Bears are dominating USDCHF market

USDCHF Price Analysis – 06 January

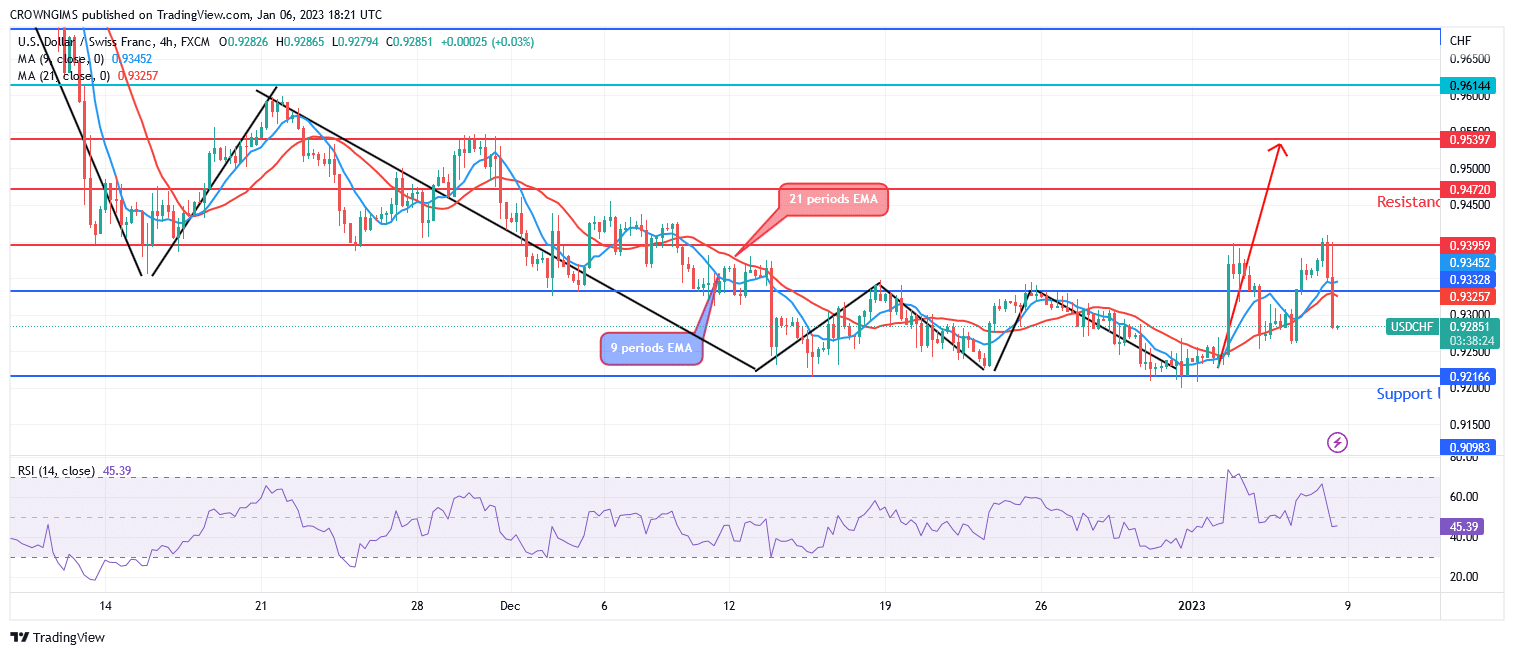

The $0.92 support level may be breached on the downside if the sellers exert more pressure, and the downward trend may continue to the $0.91 and $0.90 levels. USDCHF will break through the $0.93 level and go up toward the resistance levels of $0.94 and $0.95 if buyers apply additional pressure and defend the $0.92 support level.

USDCHF Market

Key Levels:

Resistance levels: $0.93, $0.94, $0.95

Support levels: $0.92, $0.91, $0.90

USDCHF Long-term trend: Bearish

Long-term prospects for USDCHF are promising. The bearish swing from the previous week is still evident in the daily time period. Increased seller pressure on December 14 led to a breakdown of the support level of $0.93, which caused the price to drop and test the $0.92 support level. Due to the power of the purchasers, the price increased the next day. Currently, the $0.93 resistance level is being tested. At $0.92, a triple bottom chart pattern is seen, indicating a potential price increase.

The 9-period EMA is below the 21-period EMA, and USDCHF is trading above the 9 periods EMA. A bearish market direction is indicated by the Relative Strength Index period 14 being at 44 levels and leaning downward. The $0.92 support level may be breached on the downside if the sellers exert more pressure, and the downward trend may continue to the $0.91 and $0.90 levels. Price will break through the $0.93 level and go up toward the resistance levels of $0.94 and $0.95 if buyers apply additional pressure and defend the $0.92 support level.

USDCHF Medium-term Trend: Bearish

The USDCHF is bearish in the medium-term outlook. The price was driven by the bears to the $0.92 support level, which has a significant chance of reversal. It appears that the bulls’ push is steadily building while the bears’ impetus is waning. The price attempted to overcome the $0.93 level of resistance but sellers opposed the buyers due to the low strength of U.S Dollars at non-farm payroll fundamental news.

Currently, the 21-period EMA is below the 9-period EMA. The USDCHF is currently trading below the two EMAs, indicating a bearish move. The signal line on the Relative Strength Index period 14 is pointing downward at 44 levels.

You can purchase crypto coins here: Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.