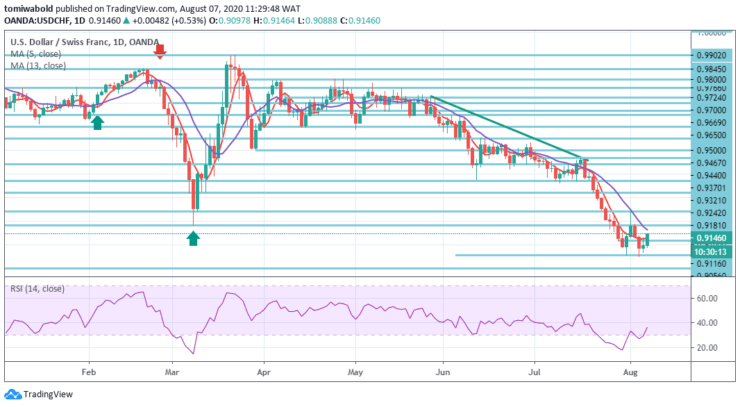

USDCHF Price Analysis – August 7

The USDCHF pair is rising on Friday for the second day in a row, moving away from the lowest level it has reached at 0.9050 level in five and a half years. The pair further recovers as buyers search for entry beneath 0.9181 level. The greenback posts mixed results across the board after recovering lost strength.

Key Levels

Resistance Levels: 0.9902, 0.9467, 0.9181

Support Levels: 0.9056, 0.9000, 0.8987

In USDCHF the primary trend is bearish. Notwithstanding the recovery, technical indicators keep pointing to weakness. It is rebounding from level 0.9050 and if it pushes beyond level 0.9242 this might establish a double bottom pattern, but it is not a projected position thus far.

The initial support is seen at level 0.9116, and a plunge beneath will exert pressure for another test of the area at 0.9056. On the upside, the first barrier is the 0.9181 level, followed by level 0.9242.

For the present time, the intraday bias in USDCHF is neutral, as some consolidations could be seen above level 0.9056. But perspective may remain bearish as long as resistance level of 0.9242 holds. As per its upside, to be the first sign of medium-term bottoming, a breach of 0.9370 resistance level is required.

On the downside, a breach of 0.9056 level may start a greater downward trend to a forecast of 61.8 percent to 0.9467 to 0.9056 levels from 0.9242 to 0.8987 levels, and then 100 percent to 0.8830 level. Nonetheless, a firm break of 0.9242 level may indicate a short-term bottoming and turn back bias for a rebound to the upside.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.