USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Analysis – October 13

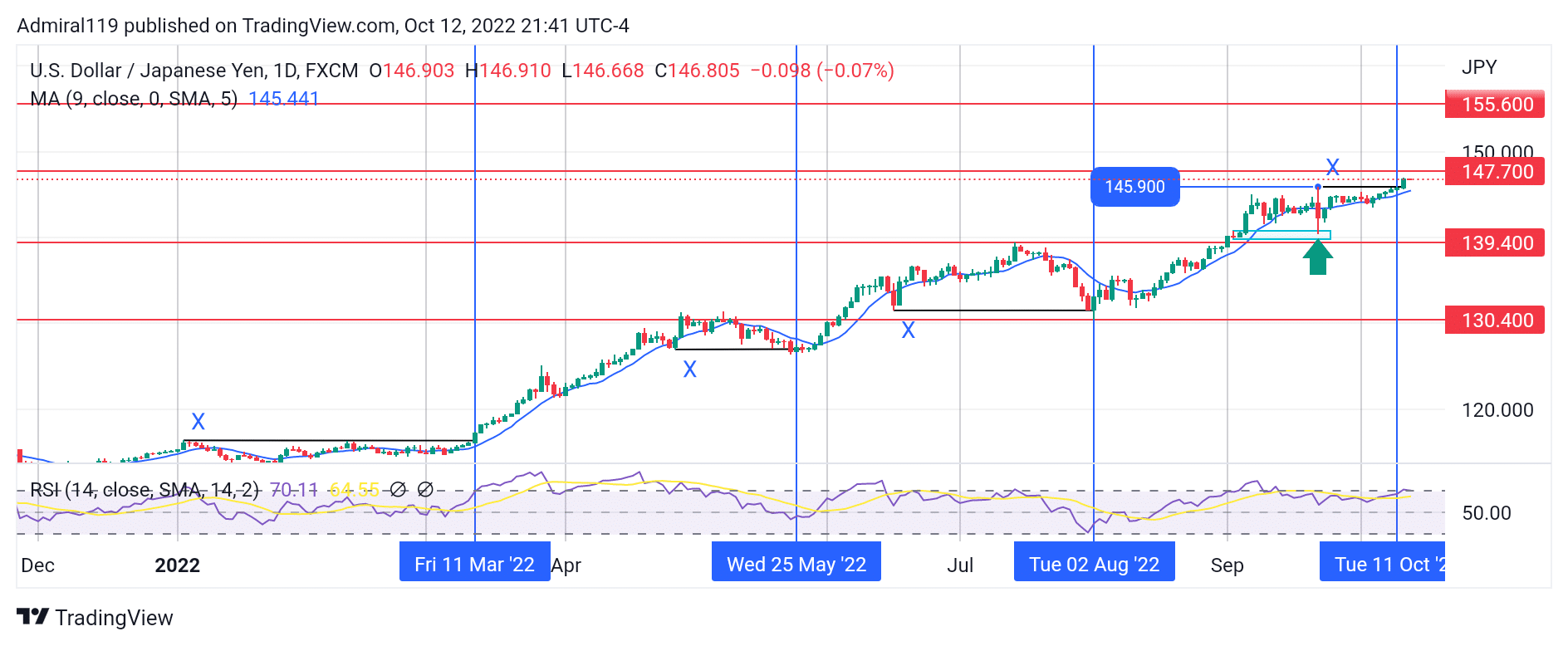

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade buyers drives the market into an overbought region. As indicated by the Relative Strength Index (RSI), USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade is currently overbought and a retracement is probable. The ranging market was broken on the 11th of March, 2022. After that, the Japanese yen became weaker than the US dollar.

Market Significant Zones

Demand Zones: 139.40, 130.40

Supply Zones: 147.70, 155.60

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Long Term Trend: Bullish

As a result of the successful breakout, the market remains extremely bullish. With prices soaring higher, USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade buyers continue to buy at every slight retracement. As the price continues to rise in fits and starts, it appears that the resistance is insufficient to withstand the market’s order flow. The previous resistance at 130.40 could be seen rebuffing the price to the downside, but only for a short period. Similarly, the previous resistance at 139.40 acted stronger but was short-lived. Prices then eventually ended up expanding upward after a liquidity grab at the daily low.

The liquidity grabs on the 25th of May, 2022, and the 2nd of August, 2022, caused the price to evade the resistance levels. The Simple Moving Average (SMA) indicator spends most of its time on the right side of the candlesticks. This SMA’s reaction toward price indicates that the USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade buyers remain adamant. A bullish order block was formed in September 2022 as the market surged upward. The bullish order block served as a re-entry level for the bulls on the 22nd of September, 2022. Due to the adamancy of the USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade buyers, a correction is more probable than a reversal at the 147.70 supply zone.

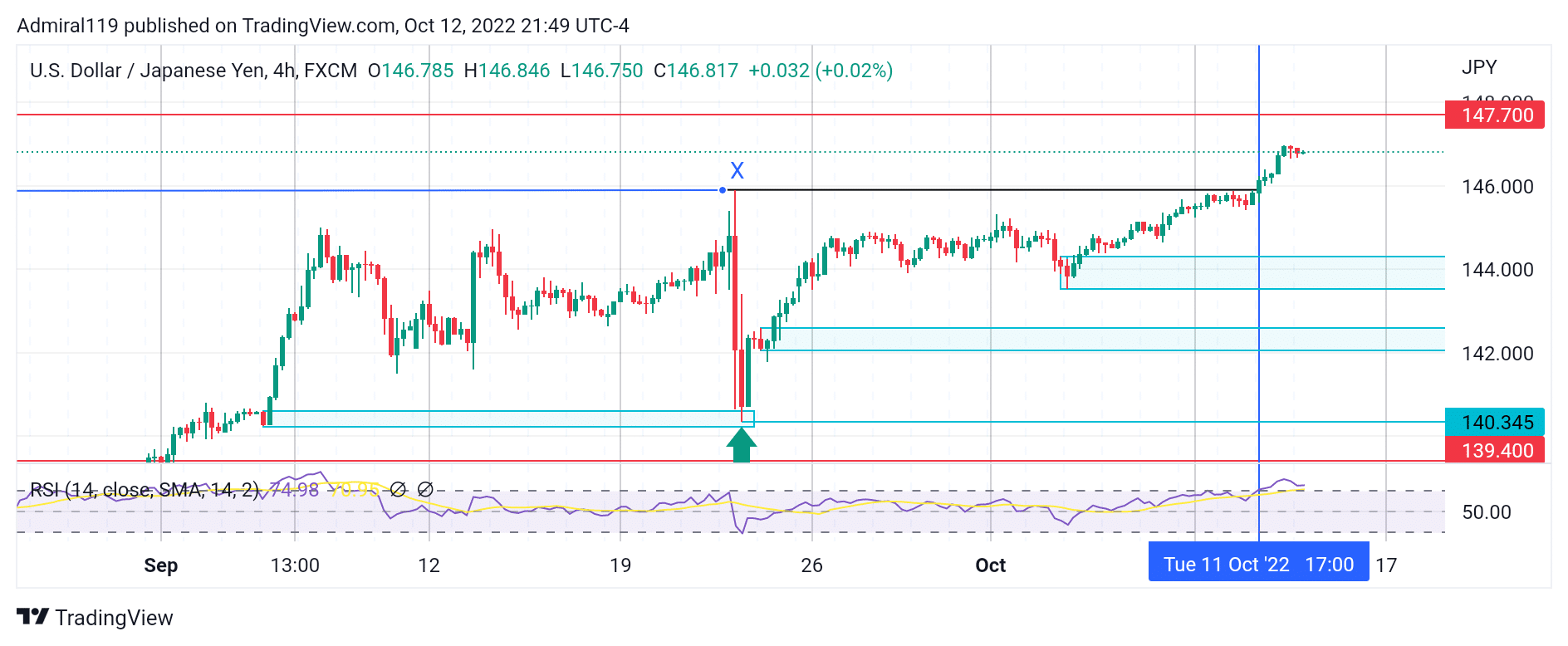

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Short Term Trend: Bullish

The consistent rally to the upside led to the break of structure at the four-hour-old high. If USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade buyers remain persistent even in this overbought region, the market may not fall below the 139.40 demand zone before resuming its upward trend.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.