USDCHF Price Analysis – March 24

As the anti-greenback rally of the market is in the spotlight, USDCHF extends the losses of the prior day to 0.9722 level, down 0.75 percent, during the early hours of trading on Tuesday. After the Fed revealed unprecedented steps to purchase limitless quantities of Treasury bonds and mortgage-backed securities, the pair stalled its recent significant positive trajectory to YTD highs.

Key Levels

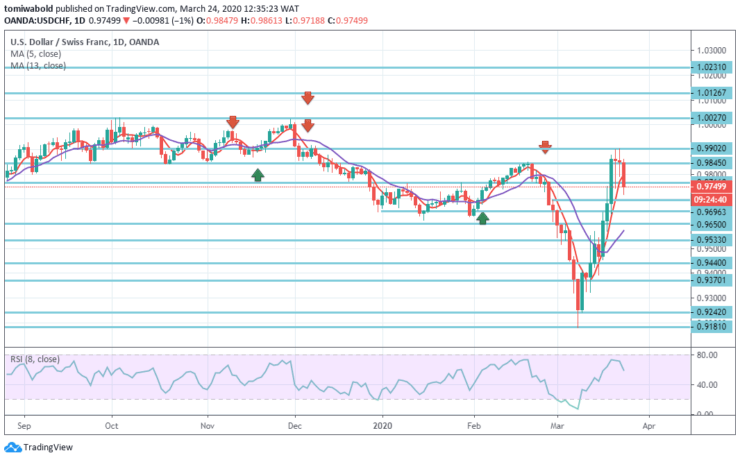

Resistance Levels: 1.0231, 10027, 0.9902

Support Levels: 0.9650, 0.9370, 0.9181

USDCHF Long term Trend: Ranging

The USDCHF pair stays within the rising wedge bearish formation, which gets confirmation once the quote falls below the level at 0.9650 unless it breaks past 0.9902 level on the daily closing basis. The recent pullback may be due to the Friday Doji formation marked around the high of the multi-months.

The plunge from the level at 1.0231 in the larger structure is regarded as the third leg of the trend from the low. It may have been completed after reaching the (low) level of 0.9181 main support. Retesting 1.0231 high level may be seen as a further advance.

USDCHF Short term Trend: Ranging

USDCHF remains in consolidation beneath the temporary high level of 0.9902. For the time being the intraday bias stays neutral. A deeper retreat is recorded but 0.9650 support level may contain downside to bring in another rally.

As previously stated the plunge from the level at 1.0231 would have been completed at level 0.9181. Past the level of 0.9902 that reaches the resistance level of 1.0027, then the level of 1.0231.

Instrument: USDCHF

Order: Sell

Entry price: 0.9845

Stop: 0.9902

Target: 0.9696

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.