S&P 500 Price Analysis – March 24

As markets offer US dollars, likely in response to the Federal Reserve’s (Fed) open-ended asset purchasing plan, the S&P 500 futures are flashing green in Asia into the European session. The stock futures and yields are increasing as prospects of a large spending bill on coronavirus rise. The Federal Reserve introducing new initiatives has turned the economy around.

Key Levels

Resistance Levels: 2854, 2600, 2400

Support levels: 2250, 2100, 2000

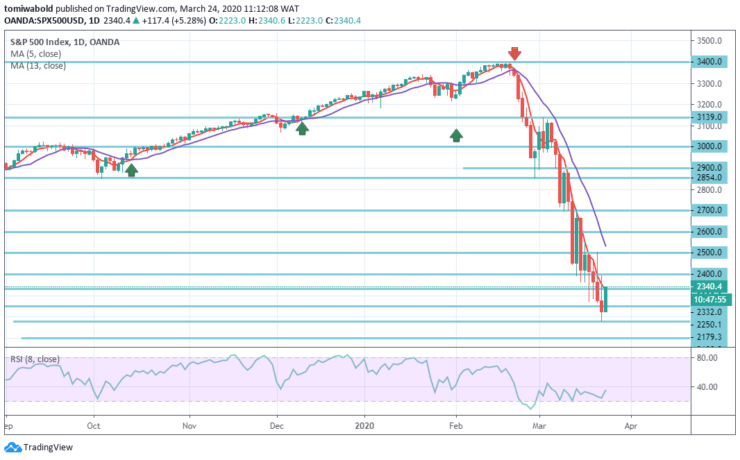

S&P 500 Long term Trend: Bearish

At 2179.3 level, the S&P 500 Index trades with upward intensity and has a strong turnaround past low levels. Bulls want the uptrend to continue and protect the 2020 low to hit the major level at 2500.

Failure to do so, however, could see bears prolonging the downward bias towards the 2100 level and the level of 2000. On the flip side, the resistance between the 2500 and 2700 levels may be attempted in a bullish recovery.

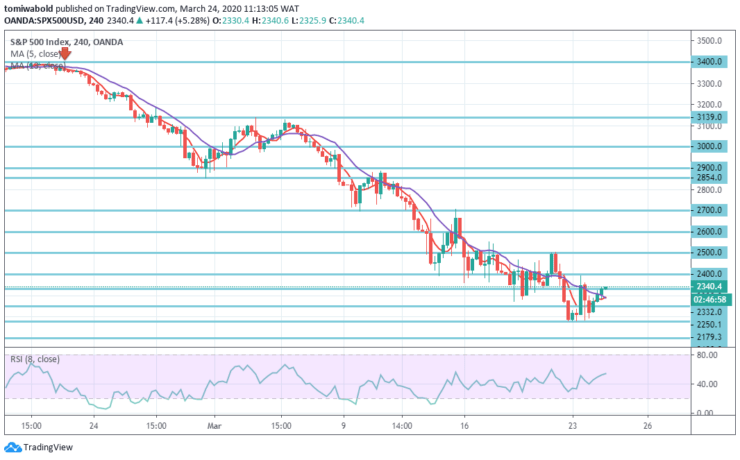

S&P 500 Short term Trend: Bearish

The structure on the 4-hour time frame is trending in ranges and appears to be firmly bearish, even with the daily range setup marginally improving. The rapid upward reaction, however, pushes the indicators closer to the likelihood of the bulls regaining power on the short-term trend.

The first major level of resistance is at level 2400, then the second at level 2500 and the third at level 2600. Even the RSI is accelerating its bullish trend as seen on the 4-hour range and is bolstered by the moving average 5 turning to cross the moving average 13.

Instrument: S&P 500

Order: Buy

Entry price: 2332

Stop: 2250

Target: 2400

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.