The safe-haven appeal for the yellow metal was greatly supported by the European Union leaders’ agreement to an impressive €750 billion stimulus package coupled with the prospects for additional stimulus in the US.

This rally occurred when buyers were coming on board to take gold higher after it climbed above the $1,814-15 resistance level, which prompted a follow-through bull trend (technically) in the early trading hours on Tuesday.

Meanwhile, the fresh optimism over a potential Covid-19 vaccine kept the financial markets in a risk-on mood. This sentiment tends to undermine the safe-haven appeal of gold and compels to traders to take some profits off the table.

Nonetheless, any pullback from this level will be considered a dip-buying opportunity considering that several strong support levels are in place.

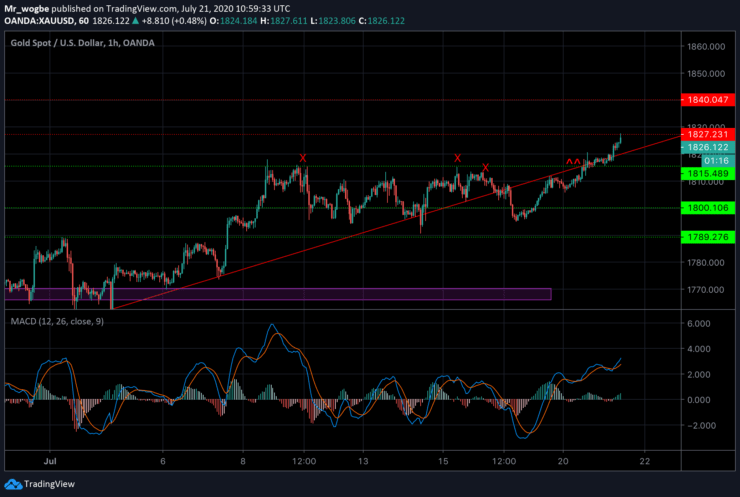

Gold (XAU) Value Forecast — July 21

XAU/USD Major Bias: Bullish

Supply Levels: $1,827, $1,830, and $1,840

Demand Levels: $1,818, $1,815, and $1,810

As we projected yesterday, gold has snapped the strong and protracted $1,815-18 resistance region, after it found fresh buyers above the $1,815 level. At press time, gold is flirting with the $1,827 resistance. It would be interesting to see how price reacts to this level.

Meanwhile, we are currently treading into overbought territory above the 4.00 line on our hourly MACD indicator. Reaching this level could precipitate a modest decline, which will inadvertently open gold up to more dip-buyers.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.