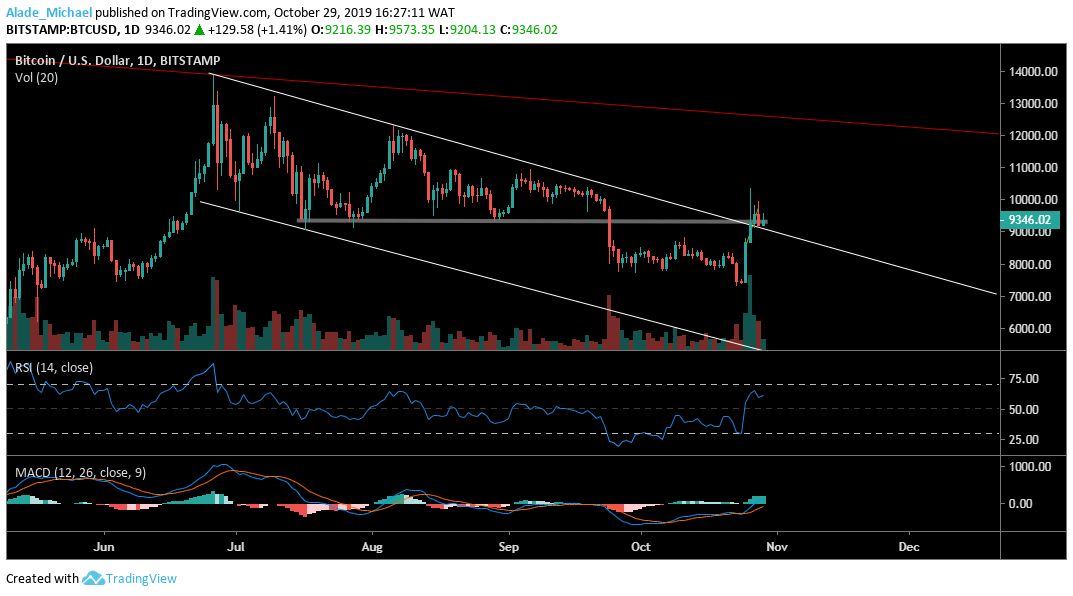

Bitcoin (BTC) Price Analysis: Daily Chart – Bullish

Key resistance levels: $9600, $9800, $10000, $10480

Key support levels: $9200, $9000, $8800, $8600

Bitcoin’s price is trading above the descending channel, which corresponds with the $9300 price zones. The BTC/USD pair is now consolidating for the past two days after meeting rejection at the $10480. Despite the price drop, Bitcoin is still bullish above the $9000 support as the price may go up to $ 9600, $9800 and $10000 if the bulls can show a strong commitment to trading.

Meanwhile, further resistance lies at $10480 and above. On the downside, Bitcoin held supports at $9200 and $9000. A break-down may cause Bitcoin to roll at $8800 and $8600. The technical RSI indicator is bullish at the moment as the MACD saw a slight cross, but yet to confirm a bullish trend for Bitcoin.

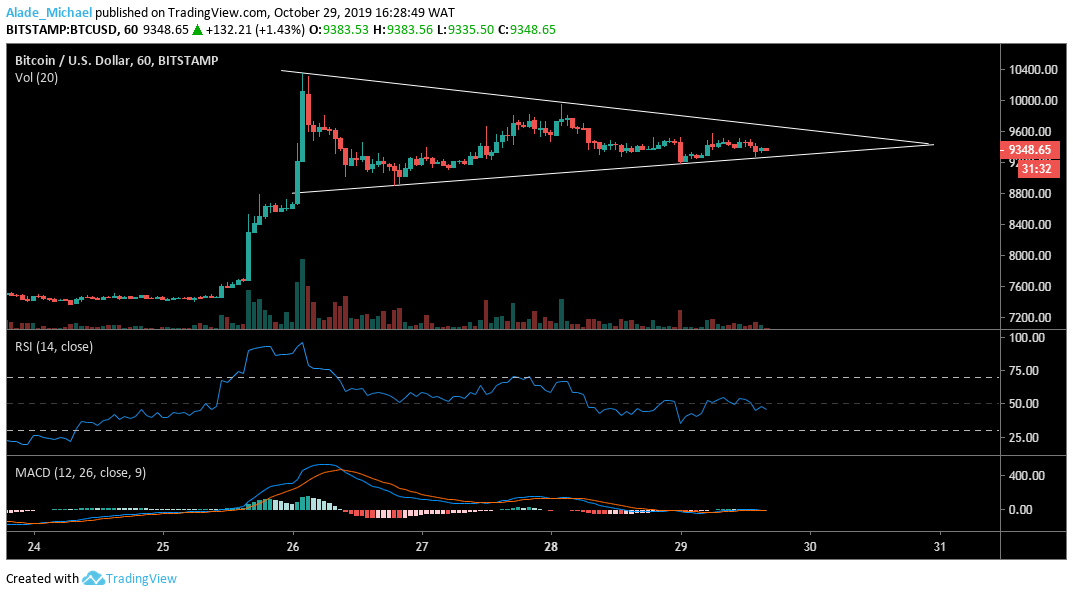

Bitcoin (BTC) Price Analysis: Hourly Chart – Bullish

Following the ongoing price variation, Bitcoin has found support on the triangle’s support but the important question now is that, can it hold above the yellow line? The London session closing will determine whether it will hold or not. However, if the price penetrates beneath the triangle, Bitcoin may further look for support at $9200, $9100 and $9000 as further drive might allow the bears to regain control.

Inversely, buying pressure is likely to keep the buyers in shape as potential resistance lies at $9550, $9700 and $9950 before we can see a climb back above the $10000 zones. The MACD is currently moving sideways to show that there’s price stability in the market. The RSI is now bearish after leaving the overbought region on October 26, suggesting the bears are slowly stepping back!

BITCOIN SELL SIGNAL

Sell Entry: $9355

TP: $9100

SL: $10000

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.