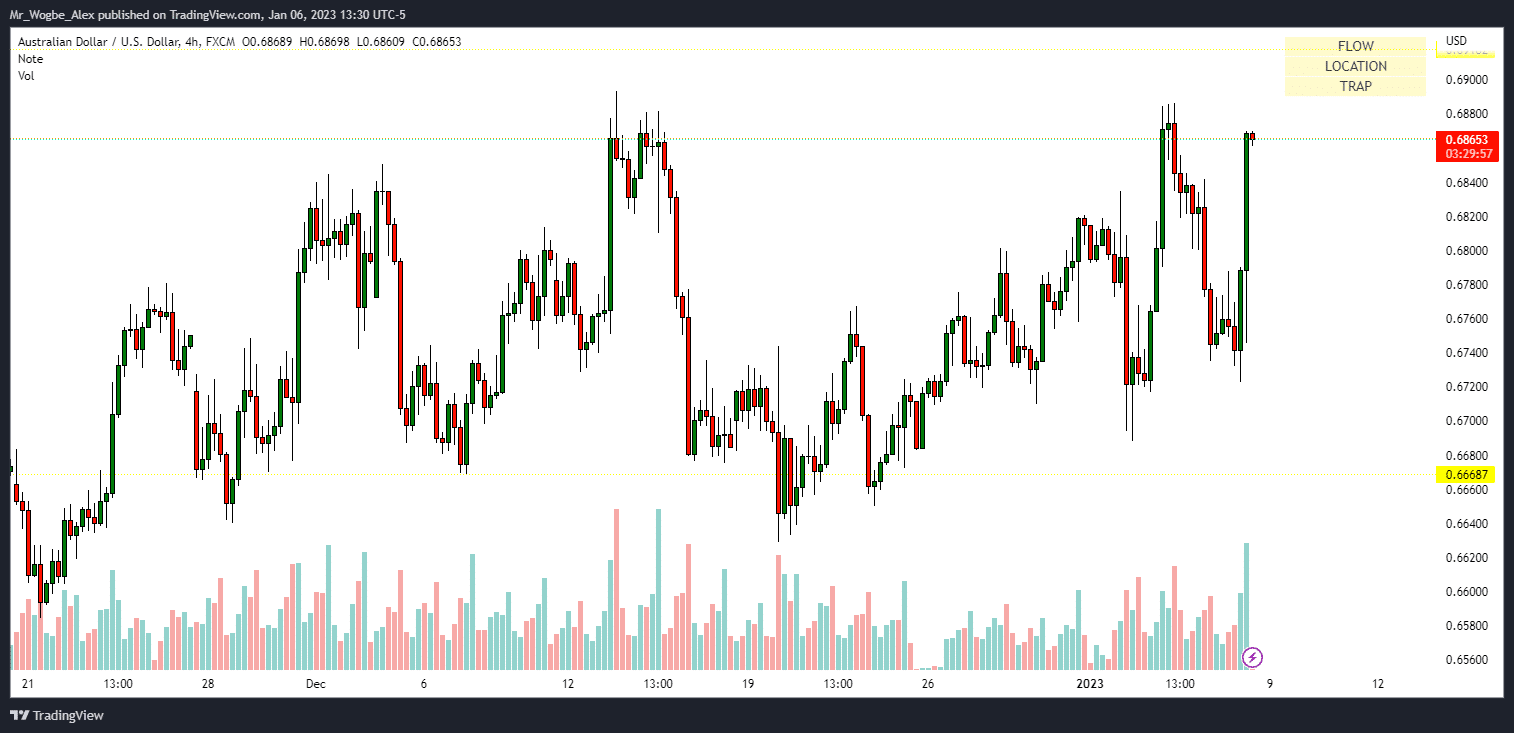

After the release of critical economic data in the United States, which, while encouraging, failed to support the USD, the Australian Dollar (AUD) rose versus the greenback. In addition, a services PMI survey fell into a contractionary zone, escalating fears of a US recession. The AUD/USD pair currently trades at 0.6863 at the time of writing.

The US labor market figures for December showed a mixed picture. Despite the economy adding 223K new jobs, more than expected at 200K, worries that wage inflation would continue to be more persistent decreased. Although the average hourly wage increased month over month by 0.3%, it decreased annually from 5.0% to 4.6%.

US Fed officials will welcome the slowdown because they believe wage pressures are one of the things keeping inflation above its 2% objective.

Australian Dollar Two-Day High vs. USD

Following the news, the AUD/USD traded slightly higher and was headed toward the 0.6800 level. But weaker-than-anticipated ISM Services data and a decline in US Factory Orders gave the AUD/USD currency pair another boost, pushing its advances to a two-day high of 0.6869.

According to statistics issued earlier today, the ISM Services PMI unexpectedly declined to 49.6 vs. 55 forecasts, its lowest rating since May 2020, and lagged behind November’s 56.5 increases. Readings of the PMI below the 50-line indicate contraction.

Apart from that, Fed speakers kept appearing in news reports. Raphael Bostic, president of the Atlanta Fed, had earlier stated that the employment report for December did not alter his assessment of the state of the economy and emphasized the need to “stay the course.” Later, despite recent reports, Federal Reserve Governor Lisa D. Cooks stated that inflation is “far too high” and of “great concern.”

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.