EURJPY Price Analysis – August 8

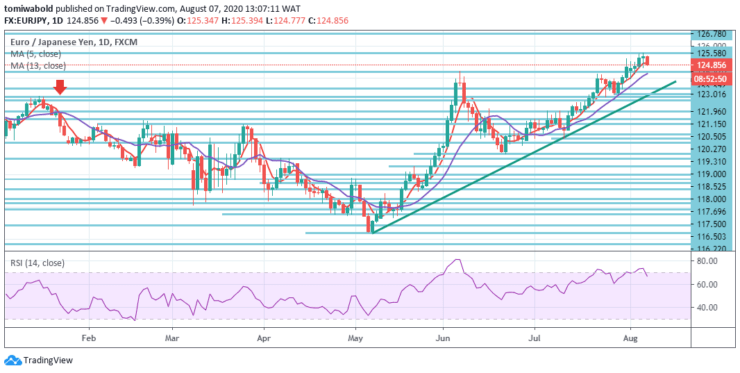

In the prior session, EURJPY’s rally reached new highs near level 125.58. Nevertheless, the step was insufficient and facilitated the existing correction lower to sub-125.00 levels. Given the continuing correction, incremental improvements stay well on the radar and bolstered by the broader risk complex change.

Key Levels

Resistance Levels: 128.67, 126.78, 125.58

Support Levels: 123.37, 121.96, 119.31

The EUR has fared well in this phase against most of its significant equivalents. In the wider sense, the entire downtrend from level 137.49 (high) should have already been concluded at level 114.42. The next crucial obstacle against this appears at mid-127.00s.

The increase from level 114.42 may aim a retracement of 61.8 percent from 137.49 to 114.42 levels at the next level 128.67. A continuous break there opens the way for a level of 137.59 (high). Even so, at a later stage, persistent breach of the moving average 13 at 124.43 level may rekindle medium to long-term bearishness for another low beneath 114.42 level.

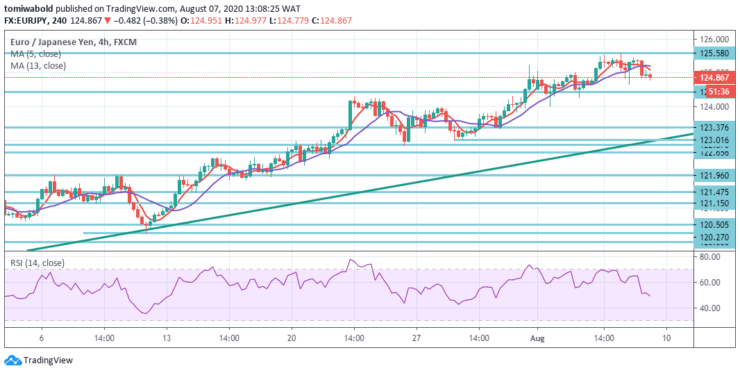

Intraday bias in EURJPY is rendered neutral as it developed a temporary peak after reaching a prediction of 61.8 percent from 119.31 to 124.43 levels at 125.58 levels. Few consolidations may be seen but as long as 123.01 support level holds, more increase is anticipated.

A 125.58 level breach might well aim a forecast of 100 percent at 129.32 level. Nonetheless, the support level breach at 123.01 now will indicate short term topping. In this scenario, to correct the entire rise from 114.42 level, the further decline may be seen in the short-term ascending trendline (now at 122.65 level).

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.