Market Analysis – December 5

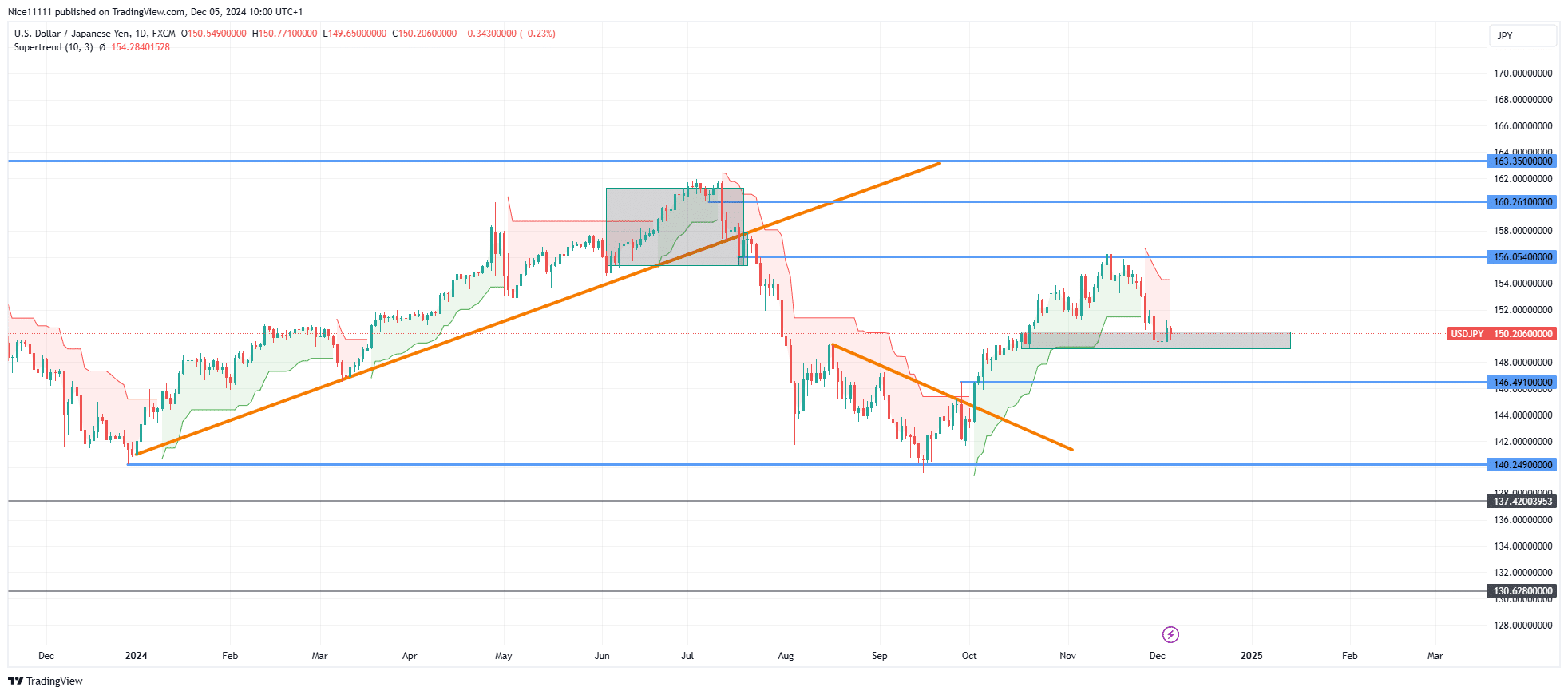

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade shifted to bearish after the price struck the resistance zone at 156.0540. The subsequent price decline has paused as the pair tests a bullish order block near the 150.2060 level.

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Key Levels

Demand Levels: 140.250, 137.420, 130.630

Supply Levels: 156.050, 160.260, 163.350

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Long-term Trend: Bearish

The previous bullish trend began in October with a breakout above the swing high at 146.4910. This upward movement breached the resistance trendline, signaling a transition from a downtrend to an uptrend. The Supertrend indicator supported this shift, displaying a green hue positioned below the daily candles, confirming bullish momentum.

However, the resistance level test at 156.0540 marked a significant turning point. The uptrend faltered as the last swing low failed, signaling a bearish reversal. The Supertrend indicator now displays a red cloud above the daily candles, further confirming the shift in market direction. This transition indicates that sellers have regained control.

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Short-term Trend: Bearish

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Short-term Trend: Bearish

On the lower timeframe, a Change of Character (ChoCh) has emerged, highlighting the potential for further bearish continuation. However, traders should wait for confirmation from a higher timeframe shift in market structure to validate this directional bias. Aligning these signals can help generate accurate forex signals while minimizing risk.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Short-term Trend: Bearish

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Short-term Trend: Bearish