USDCHF may decrease further

USDCHF Price Analysis – 10 November

If the purchasing momentum is successful in breaking over the $0.90 resistance level in USDCHF market, the price can move past the $0.91 resistance level and in the direction of the $0.92 barrier levels. If sellers put in enough pressure, they might break through the $0.89 barrier level, which would send the price down into the $0.88 and $0.87 levels.

USDCHF Market

Key Levels:

Resistance levels: $0.90, $0.91, $0.92

Support levels: $0.89, $0.88, $0.87

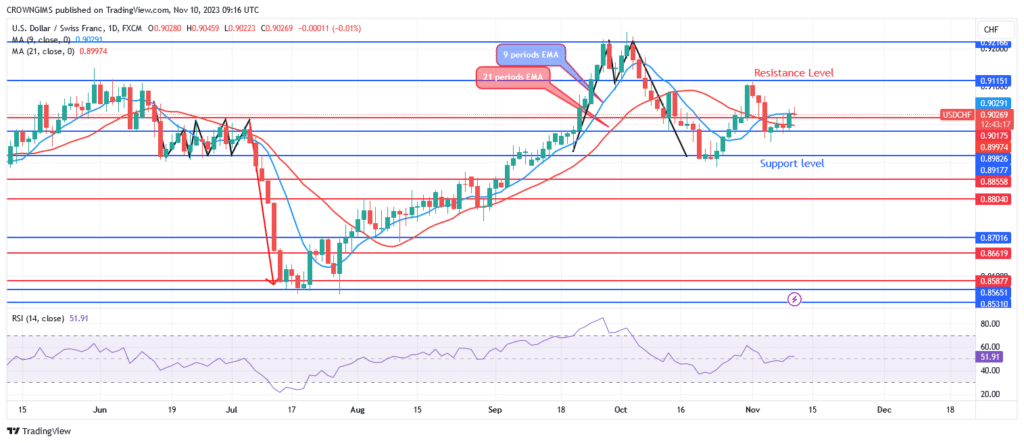

USDCHF Long-term trend: Bearish

USDCHF daily chart is negative. The USDCHF is currently being controlled by sellers, and it is declining. It is not having any trouble surpassing the $0.91 barrier. The USDCHF market has been under buyer control since October 24. After the currency pair broke through the $0.88 resistance level, its price started to surge. A powerful bearish engulfing candle pattern formed at the $0.90 resistance level, indicating the start of a negative trend. The USDCHF is getting closer to $0.88 and is declining.

The USD/CHF exchange rate is currently below between the 9- and 21-period moving averages, indicating a strengthening of the vendors’ momentum. The Relative Strength Index period 14 at 52 levels indicates a bearish market. If the purchasing momentum is successful in breaking over the $0.90 resistance level, the price can move past the $0.91 resistance level and in the direction of the $0.92 barrier levels. If sellers put in enough pressure, they might break through the $0.89 barrier level, which would send the price down into the $0.88 and $0.87 levels.

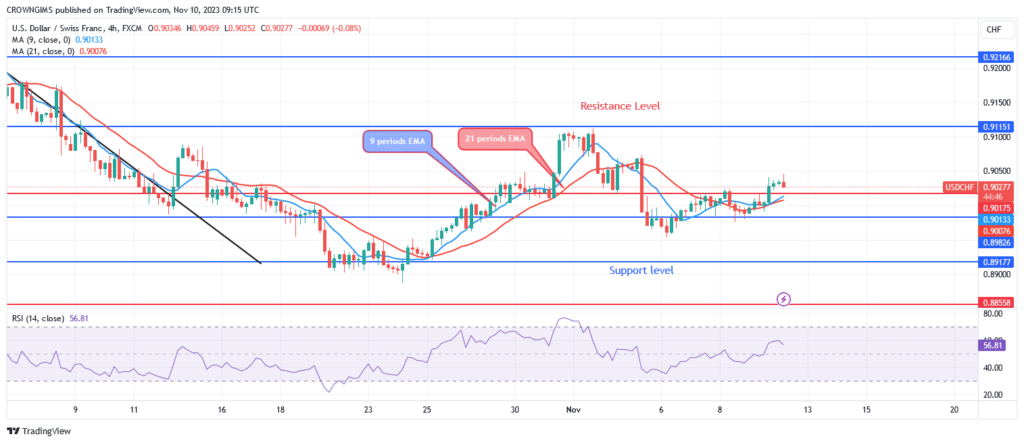

USDCHF Medium-term Trend: Bearish

USDCHF is on the decline from a medium-term perspective. The emergence of a double top chart pattern near the $0.92 resistance level on October 4 signifies the start of a bearish trend for the currency pair. Bearish candles are a reflection of the state of the market. On October 24, the $0.89 support level was put to the test. It pulled back to the $0.90 mark. The sellers are presently gaining pace and attempting to reach the $0.88 support level.

The fact that the currency pair is trading below both the 9- and 21-period exponential moving averages suggests a bearish market. The Relative Strength Index’s period 14 signal line is declining, suggesting a sell; the index is currently at 55.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.