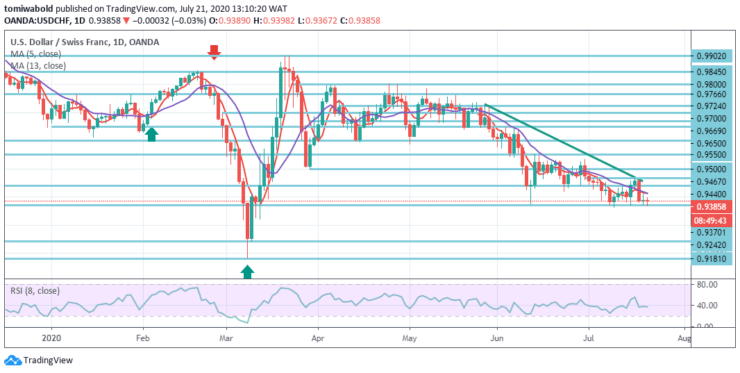

USDCHF Price Analysis – July 21

Today, USDCHF posts defensively beyond the level of 0.9370. Even though some consolidation is anticipated at this stage, it may not be impossible to rule out a close down beneath. The US dollar stayed on the defensive with fears that the continuing increase in infections with coronavirus may hinder the recovery of the US economy.

Key Levels

Resistance Levels: 1.0231, 0.9902, 0.9550

Support Levels: 0.9370, 0.9242, 0.9181

From a technology standpoint, the failure of the pair to inspire any tangible buying interest implies that the pressure of the near-term bearish could still be far from over. In the broader context, a collapse from level 1.0231 is seen as the third phase of the trend from level 1.0342.

This would have finished at level 0.9181 after reaching key support level 0.9242. The 0.9902 level breach may broaden the rebound from level 0.9181 to resistance level 1.0027.

USDCHF retains a support level beyond 0.9370 and intraday bias stays initially neutral. The ongoing state asserts that the wider decrease from 0.9902 level is not over. The 0.9370 level breach may aim at a low-level test of 0.9181.

Whereas, a breach of 0.9467 resistance level signals a short-term bottoming and shifts the bias back to the upside for and beyond 0.9550 resistance level.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.