USDCHF Price Analysis – October 29

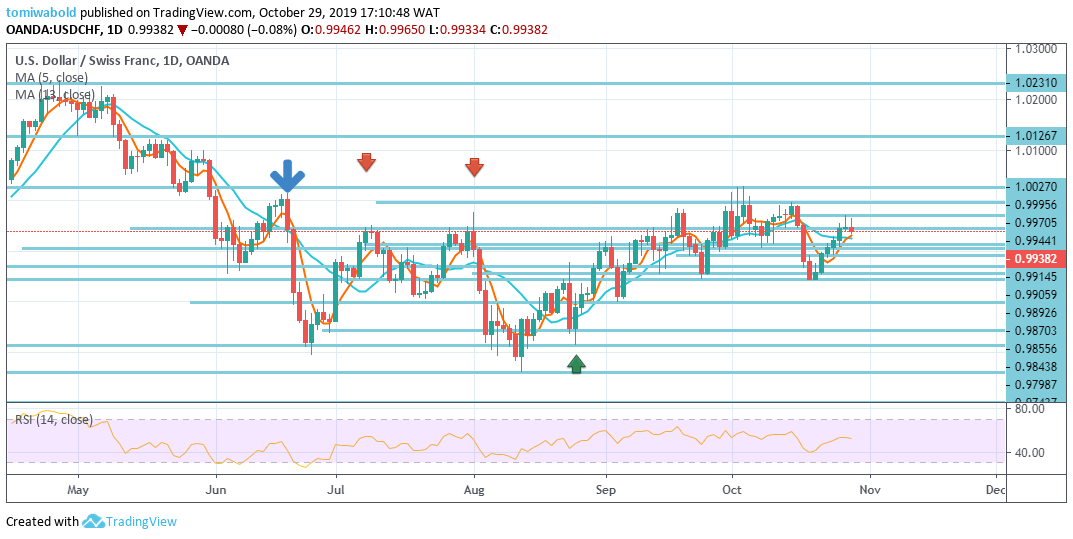

The USDCHF pair in the prior session advanced to fresh session highs, around the level at 0.9970 zone but retreated again, however earlier today with buyers making a fresh attempt to build on the prior momentum had moved further but stalled on the level at 0.9963 to retreat again for the downside crossing the horizontal zone on the level at 0.9944.

Key Levels

Resistance Levels: 1.0231, 1.0126, 1.0027

Support Levels: 0.9905, 0.9843, 0.9659

USDCHF Long term Trend: Bullish

As seen on the daily, the FX pair is losing steam for the upward advance. However with the level at 0.9905 minor support intact, then a further advance to the upside is still expected to the level at 1.0027 resistance initially.

While the firm breaks outside of the zone there may reactivate the resumption of the whole rally from the level at 0.9659. As it is presently, the FX pair is in a short-term downtrend, this is likely a correction, as both the short and long-term outlook remains bullish.

USDCHF Short term Trend: Ranging

On the flip side of the 4-hour time frame, the USDCHF had traded about 17 pips higher after the open, the FX pair was unable to hold on to its earlier gains in the European session while the bears took control and may end the day below its opening price.

Meanwhile, on the downside, a break of the level at 0.9905 minor support may change the bias back to the downside for the retest of the level at 0.9843 support instead. Otherwise, the short term trend may remain neutral at first.

Instrument: USDCHF

Order: Buy

Entry price: 0.9914

Stop: 0.9892

Target: 1.0027

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.