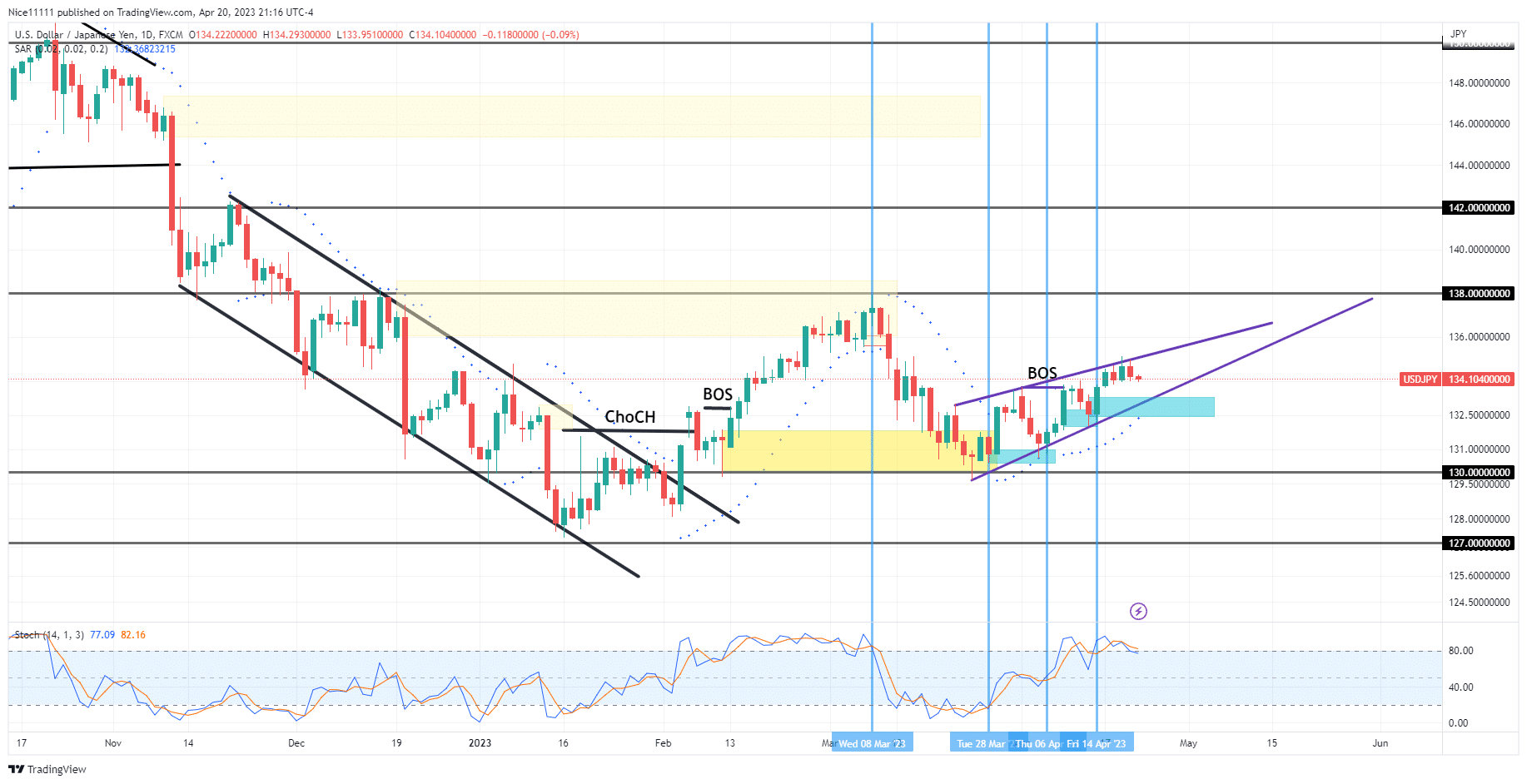

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade broke out of the bearish parallel channel in February. A double-bottom chart pattern played out successfully after the Stochastic Oscillators swerved into the oversold region on the 16th of January. The Parabolic SAR (Stop and Reverse) points appeared below the daily candlesticks to lead the market to the resistance zone of 138.0. An unmitigated order block firmly resisted the ascent at the supply zone.

The price of USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade declined until the support level of 130.0 was reached. A bullish order block gave the buyers an opportunity for longs. The market structure changed immediately as higher highs and lows formed with bullish breaks of structure.

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Short-term Trend: Bullish

A rising wedge has defined the price action of the market in March and April. The last test of the supporting trendline has propelled the price above the resistance trendline. The break was led by three white soldiers. The Stochastic is overbought on the daily and four-hour charts. A correction is therefore expected towards 134.50.

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.